Australian shares are poised for a moderate gain today, as the ASX looks to join a 'buy the dip' rally, reflecting optimism among global traders. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for investors seeking opportunities beyond the well-known names. While the term "penny stocks" might feel outdated, these investments can still offer surprising value and potential growth when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.38 | A$114.16M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.87 | A$54.17M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.95 | A$448.77M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.63 | A$272.35M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.86 | A$411.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.25 | A$1.38B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.78 | A$257.38M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.28 | A$126.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 414 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Atlas Pearls (ASX:ATP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Pearls Limited operates in the production and sale of South Sea pearls in Australia and Indonesia, with a market cap of A$80.66 million.

Operations: The company generates revenue from the sale of loose pearls, with A$39.77 million coming from Australia and A$24.99 million from Indonesia.

Market Cap: A$80.66M

Atlas Pearls Limited, with a market cap of A$80.66 million, operates in the South Sea pearl industry with significant revenue streams from both Australia (A$39.77 million) and Indonesia (A$24.99 million). The company recently declared a fully franked dividend of A$0.014 per share for the first half of 2025, indicating shareholder returns despite a decline in net income to A$21.9 million from A$31.47 million last year. Atlas maintains high return on equity at 30.8% and benefits from an experienced management team and board, while remaining debt-free and trading below estimated fair value by 42.6%.

- Click here to discover the nuances of Atlas Pearls with our detailed analytical financial health report.

- Gain insights into Atlas Pearls' historical outcomes by reviewing our past performance report.

Focus Minerals (ASX:FML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Focus Minerals Limited is involved in the exploration and development of gold properties in Western Australia, with a market cap of A$788.04 million.

Operations: The company's revenue is primarily derived from its Coolgardie operations, which generated A$151.74 million.

Market Cap: A$788.04M

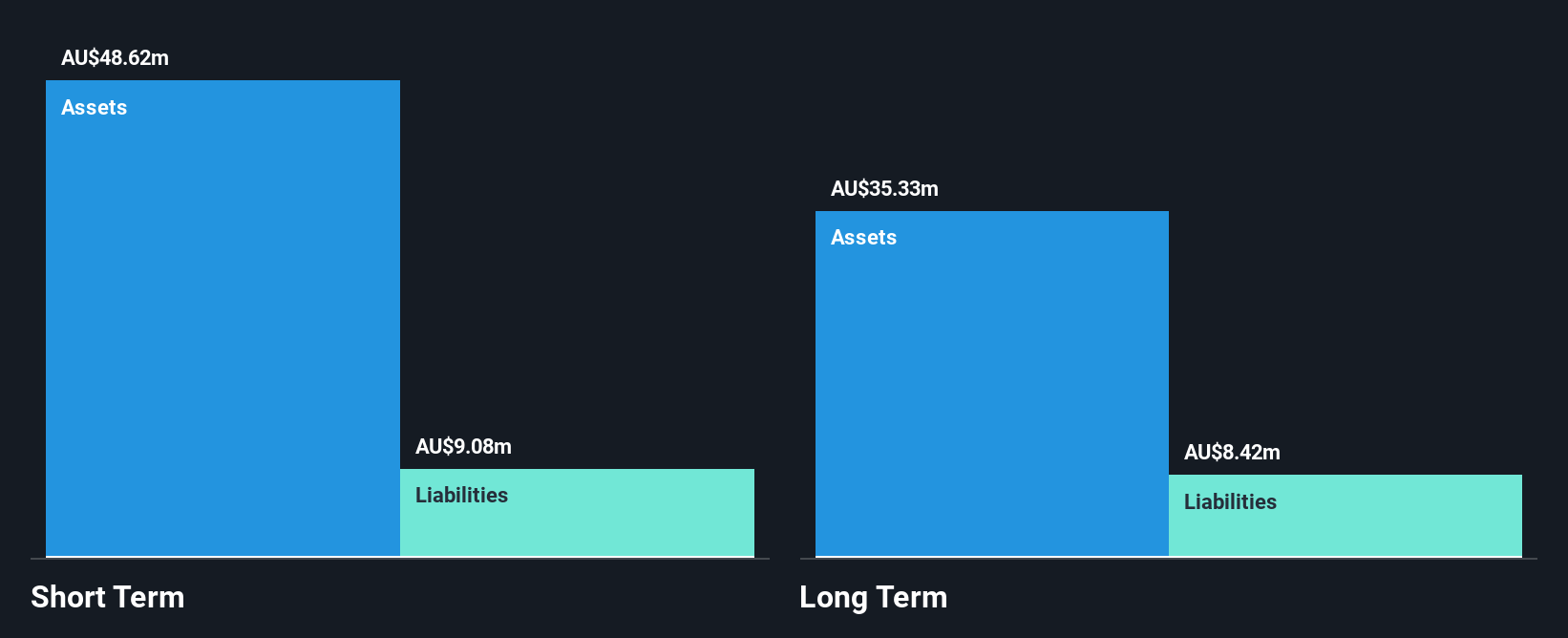

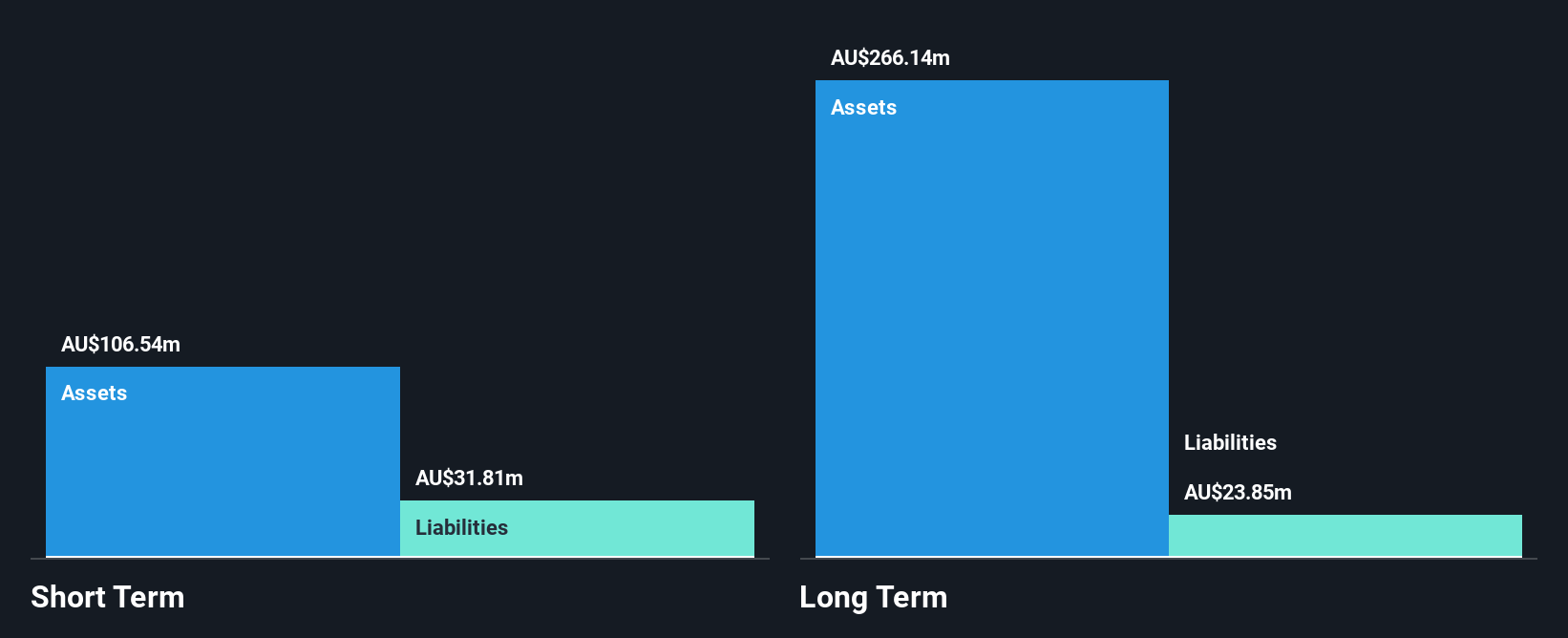

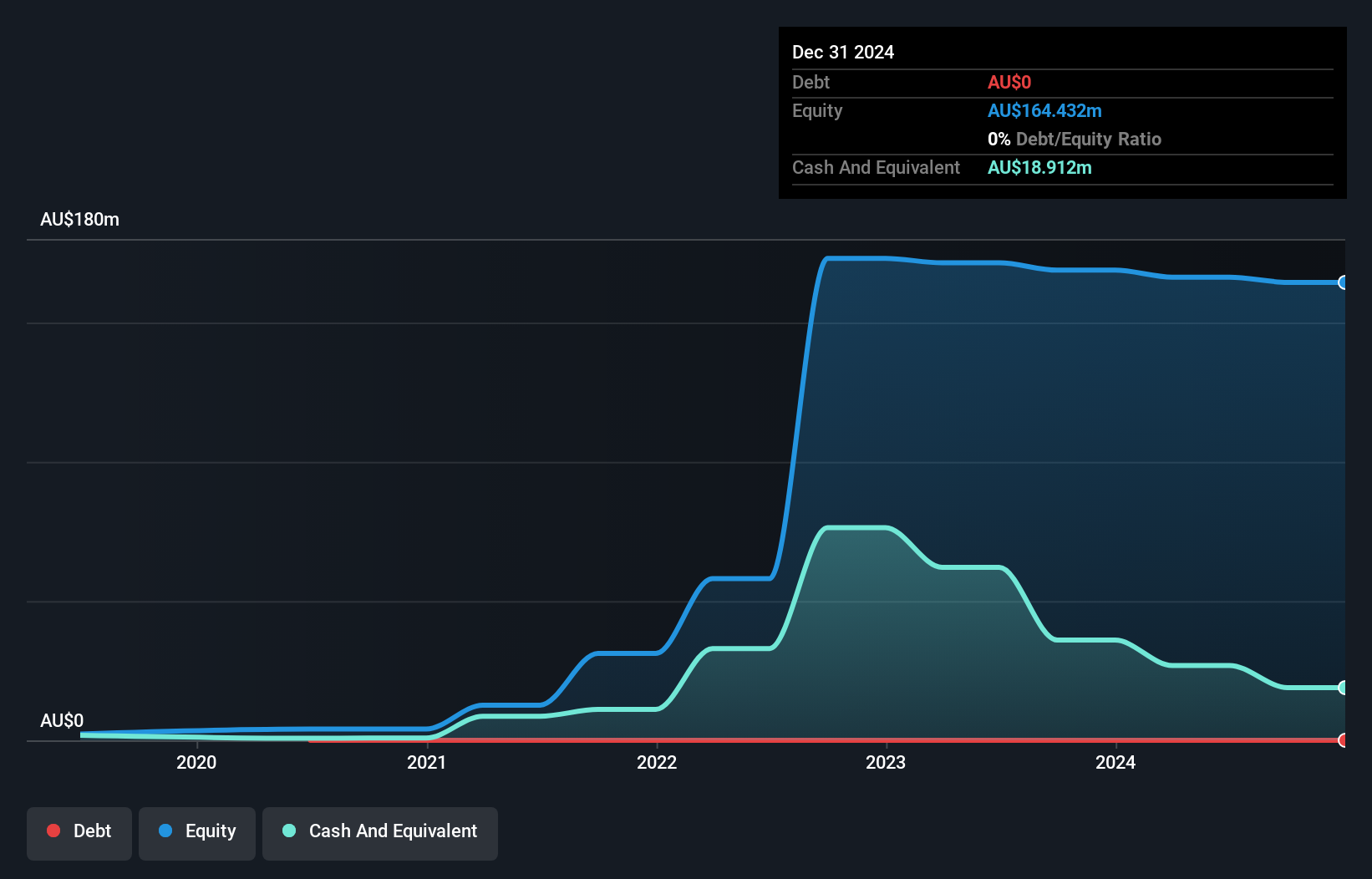

Focus Minerals Limited, with a market cap of A$788.04 million, has demonstrated significant earnings growth, outpacing industry averages. The company reported half-year sales of A$77.73 million and net income of A$221.4 million, marking a turnaround from the previous year's loss. Its experienced management and board enhance operational stability while maintaining a debt-free status strengthens its financial position. Despite high share price volatility and low return on equity at 6.1%, Focus's short-term assets comfortably cover both short- and long-term liabilities, suggesting robust liquidity amidst volatile market conditions typical for penny stocks.

- Click to explore a detailed breakdown of our findings in Focus Minerals' financial health report.

- Evaluate Focus Minerals' historical performance by accessing our past performance report.

Global Lithium Resources (ASX:GL1)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Lithium Resources Limited focuses on the evaluation, exploration, and development of lithium resources in Australia, with a market cap of A$138.72 million.

Operations: Currently, the company has not reported any revenue segments.

Market Cap: A$138.72M

Global Lithium Resources Limited, with a market cap of A$138.72 million, is pre-revenue and unprofitable, reporting a net loss of A$3.85 million for the year ending June 2025. The company maintains a debt-free status with short-term assets of A$16.6 million exceeding its liabilities, indicating solid liquidity despite having less than one year of cash runway if current cash flow trends persist. Its share price has been highly volatile recently, and the board is relatively new with an average tenure of one year. Earnings are forecast to decline significantly over the next three years without expected profitability in sight.

- Dive into the specifics of Global Lithium Resources here with our thorough balance sheet health report.

- Evaluate Global Lithium Resources' prospects by accessing our earnings growth report.

Seize The Opportunity

- Discover the full array of 414 ASX Penny Stocks right here.

- Contemplating Other Strategies? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ATP

Atlas Pearls

Produces and sells south sea pearls in Australia and Indonesia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives