Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:KRR

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Australian market has recently experienced a slight downturn, with the ASX200 dipping to its lowest level in two weeks amid profit-taking and reactions to Wall Street's weak performance. In such fluctuating conditions, investors often seek opportunities that offer both potential growth and stability. While the term "penny stocks" might evoke images of outdated trading practices, these smaller or newer companies can still present valuable opportunities when they exhibit strong financial health and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.6675 | A$92.24M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$830.68M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.82 | A$233.81M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$222.46M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$109.1M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

King River Resources (ASX:KRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: King River Resources Limited, with a market cap of A$21.40 million, is involved in the exploration and development of mineral resources in Australia.

Operations: King River Resources Limited does not have specified revenue segments in the provided text.

Market Cap: A$21.4M

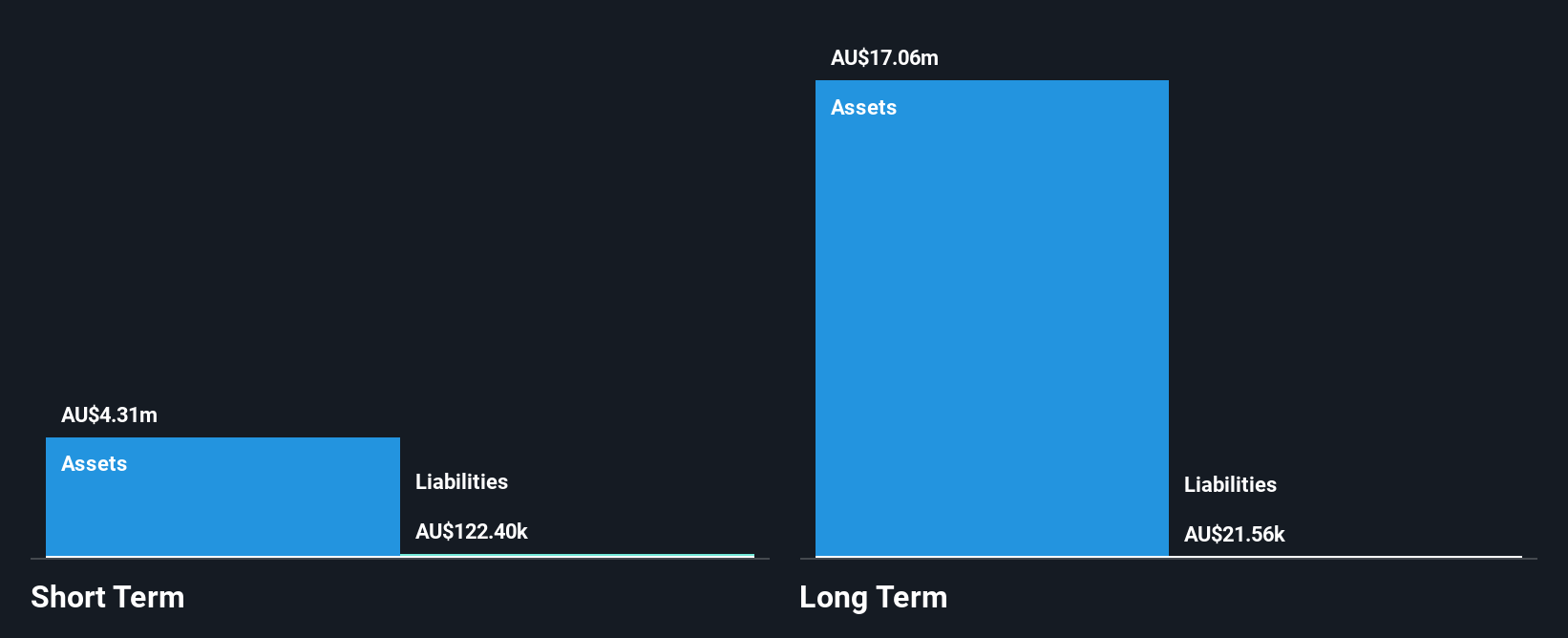

King River Resources, with a market cap of A$21.40 million, remains pre-revenue with minimal sales of A$92K reported for the year ending June 30, 2024. The company is debt-free and has substantial short-term assets (A$8.1M) that comfortably cover both its short-term (A$442.6K) and long-term liabilities (A$43.2K). Despite achieving profitability over the past five years, recent earnings have declined significantly by 43.7% in the last year compared to industry averages. The stock's high volatility and large one-off items impacting financial results present risks typical for penny stocks like King River Resources in Australia.

- Jump into the full analysis health report here for a deeper understanding of King River Resources.

- Understand King River Resources' track record by examining our performance history report.

Maggie Beer Holdings (ASX:MBH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Maggie Beer Holdings Limited is an Australian company that manufactures and sells food, beverage, and gifting products, with a market cap of A$21.61 million.

Operations: The company's revenue is derived from three primary segments: Paris Creek Farms (A$15.44 million), Maggie Beer Products (A$33.97 million), and Hampers & Gifts Australia (A$42.45 million).

Market Cap: A$21.61M

Maggie Beer Holdings, with a market cap of A$21.61 million, derives significant revenue from its Hampers & Gifts Australia segment (A$42.45 million). Despite being unprofitable, the company has reduced losses over five years by 17.4% annually and maintains sufficient cash runway for over a year based on current free cash flow levels. Its short-term assets (A$27.1M) exceed both short-term (A$11.9M) and long-term liabilities (A$6.3M), while remaining debt-free compared to five years ago when it had a debt-to-equity ratio of 2.3%. The stock's volatility remains higher than most Australian stocks, reflecting typical penny stock risks.

- Unlock comprehensive insights into our analysis of Maggie Beer Holdings stock in this financial health report.

- Examine Maggie Beer Holdings' past performance report to understand how it has performed in prior years.

Tribeca Global Natural Resources (ASX:TGF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tribeca Global Natural Resources Limited is an investment firm focused on infrastructure investments, with a market cap of A$121.34 million.

Operations: The company's revenue segment is primarily derived from investments in securities, which reported a value of -A$2.40 million.

Market Cap: A$121.34M

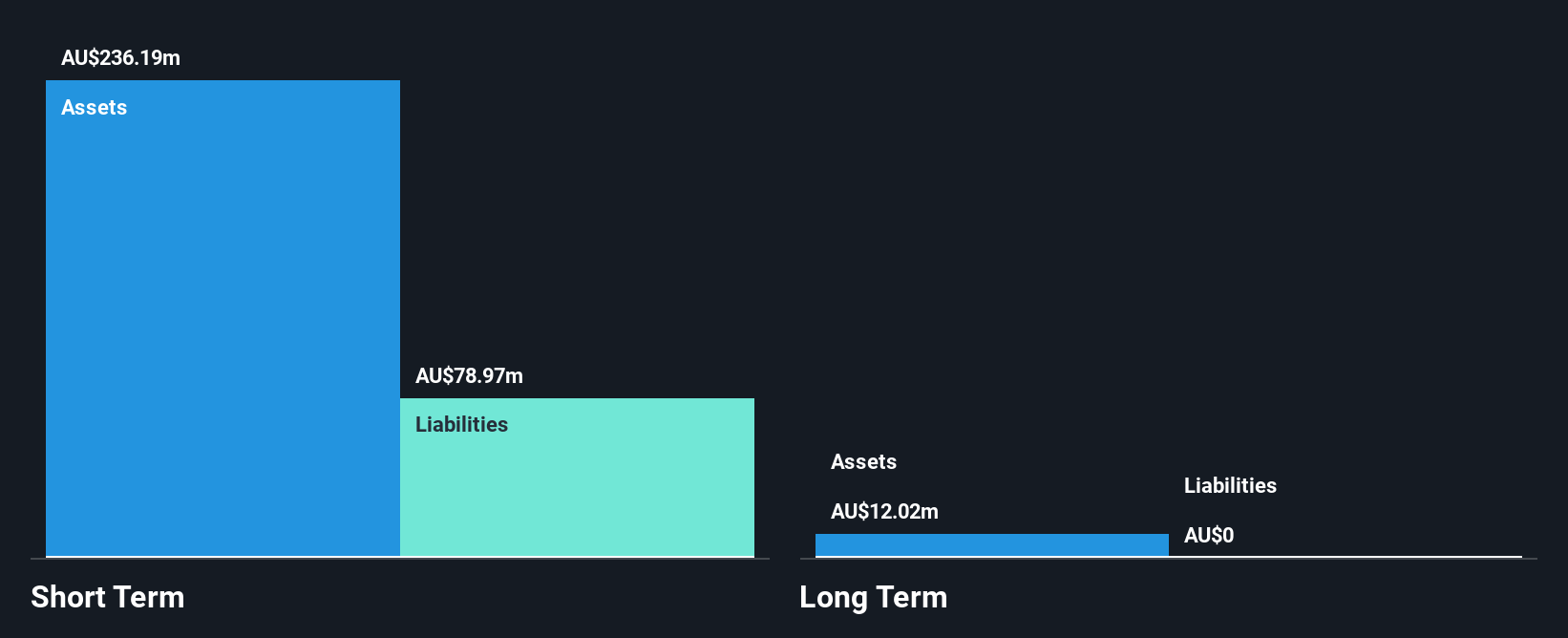

Tribeca Global Natural Resources Limited, with a market cap of A$121.34 million, is pre-revenue, generating less than US$1 million. Despite being unprofitable, it benefits from a robust cash runway exceeding three years due to positive and growing free cash flow. The company has no debt and its short-term assets (A$225.2M) comfortably cover short-term liabilities (A$75.4M). However, its negative return on equity (-5.84%) highlights ongoing profitability challenges. While losses have increased by 6.6% annually over five years, the absence of shareholder dilution in the past year provides some stability amidst typical penny stock volatility concerns.

- Click to explore a detailed breakdown of our findings in Tribeca Global Natural Resources' financial health report.

- Gain insights into Tribeca Global Natural Resources' past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Discover the full array of 1,047 ASX Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if King River Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KRR

King River Resources

Engages in the exploration and development of mineral resources in Australia.