November 2025's Top Undervalued Small Caps With Insider Activity In Asian Markets

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, including a record U.S. government shutdown and fluctuating consumer sentiment, Asian markets present a unique opportunity for investors interested in small-cap stocks. In this environment, identifying companies with solid fundamentals and notable insider activity can be crucial for those looking to navigate the complexities of the current market landscape.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.5x | 1.0x | 20.50% | ★★★★★★ |

| East West Banking | 3.1x | 0.7x | 18.21% | ★★★★☆☆ |

| Eureka Group Holdings | 10.8x | 4.7x | 25.54% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.79% | ★★★★☆☆ |

| BWP Trust | 10.3x | 13.5x | 15.79% | ★★★★☆☆ |

| Bumitama Agri | 11.6x | 1.7x | 44.72% | ★★★☆☆☆ |

| PolyNovo | 62.5x | 6.4x | 26.03% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -428.34% | ★★★☆☆☆ |

| Chinasoft International | 23.9x | 0.7x | -1309.48% | ★★★☆☆☆ |

| Far East Orchard | 9.8x | 3.2x | 12.75% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

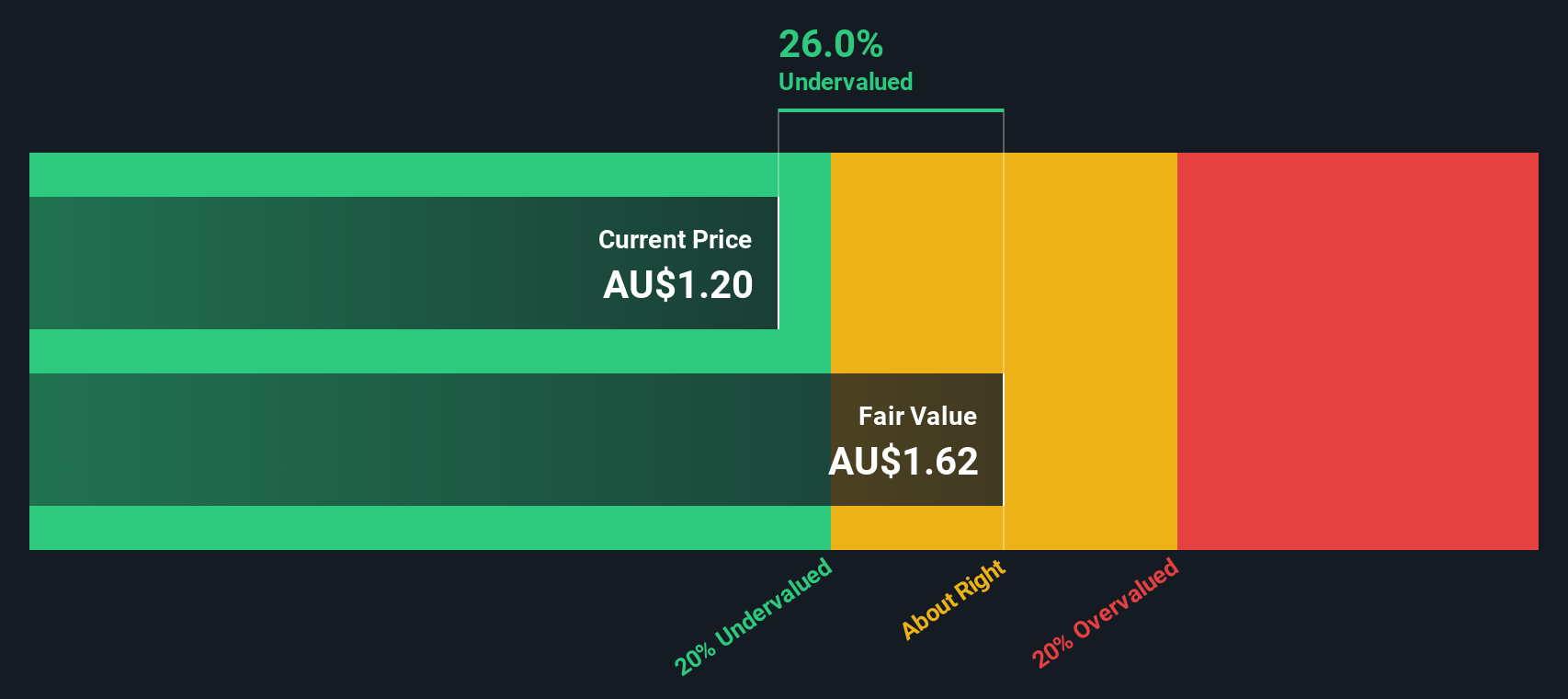

PolyNovo (ASX:PNV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PolyNovo is a company focused on the development, manufacturing, and commercialization of its NovoSorb technology, with a market cap of A$1.75 billion.

Operations: The company generates revenue primarily from the development, manufacturing, and commercialization of NovoSorb technology, with a recent revenue figure of A$128.70 million. The cost of goods sold (COGS) is A$13.65 million, contributing to a gross profit margin of 89.39%. Operating expenses are significant at A$107.13 million, impacting net income despite non-operating gains.

PE: 62.5x

PolyNovo, a promising player in the medical device sector, recently reported a revenue increase to A$129.19 million for the year ending June 30, 2025. Their net income also rose to A$13.21 million, reflecting improved financial health despite being dropped from the S&P/ASX 200 Index in September 2025. Insider confidence is evident as David Williams purchased shares worth approximately A$85,869. The appointment of Robert Douglas to the board brings over three decades of industry expertise and governance experience, potentially steering future growth amidst their high-risk funding landscape reliant on external borrowing sources.

- Dive into the specifics of PolyNovo here with our thorough valuation report.

Explore historical data to track PolyNovo's performance over time in our Past section.

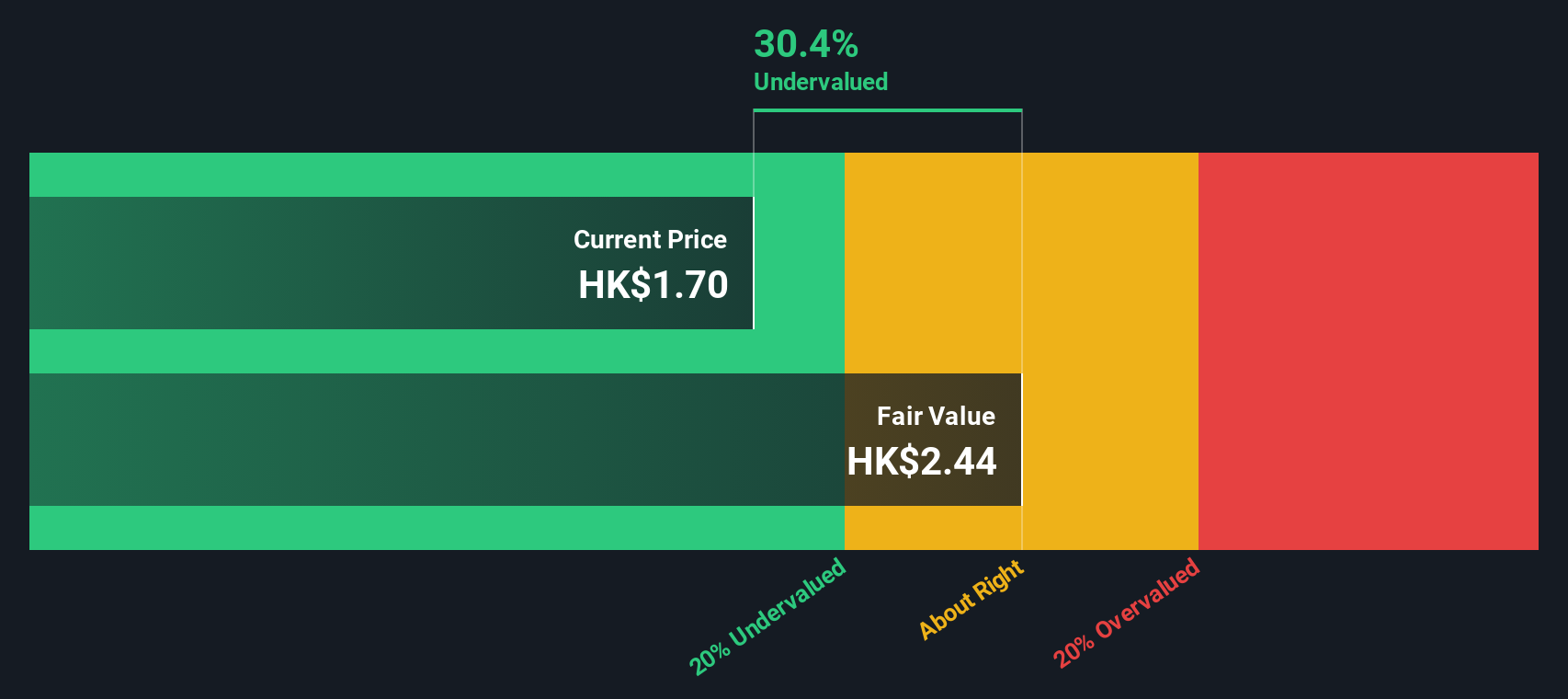

Sinofert Holdings (SEHK:297)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sinofert Holdings is a major fertilizer distributor and producer in China, with operations spanning production, basic business, and growth business segments, and it has a market capitalization of approximately HK$5.63 billion.

Operations: Sinofert Holdings generates revenue primarily from its Basic Business and Growth Business segments, with the latter contributing significantly to overall earnings. The company's cost of goods sold (COGS) is a major expense, impacting its gross profit margins. Notably, Sinofert's gross profit margin has shown an increasing trend reaching 12.84% in recent periods.

PE: 9.8x

Sinofert Holdings, a key player in Asia's fertilizer industry, recently reported sales of CNY 14.7 billion for the first half of 2025, up from CNY 13.7 billion the previous year. Their net income also saw a slight increase to CNY 1.1 billion. Insider confidence is evident with Tielin Wang purchasing 450,000 shares valued at approximately US$640K between August and November 2025, reflecting potential faith in future growth despite reliance on higher-risk external borrowing for funding.

- Click here and access our complete valuation analysis report to understand the dynamics of Sinofert Holdings.

Understand Sinofert Holdings' track record by examining our Past report.

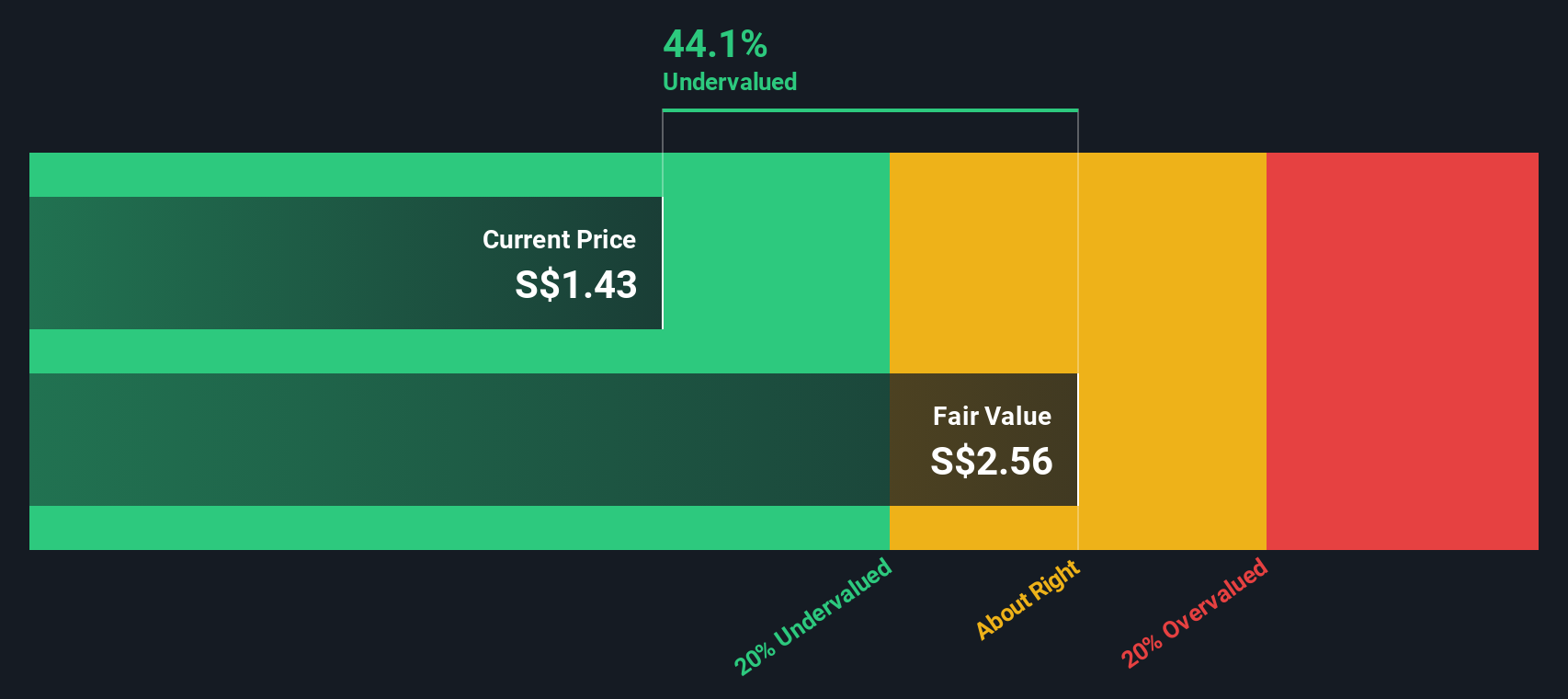

Bumitama Agri (SGX:P8Z)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bumitama Agri is a company engaged in the cultivation of oil palm plantations and the production of crude palm oil, with a market capitalization of approximately SGD 1.32 billion.

Operations: The company's revenue primarily stems from its Plantations and Palm Oil Mills segment, with the latest reported revenue at IDR 18.87 billion. Over recent periods, the gross profit margin has shown variability, reaching up to 38.92% in mid-2022 before adjusting to 28.12% by mid-2025. Operating expenses have consistently impacted profitability, with notable costs in sales and marketing alongside general and administrative expenses contributing to overall financial performance.

PE: 11.6x

Bumitama Agri, a small player in Asia's agricultural sector, shows promise with its recent financial performance. For the half year ending June 2025, sales rose to IDR 9.74 trillion from IDR 7.6 trillion the previous year, while net income increased to IDR 1.27 trillion from IDR 857 billion. Despite relying solely on external borrowing for funding, insider confidence is evident through share purchases over the past months. Earnings are projected to grow nearly 10% annually, suggesting potential value amidst industry challenges.

- Get an in-depth perspective on Bumitama Agri's performance by reading our valuation report here.

Examine Bumitama Agri's past performance report to understand how it has performed in the past.

Make It Happen

- Navigate through the entire inventory of 40 Undervalued Asian Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:297

Sinofert Holdings

An investment holding company, engages in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products in Mainland China and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives