Stock Analysis

Promising ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market has recently seen the ASX200 reach a new all-time intra-day high, driven by strong performances in Health Care, Financials, and Utilities sectors. Amid these developments, investors might find opportunities in penny stocks—smaller or newer companies that can offer unexpected value. While the term "penny stock" may seem outdated, it still captures the essence of investing in lesser-known firms with solid financial foundations and potential for growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$325.58M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.50 | A$111.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.64 | A$803.73M | ★★★★★☆ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.075 | A$116.81M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,045 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Clover (ASX:CLV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Corporation Limited produces, refines, and sells natural oils and encapsulated powders across multiple regions including Australia, New Zealand, Asia, Europe, the Middle East, and the Americas; it has a market cap of A$80.99 million.

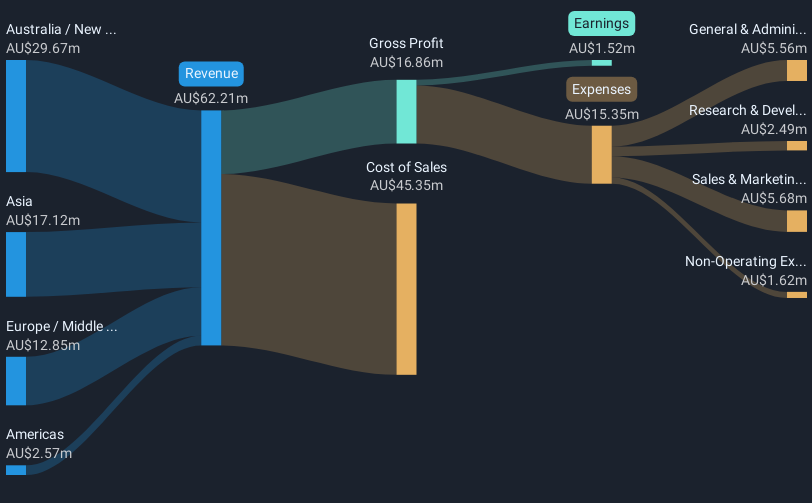

Operations: The company generates revenue of A$62.21 million from its Nutritional Oil and Microencapsulated Powders segment.

Market Cap: A$80.99M

Clover Corporation Limited, with a market cap of A$80.99 million, is an intriguing option in the penny stock space due to its significant presence across multiple regions and revenue generation of A$62.21 million from its Nutritional Oil and Microencapsulated Powders segment. Despite facing challenges with declining earnings and profit margins over the past year, Clover maintains strong financial health, evidenced by a reduced debt-to-equity ratio and sufficient short-term assets to cover liabilities. The company's management team is experienced, though its return on equity remains low at 2.3%. Earnings are forecasted to grow significantly in the future.

- Click here to discover the nuances of Clover with our detailed analytical financial health report.

- Assess Clover's future earnings estimates with our detailed growth reports.

EVZ (ASX:EVZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EVZ Limited, with a market cap of A$19.42 million, operates in the engineering services sectors across Australia and Asia through its subsidiaries.

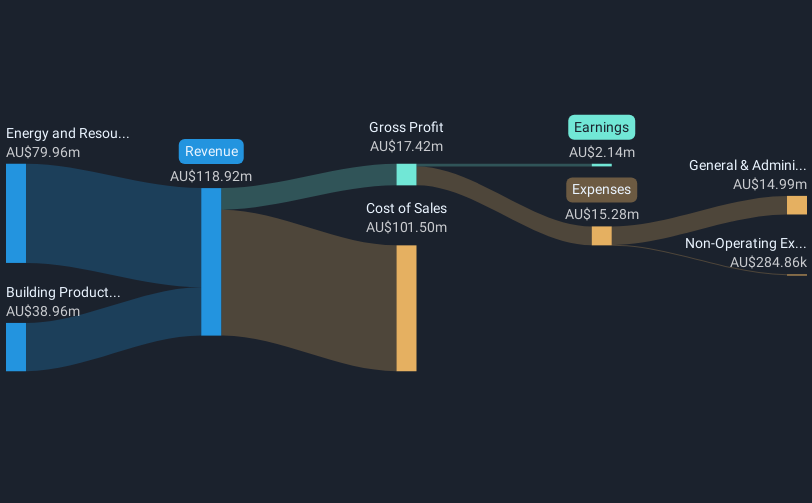

Operations: The company generates revenue from two main segments: Building Products, contributing A$38.96 million, and Energy and Resources, accounting for A$79.96 million.

Market Cap: A$19.42M

EVZ Limited, with a market cap of A$19.42 million, presents a compelling profile in the penny stock arena due to its strong financial position and growth trajectory. The company has no debt and boasts high-quality earnings, with short-term assets (A$37.3M) comfortably covering both short-term (A$26.6M) and long-term liabilities (A$4.9M). EVZ's earnings have grown significantly by 47.9% over the past year, outpacing industry growth rates, though its return on equity remains low at 6.5%. The management team is seasoned with an average tenure of 7.2 years, further supporting its operational stability.

- Unlock comprehensive insights into our analysis of EVZ stock in this financial health report.

- Understand EVZ's track record by examining our performance history report.

Seafarms Group (ASX:SFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Seafarms Group Limited is an aquaculture company operating in Australia and internationally, with a market cap of A$9.67 million.

Operations: The company's revenue is primarily generated from its aquaculture segment, amounting to A$25.51 million.

Market Cap: A$9.67M

Seafarms Group Limited, with a market cap of A$9.67 million, faces financial challenges as reflected in its recent earnings report showing a net loss of A$19.31 million for the year ending June 30, 2024. Despite generating A$25.51 million in revenue from its aquaculture segment, the company remains unprofitable and has less than a year of cash runway based on current free cash flow. While short-term assets exceed liabilities and debt levels have improved over time, auditor concerns about its ability to continue as a going concern highlight significant risks for investors in this volatile penny stock environment.

- Jump into the full analysis health report here for a deeper understanding of Seafarms Group.

- Explore historical data to track Seafarms Group's performance over time in our past results report.

Turning Ideas Into Actions

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,042 more companies for you to explore.Click here to unveil our expertly curated list of 1,045 ASX Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CLV

Clover

Engages in the production, refining, and sale of natural oils and encapsulated powders in Australia, New Zealand, Asia, Europe, the Middle East, and the Americas.