- Australia

- /

- Metals and Mining

- /

- ASX:GRR

Top 3 ASX Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

The Australian market has seen a positive trend, rising 2.1% over the last week and climbing 11% in the past year, with earnings forecasted to grow by 13% annually. In this favorable environment, identifying dividend stocks that offer reliable income and potential for capital appreciation can be particularly rewarding for investors.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Collins Foods (ASX:CKF) | 3.65% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.56% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.31% | ★★★★★☆ |

| Auswide Bank (ASX:ABA) | 9.66% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.02% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.54% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.65% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.58% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 6.26% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.92% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Fenix Resources (ASX:FEX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fenix Resources Limited (ASX:FEX) is an Australian company focused on the exploration, development, and mining of mineral tenements in Western Australia with a market cap of A$230.60 million.

Operations: Fenix Resources Limited generates revenue from its mineral tenements in Western Australia, with segment adjustments amounting to A$311.38 million.

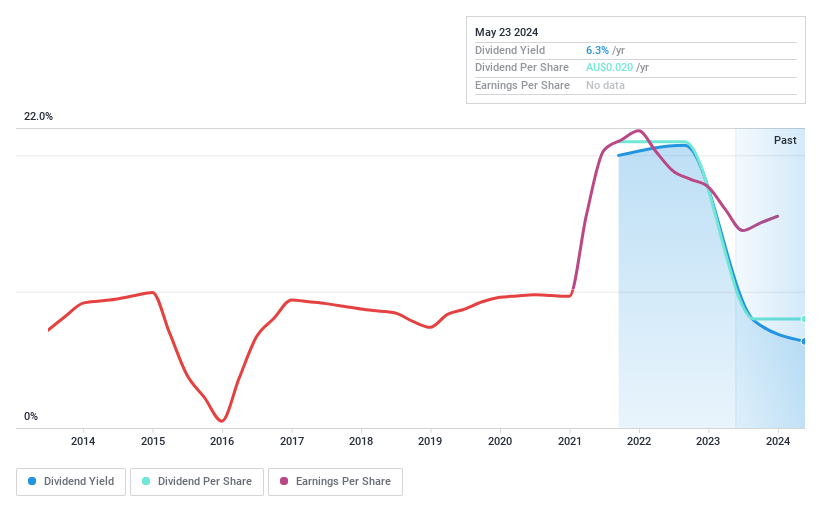

Dividend Yield: 6.2%

Fenix Resources' dividends are well-covered by both earnings and cash flows, with payout ratios of 31.5% and 35.5%, respectively. However, the company has a volatile dividend history over its three years of payments, which have also fallen during this period. Despite trading at good value compared to peers and having a high dividend yield in the top 25% of Australian payers, significant insider selling in the past quarter raises concerns about stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Fenix Resources.

- The analysis detailed in our Fenix Resources valuation report hints at an deflated share price compared to its estimated value.

Grange Resources (ASX:GRR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grange Resources Limited (ASX:GRR) operates an integrated iron ore mining and pellet production business in Australia and internationally, with a market cap of A$347.20 million.

Operations: Grange Resources Limited generates revenue primarily from its ore mining segment, which amounted to A$614.74 million.

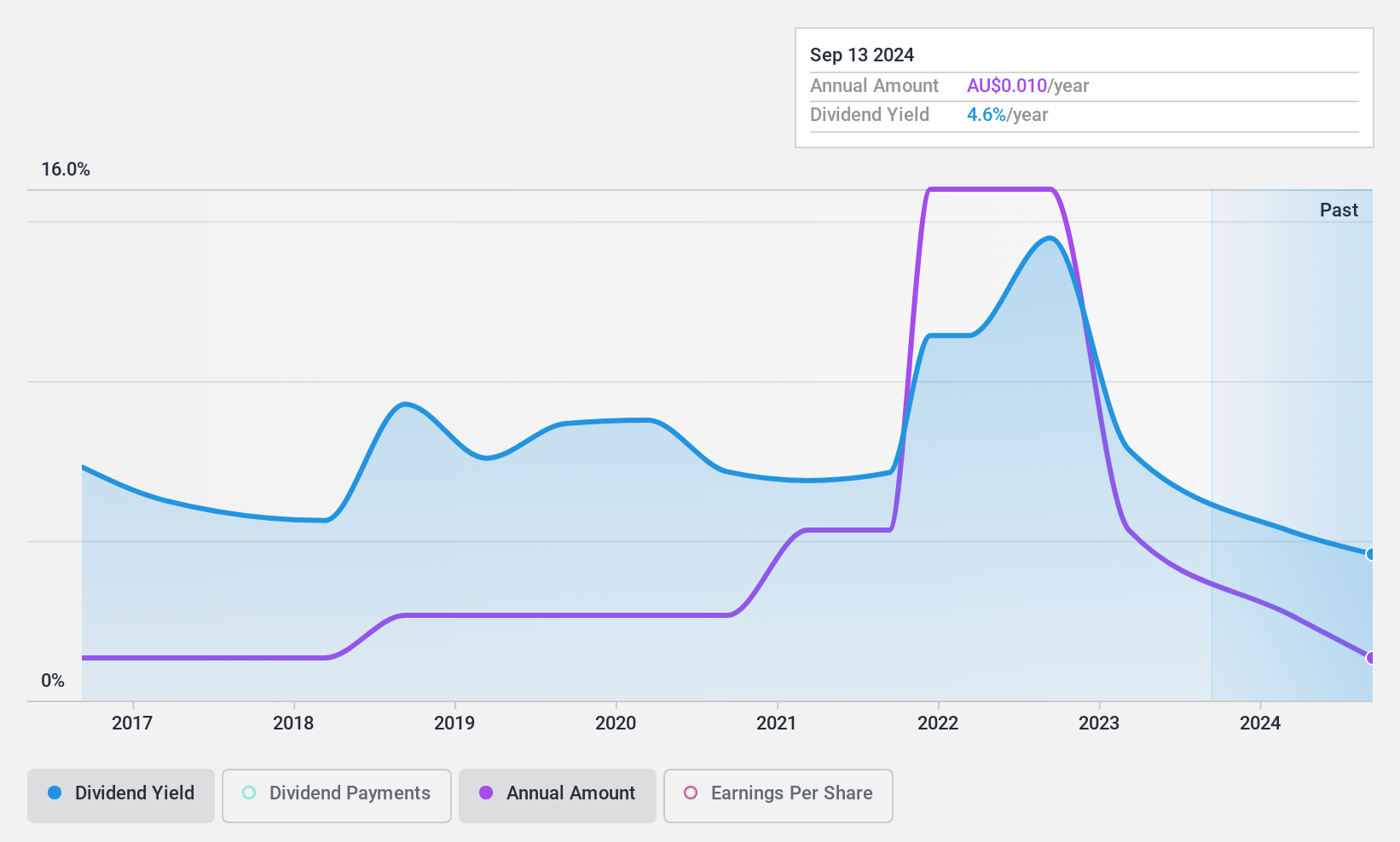

Dividend Yield: 6.7%

Grange Resources offers a high dividend yield in the top 25% of Australian payers, with dividends well-covered by earnings and cash flows, boasting low payout ratios of 15.4% and 14.4%, respectively. However, its dividend history has been volatile over the past decade with no growth in payments. Recent executive changes saw Mr. Weidong Wang take over as CEO on July 15, 2024, following Mr. Honglin Zhao's retirement from both his CEO role and the Board of Directors.

- Take a closer look at Grange Resources' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Grange Resources shares in the market.

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited (ASX:SRV) offers executive serviced and virtual offices, coworking spaces, and various IT, communications, and secretarial services with a market cap of A$473.40 million.

Operations: Servcorp Limited generates revenue from executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services.

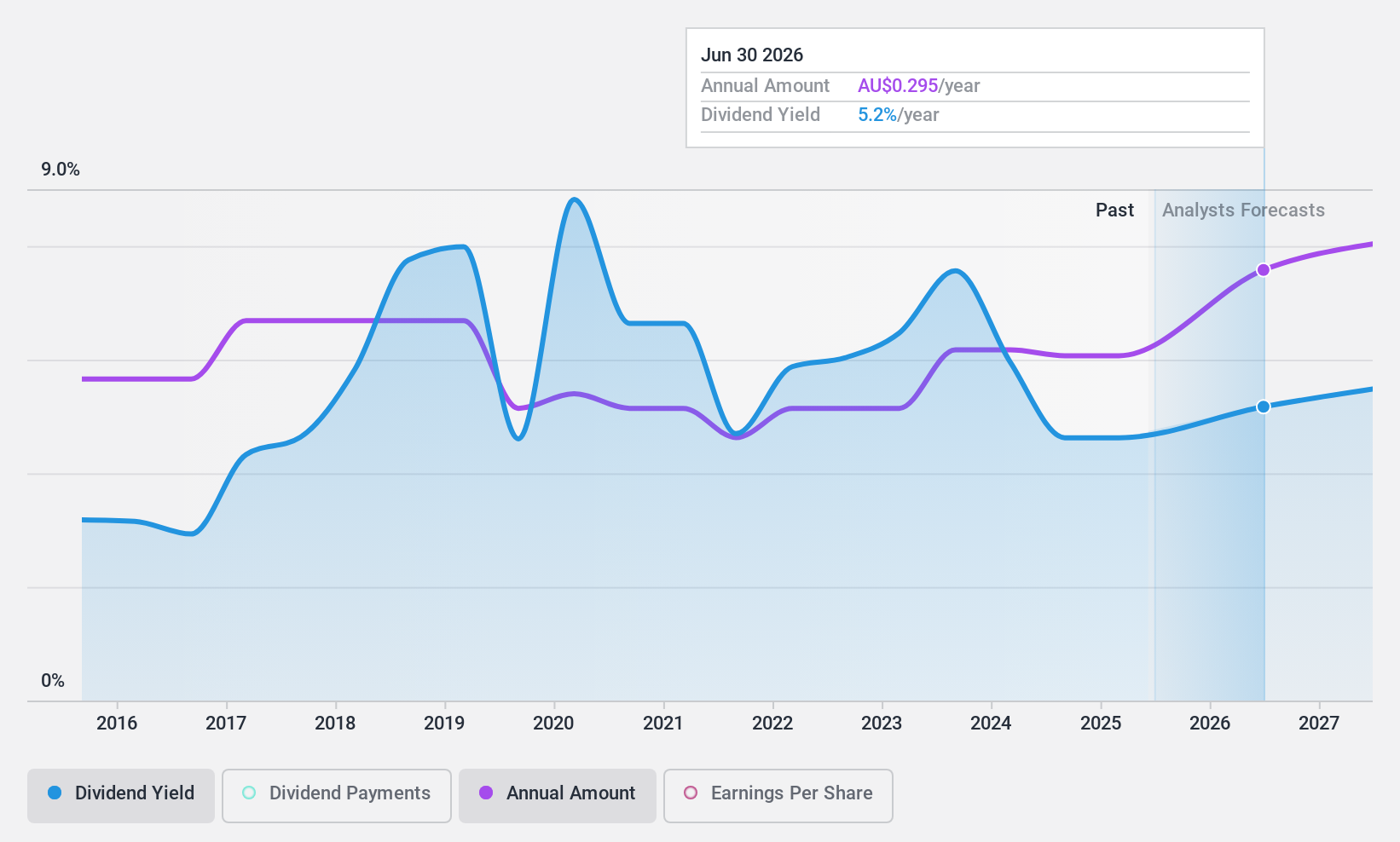

Dividend Yield: 5%

Servcorp Limited reported significant earnings growth for the fiscal year ended June 30, 2024, with net income rising to A$39.04 million from A$11.07 million a year ago. The company declared a final dividend of 13 cents per share, increasing total dividends for FY24 by 14% to 25 cents per share. Despite past volatility in dividend payments, Servcorp's dividends are well-covered by both earnings and cash flows, with payout ratios of 7.1% and 14.4%, respectively.

- Click here to discover the nuances of Servcorp with our detailed analytical dividend report.

- Our valuation report unveils the possibility Servcorp's shares may be trading at a discount.

Taking Advantage

- Access the full spectrum of 34 Top ASX Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GRR

Grange Resources

Owns and operates integrated iron ore mining and pellet production business in Australia and internationally.

Flawless balance sheet, good value and pays a dividend.