Stock Analysis

- Australia

- /

- Healthtech

- /

- ASX:M7T

Mach7 Technologies (ASX:M7T) pops 11% this week, taking five-year gains to 196%

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. One great example is Mach7 Technologies Limited (ASX:M7T) which saw its share price drive 196% higher over five years. And in the last week the share price has popped 11%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Mach7 Technologies

Mach7 Technologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Mach7 Technologies can boast revenue growth at a rate of 22% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 24% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes Mach7 Technologies worth investigating - it may have its best days ahead.

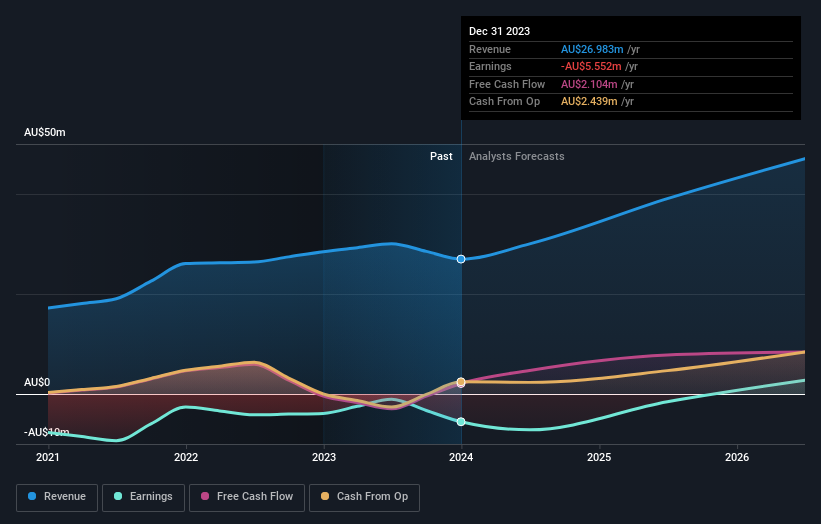

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Mach7 Technologies has rewarded shareholders with a total shareholder return of 21% in the last twelve months. However, the TSR over five years, coming in at 24% per year, is even more impressive. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Mach7 Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:M7T

Mach7 Technologies

Mach7 Technologies Limited provides enterprise imaging data sharing, storage, and interoperability for healthcare enterprises in North America, the Asia Pacific, the Middle East, Europe and internationally.

Flawless balance sheet with reasonable growth potential.