- Australia

- /

- Medical Equipment

- /

- ASX:NAN

3 Promising ASX Penny Stocks With Market Caps Over A$70M

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.33% at 8226 points, driven by strong performances in the Energy and Industrials sectors. In this context, investors often seek opportunities in smaller companies that could offer growth potential despite their lower price points. Though "penny stocks" is an older term, it remains relevant for identifying these smaller or newer companies with solid financials and potential for growth. Here, we explore three such penny stocks on the ASX that stand out for their financial strength and promise of future value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$301.21M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.555 | A$344.18M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.82 | A$100.68M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.195 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.49 | A$132.44M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.32 | A$112.68M | ★★★★★☆ |

Click here to see the full list of 1,037 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Aussie Broadband (ASX:ABB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.11 billion.

Operations: The company's revenue is segmented into Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

Market Cap: A$1.11B

Aussie Broadband Limited, with a market cap of A$1.11 billion, has demonstrated significant revenue growth, reaching nearly A$1 billion in sales for the fiscal year ending June 2024. The company has improved its financial position from negative shareholder equity five years ago to positive now. However, challenges remain as short-term assets do not cover long-term liabilities and recent earnings were impacted by a large one-off loss of A$10.5 million. Despite these issues, the company's debt is well covered by operating cash flow and it trades at a substantial discount to its estimated fair value.

- Unlock comprehensive insights into our analysis of Aussie Broadband stock in this financial health report.

- Review our growth performance report to gain insights into Aussie Broadband's future.

Camplify Holdings (ASX:CHL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Camplify Holdings Limited operates peer-to-peer digital marketplace platforms that connect RV owners with hirers across Australia, New Zealand, the United Kingdom, Spain, Germany, Austria, and the Netherlands; it has a market cap of A$73.65 million.

Operations: The company's revenue is primarily derived from its Hire segment, generating A$34.49 million, complemented by Membership fees amounting to A$5.17 million.

Market Cap: A$73.65M

Camplify Holdings Limited, with a market cap of A$73.65 million, has shown revenue growth, reporting A$47.75 million in sales for the year ending June 2024, up from A$38.23 million previously. Despite this growth, the company remains unprofitable with a net loss of A$8.12 million and negative return on equity at -13.92%. Short-term assets exceed liabilities and cash reserves surpass total debt, providing some financial stability amidst losses that have increased over five years by 17.4% annually. Recently added to the S&P/ASX Emerging Companies Index, analysts expect significant stock price appreciation potential at 125.6%.

- Click here to discover the nuances of Camplify Holdings with our detailed analytical financial health report.

- Gain insights into Camplify Holdings' outlook and expected performance with our report on the company's earnings estimates.

Nanosonics (ASX:NAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanosonics Limited is a global infection prevention company with a market cap of A$982.91 million.

Operations: The company generates revenue of A$170.01 million from its Healthcare Equipment segment.

Market Cap: A$982.91M

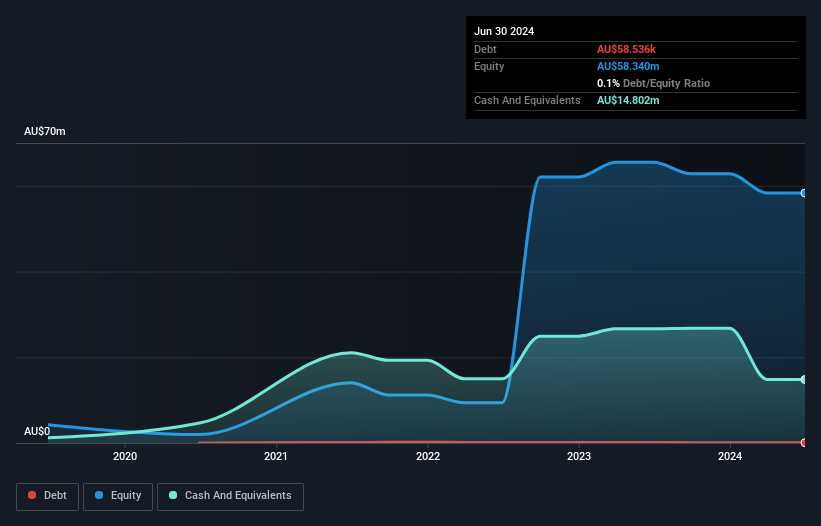

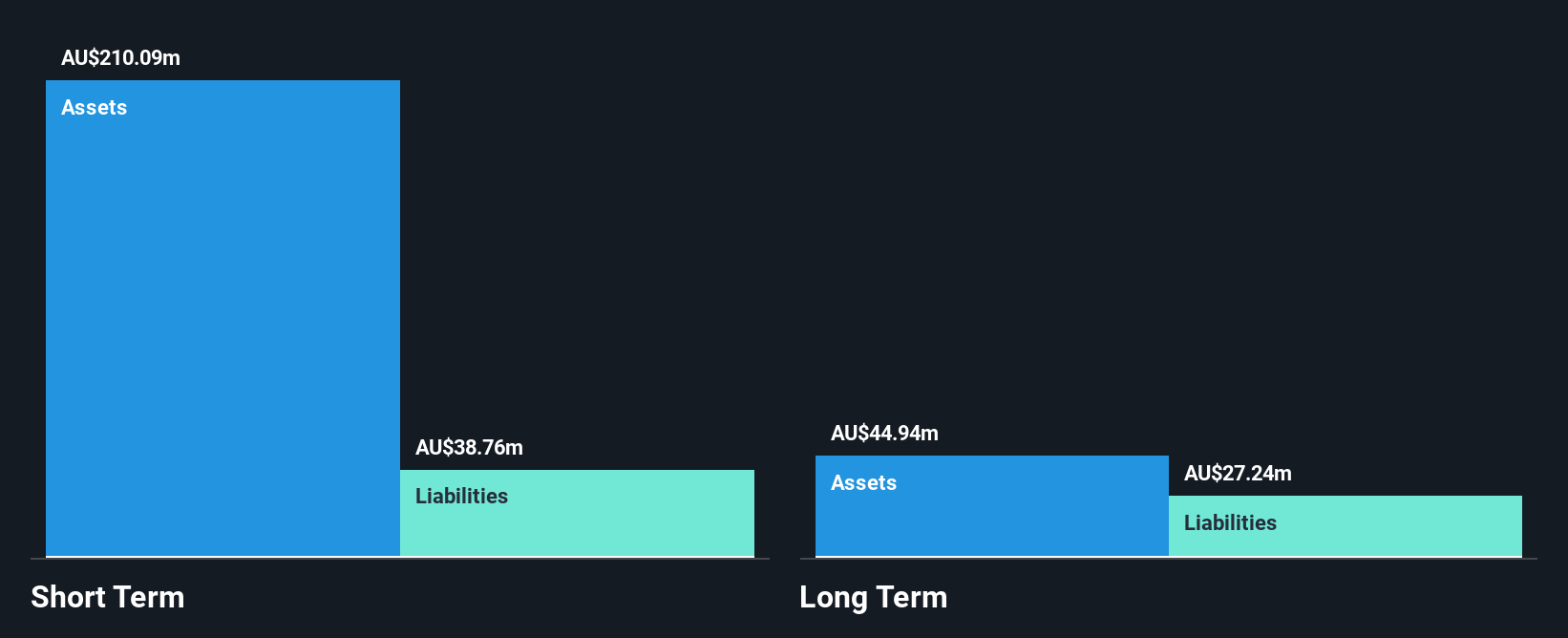

Nanosonics Limited, with a market cap of A$982.91 million, operates debt-free and maintains strong financial stability, as short-term assets significantly exceed both short and long-term liabilities. Despite high-quality earnings, the company experienced a 34.8% decline in earnings growth over the past year and reported decreased profit margins from 12% to 7.6%. Recent changes include its removal from the S&P/ASX 200 Index and upcoming board member departures, which could impact governance dynamics. Revenue increased slightly to A$170.01 million for the year ending June 2024; however, net income fell to A$12.97 million from A$19.88 million previously.

- Get an in-depth perspective on Nanosonics' performance by reading our balance sheet health report here.

- Gain insights into Nanosonics' future direction by reviewing our growth report.

Summing It All Up

- Dive into all 1,037 of the ASX Penny Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAN

Flawless balance sheet with reasonable growth potential.