- Australia

- /

- Medical Equipment

- /

- ASX:PNV

Uncovering Opportunities: 4DS Memory And 2 Other ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market is experiencing a cautious start to the week, with the ASX200 set to decline amid mixed performances on Wall Street and ongoing scrutiny of major companies. In such fluctuating conditions, investors often turn their attention to smaller stocks that may offer unique opportunities. Penny stocks, though an older term, still highlight companies that can provide growth potential when supported by strong financials. In this article, we will explore three ASX penny stocks that stand out for their financial strength and potential value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

4DS Memory (ASX:4DS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 4DS Memory Limited is a semiconductor technology company in Australia that specializes in non-volatile memory technology services, with a market cap of A$162.24 million.

Operations: The company's revenue is derived from its computer storage devices segment, totaling A$0.00805 million.

Market Cap: A$162.24M

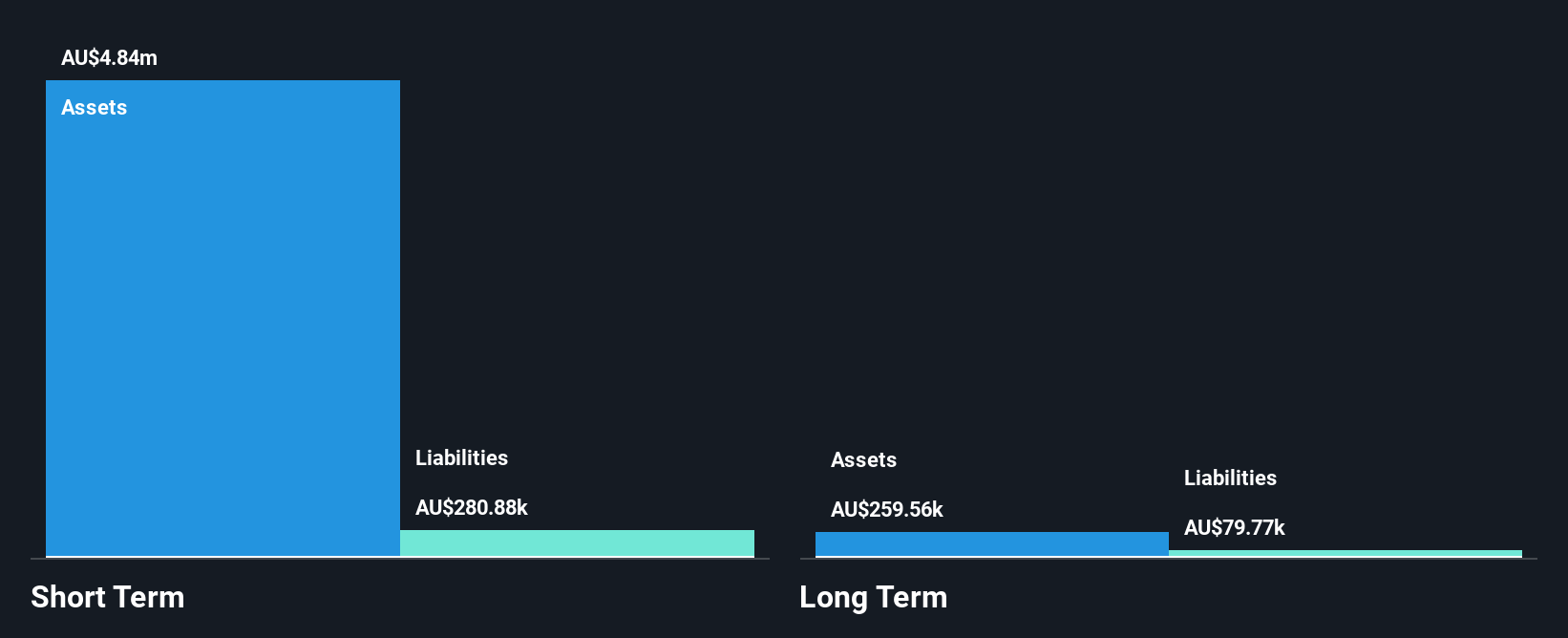

4DS Memory, a semiconductor technology firm in Australia, is pre-revenue with earnings from its computer storage devices segment totaling A$8K. Despite being debt-free and having sufficient cash runway for over a year, 4DS remains unprofitable and isn't expected to achieve profitability in the next three years. The management team is relatively new with an average tenure of 1.8 years, while the board has more experience at 8.8 years average tenure. Recent earnings reports show reduced net losses from A$5.79 million to A$5.45 million year-on-year, indicating gradual loss reduction over five years at 1.8% annually without significant shareholder dilution recently.

- Get an in-depth perspective on 4DS Memory's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into 4DS Memory's track record.

Image Resources (ASX:IMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Image Resources NL is a mineral sands mining company based in Western Australia with a market cap of A$109.96 million.

Operations: Image Resources NL has not reported any specific revenue segments.

Market Cap: A$109.96M

Image Resources NL, a mineral sands mining company in Western Australia with a market cap of A$109.96 million, is currently unprofitable and has seen losses increase by 33.2% annually over the past five years. Despite being debt-free and having short-term assets of A$43.8 million exceeding its short-term liabilities of A$4.1 million, it struggles with long-term liabilities totaling A$51.5 million. The management team and board are experienced, averaging tenures of 9.2 and 8.3 years respectively; however, shareholder dilution occurred last year with shares outstanding growing by 3.8%. Recent earnings reports showed a net loss of A$5.16 million for the half-year ended June 2024 compared to a profit previously reported in the same period last year.

- Click to explore a detailed breakdown of our findings in Image Resources' financial health report.

- Gain insights into Image Resources' past trends and performance with our report on the company's historical track record.

PolyNovo (ASX:PNV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across the United States, Australia, New Zealand, and internationally with a market cap of A$1.64 billion.

Operations: The company's revenue primarily comes from the development, manufacturing, and commercialisation of the NovoSorb Technology, generating A$103.23 million.

Market Cap: A$1.64B

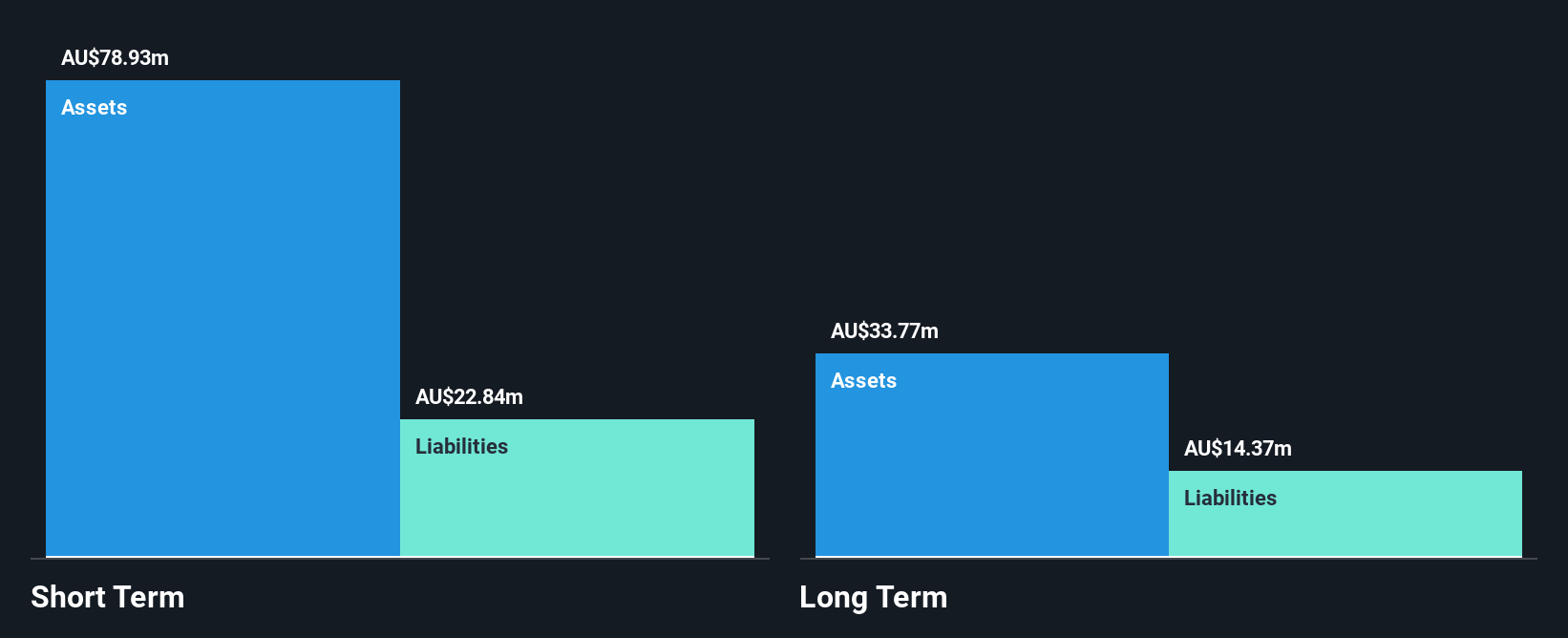

PolyNovo Limited, with a market cap of A$1.64 billion, has shown significant revenue growth, reaching A$104.76 million for the year ended June 2024 compared to A$66.54 million the previous year. The company transitioned to profitability with a net income of A$5.26 million from a prior loss, indicating strong financial progress. Despite low return on equity at 7.3%, PolyNovo's debt is well covered by operating cash flow and its short-term assets exceed liabilities comfortably. However, recent insider selling and an inexperienced management team may pose challenges as it navigates further expansion and strategic adjustments following board changes.

- Jump into the full analysis health report here for a deeper understanding of PolyNovo.

- Examine PolyNovo's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Reveal the 1,026 hidden gems among our ASX Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNV

PolyNovo

Designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally.

High growth potential with excellent balance sheet.