Stock Analysis

- Australia

- /

- Medical Equipment

- /

- ASX:IPD

Brookside Energy And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market remains buoyant, with the ASX200 closing up 0.84% at 8,295 points amid positive expectations for global economic developments. In such a vibrant market landscape, identifying stocks with solid fundamentals becomes crucial for investors seeking to capitalize on growth opportunities. Penny stocks, while often seen as relics of past trading days, still hold potential when backed by strong financials and can offer a unique mix of affordability and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.885 | A$306.91M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.565 | A$350.38M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.61 | A$71.5M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.86 | A$127.05M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.49 | A$132.44M | ★★★★★★ |

Click here to see the full list of 1,038 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Brookside Energy (ASX:BRK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brookside Energy Limited, with a market cap of A$49.16 million, is involved in the exploration, production, and appraisal of oil and gas projects in the United States.

Operations: The company's revenue is primarily generated from its Oil and Gas & Other US Entities segment, which accounts for A$41.63 million, with a minor contribution of A$0.03 million from its Corporate activities.

Market Cap: A$49.16M

Brookside Energy, with a market cap of A$49.16 million, has shown significant financial resilience despite recent challenges. The company reported A$15.41 million in sales for the half-year ending June 2024, although this was a decline from the previous year's A$26.8 million. Despite negative earnings growth over the past year, Brookside's debt management is strong with more cash than total debt and short-term assets exceeding liabilities. Its price-to-earnings ratio of 3.3x indicates good value compared to peers and industry standards, while its net profit margin has improved to 36.8%. However, management's inexperience could pose risks moving forward.

- Get an in-depth perspective on Brookside Energy's performance by reading our balance sheet health report here.

- Gain insights into Brookside Energy's future direction by reviewing our growth report.

ImpediMed (ASX:IPD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ImpediMed Limited is a medical technology company that manufactures and sells bioimpedance spectroscopy (BIS) technology medical devices in the United States and Europe, with a market cap of A$117.37 million.

Operations: The company generates revenue from its Medical segment, amounting to A$10.32 million.

Market Cap: A$117.37M

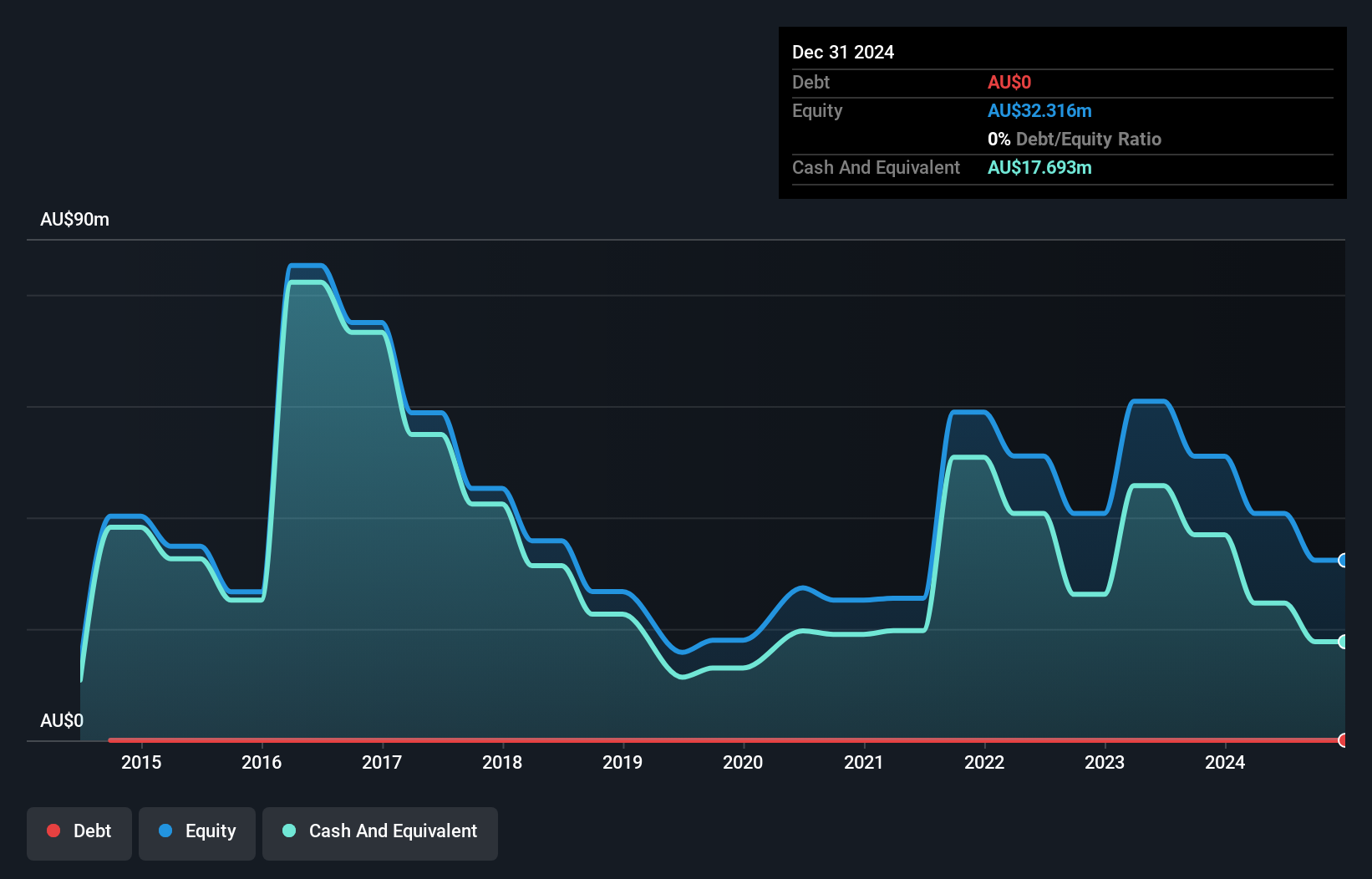

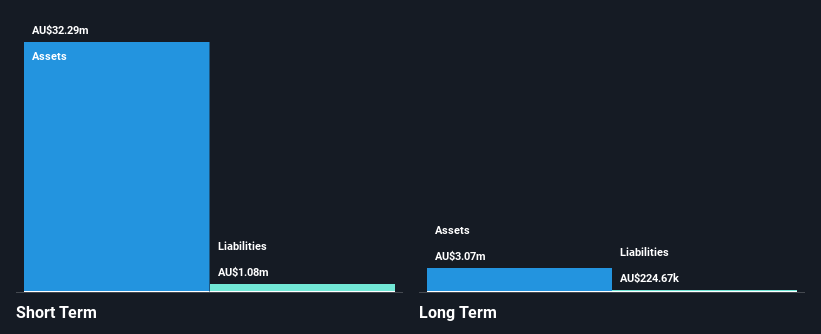

ImpediMed Limited, with a market cap of A$117.37 million, is navigating financial challenges typical of many penny stocks. The company reported A$10.32 million in revenue for the fiscal year ending June 2024, down from A$11.34 million the previous year, and incurred a net loss of A$19.79 million. Despite being unprofitable, ImpediMed has reduced its losses over five years and remains debt-free with short-term assets significantly exceeding liabilities (A$29.5M vs A$4.7M). However, both its management team and board are relatively inexperienced, which may influence future strategic decisions amidst stable weekly volatility at 10%.

- Unlock comprehensive insights into our analysis of ImpediMed stock in this financial health report.

- Explore ImpediMed's analyst forecasts in our growth report.

Paradigm Biopharmaceuticals (ASX:PAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Paradigm Biopharmaceuticals Limited focuses on the research and development of therapeutic products for human use in Australia, with a market cap of A$78.83 million.

Operations: Paradigm Biopharmaceuticals Limited currently does not report any revenue segments.

Market Cap: A$78.83M

Paradigm Biopharmaceuticals Limited, with a market cap of A$78.83 million, is pre-revenue and currently unprofitable, reflecting common characteristics of penny stocks. The company is debt-free and maintains a strong balance sheet with short-term assets of A$24.3 million surpassing its liabilities. Recent developments include the submission of an amended Phase 3 clinical trial protocol to the FDA, which could streamline trial processes and potentially reduce costs. However, Paradigm's cash runway is less than a year, indicating financial pressures ahead as it progresses through critical clinical milestones amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Paradigm Biopharmaceuticals.

- Review our growth performance report to gain insights into Paradigm Biopharmaceuticals' future.

Where To Now?

- Take a closer look at our ASX Penny Stocks list of 1,038 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPD

ImpediMed

A medical technology company, manufactures, and sells bioimpedance spectroscopy (BIS) technology medical devices in the Unites States and Europe.