Stock Analysis

The recent 22% drop in Firetail Resources Limited's (ASX:FTL) stock could come as a blow to insiders who purchased AU$150.5k worth of stock at an average buy price of AU$0.091 over the past 12 months. Insiders buy with the expectation to see their investments rise in value over a period of time. However, recent losses have rendered their above investment worth AU$82.8k which is not ideal.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

See our latest analysis for Firetail Resources

Firetail Resources Insider Transactions Over The Last Year

The Executive Chairman of the Board Brett Grosvenor made the biggest insider purchase in the last 12 months. That single transaction was for AU$140k worth of shares at a price of AU$0.09 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being AU$0.05). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. In our view, the price an insider pays for shares is very important. Generally speaking, it catches our eye when an insider has purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price. Brett Grosvenor was the only individual insider to buy during the last year.

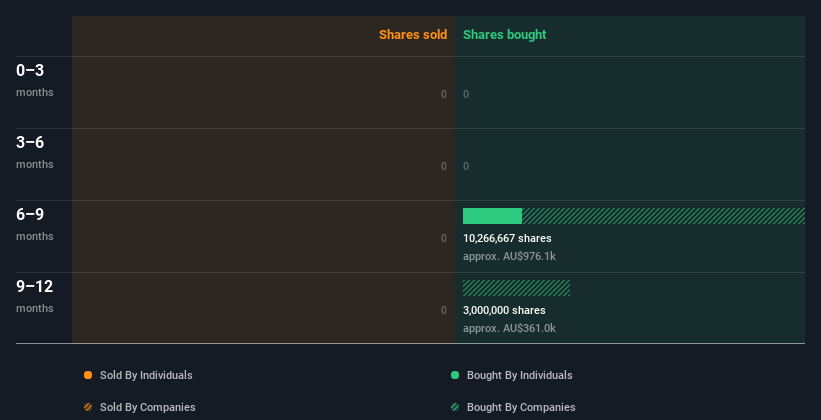

Brett Grosvenor bought a total of 1.66m shares over the year at an average price of AU$0.091. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Does Firetail Resources Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Firetail Resources insiders own about AU$1.4m worth of shares. That equates to 19% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Firetail Resources Insider Transactions Indicate?

The fact that there have been no Firetail Resources insider transactions recently certainly doesn't bother us. But insiders have shown more of an appetite for the stock, over the last year. Overall we don't see anything to make us think Firetail Resources insiders are doubting the company, and they do own shares. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Our analysis shows 5 warning signs for Firetail Resources (4 can't be ignored!) and we strongly recommend you look at these before investing.

But note: Firetail Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're helping make it simple.

Find out whether Firetail Resources is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FTL

Firetail Resources

Engages in the acquisition and exploration of resource projects in Australia and Peru.

Flawless balance sheet and slightly overvalued.