- Australia

- /

- Medical Equipment

- /

- ASX:MX1

Take Care Before Diving Into The Deep End On Micro-X Limited (ASX:MX1)

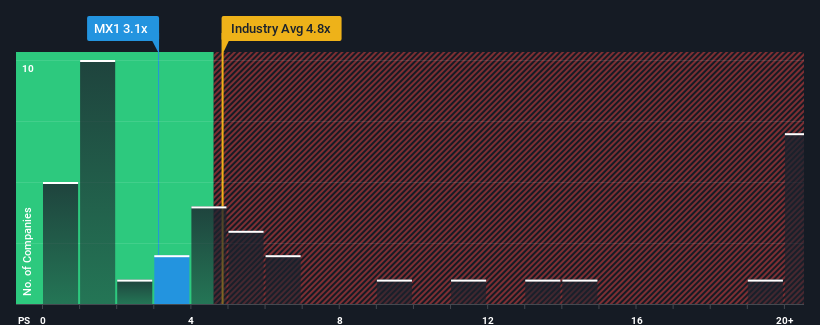

With a price-to-sales (or "P/S") ratio of 3.1x Micro-X Limited (ASX:MX1) may be sending bullish signals at the moment, given that almost half of all the Medical Equipment companies in Australia have P/S ratios greater than 4.8x and even P/S higher than 14x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Micro-X

How Has Micro-X Performed Recently?

Recent times haven't been great for Micro-X as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Micro-X will help you uncover what's on the horizon.How Is Micro-X's Revenue Growth Trending?

Micro-X's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.6% last year. The latest three year period has also seen an excellent 160% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 78% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

With this information, we find it odd that Micro-X is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Micro-X's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Micro-X's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Micro-X is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Micro-X, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MX1

Micro-X

Designs, develops, manufactures, and commercializes imaging products for healthcare, defense, and security markets through cold cathode X-ray technology.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives