- Australia

- /

- Metals and Mining

- /

- ASX:GRX

Discover 3 ASX Penny Stocks With Market Caps Over A$200M

Reviewed by Simply Wall St

The Australian market has seen a downturn, with the ASX200 dropping 1.3% to 8,235 points amid widespread sector retreats and adjusted expectations for RBA rate cuts. In such fluctuating conditions, investors often look beyond the major indices to explore opportunities in smaller or newer companies. Penny stocks, despite their somewhat outdated moniker, continue to offer intriguing possibilities for growth at lower price points by combining strong balance sheets with solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GreenX Metals (ASX:GRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GreenX Metals Limited focuses on the exploration and evaluation of the Arctic Rift Copper Project in Greenland, with a market cap of A$226.40 million.

Operations: The company generates its revenue primarily from mineral exploration, amounting to A$0.46 million.

Market Cap: A$226.4M

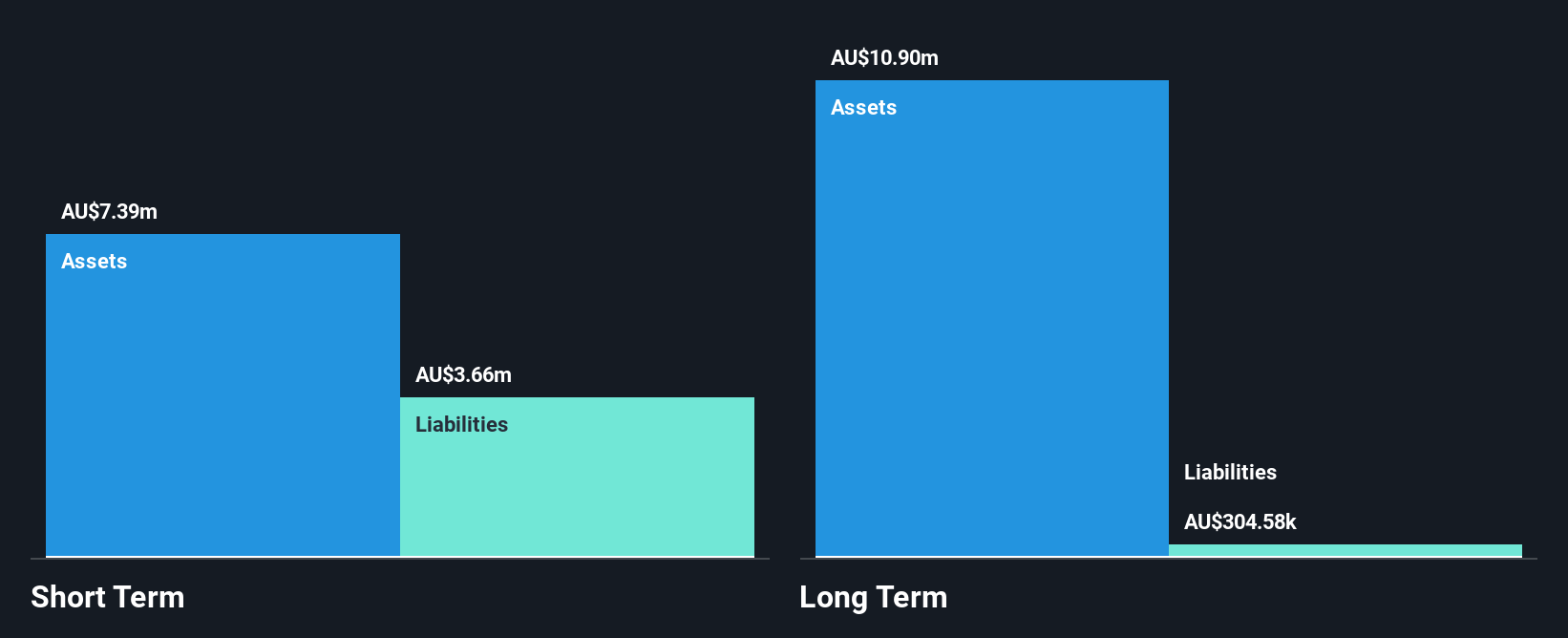

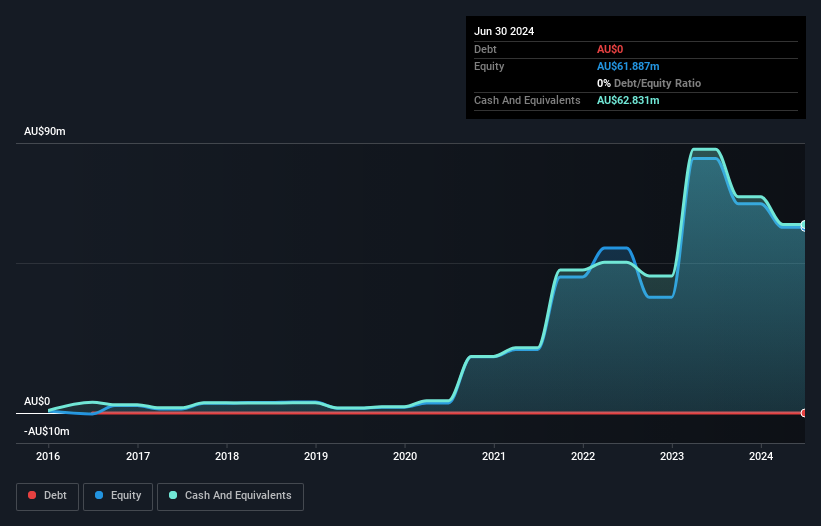

GreenX Metals Limited, with a market cap of A$226.40 million, is focused on the Arctic Rift Copper Project in Greenland and remains pre-revenue, generating only A$0.46 million from exploration activities. The company has no debt and maintains a sufficient cash runway for over a year based on current free cash flow. However, it faces challenges with ongoing losses increasing at 8.7% annually over five years and recent shareholder dilution by 2.4%. Notably, GreenX expanded its portfolio through an Earn-in Agreement to acquire interest in Germany's Richelsdorf copper-silver mines amid EU support for strategic raw materials like copper.

- Jump into the full analysis health report here for a deeper understanding of GreenX Metals.

- Learn about GreenX Metals' historical performance here.

Mayne Pharma Group (ASX:MYX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mayne Pharma Group Limited is a specialty pharmaceutical company that manufactures and sells branded and generic products across Australia, New Zealand, the United States, Canada, Europe, Asia, and other international markets with a market cap of A$389.51 million.

Operations: The company's revenue is derived from three main segments: Dermatology (A$174.86 million), Women's Health (A$142.83 million), and International markets (A$70.71 million).

Market Cap: A$389.51M

Mayne Pharma Group Limited, with a market cap of A$389.51 million, has seen its revenue rise significantly to A$388.4 million for the year ended June 30, 2024. Despite this growth, the company remains unprofitable with a net loss of A$174.23 million and negative return on equity at -37.13%. Short-term assets of A$460.6 million exceed both short and long-term liabilities, indicating some financial stability despite losses increasing over five years by 0.9% annually. The company's cash runway is less than a year if free cash flow continues to decline but exceeds three years at current levels without further reductions.

- Dive into the specifics of Mayne Pharma Group here with our thorough balance sheet health report.

- Gain insights into Mayne Pharma Group's future direction by reviewing our growth report.

Weebit Nano (ASX:WBT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Weebit Nano Limited develops non-volatile memory using Resistive RAM (ReRAM) technology with operations in Israel and France, and has a market cap of A$388.97 million.

Operations: The company's revenue segment is focused on Memory and Semiconductor Technology Development, generating A$1.02 million.

Market Cap: A$388.97M

Weebit Nano Limited, with a market cap of A$388.97 million, remains pre-revenue with sales of A$1.02 million and a net loss of A$41.25 million for the year ended June 30, 2024. Despite lacking profitability forecasts within the next three years, Weebit has over three years of cash runway if current cash flow trends persist and is debt-free. Recent developments include collaboration with DB HiTek to integrate its ReRAM technology into chips for consumer and industrial applications, aiming for production readiness by mid-2025. The company’s board and management are seasoned, providing experienced oversight as they advance their semiconductor innovations.

- Click here to discover the nuances of Weebit Nano with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Weebit Nano's future.

Next Steps

- Embark on your investment journey to our 1,026 ASX Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GRX

GreenX Metals

Engages in the exploration and evaluation of mineral properties in Greenland, Poland, and Germany.

Flawless balance sheet low.