- Australia

- /

- Diversified Financial

- /

- ASX:SOL

Declining Stock and Solid Fundamentals: Is The Market Wrong About Washington H. Soul Pattinson and Company Limited (ASX:SOL)?

Washington H. Soul Pattinson (ASX:SOL) has had a rough three months with its share price down 13%. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. In this article, we decided to focus on Washington H. Soul Pattinson's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Washington H. Soul Pattinson

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Washington H. Soul Pattinson is:

6.2% = AU$320m ÷ AU$5.2b (Based on the trailing twelve months to July 2021).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every A$1 worth of equity, the company was able to earn A$0.06 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Washington H. Soul Pattinson's Earnings Growth And 6.2% ROE

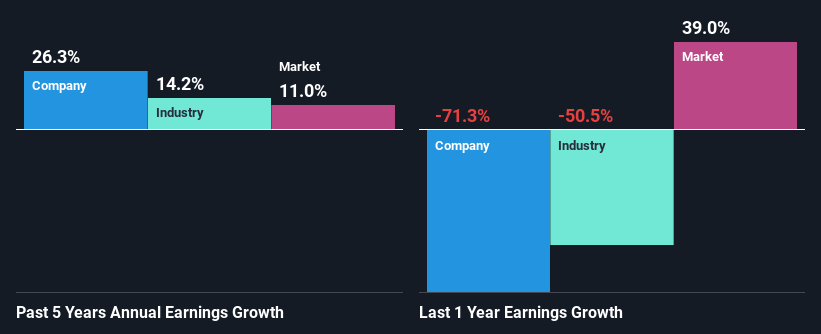

At first glance, Washington H. Soul Pattinson's ROE doesn't look very promising. Although a closer study shows that the company's ROE is higher than the industry average of 4.9% which we definitely can't overlook. Particularly, the substantial 26% net income growth seen by Washington H. Soul Pattinson over the past five years is impressive . That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. Hence, there might be some other aspects that are causing earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

Next, on comparing with the industry net income growth, we found that Washington H. Soul Pattinson's growth is quite high when compared to the industry average growth of 14% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Washington H. Soul Pattinson is trading on a high P/E or a low P/E, relative to its industry.

Is Washington H. Soul Pattinson Using Its Retained Earnings Effectively?

The three-year median payout ratio for Washington H. Soul Pattinson is 43%, which is moderately low. The company is retaining the remaining 57%. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Washington H. Soul Pattinson is reinvesting its earnings efficiently.

Additionally, Washington H. Soul Pattinson has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 50% of its profits over the next three years. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 7.0%.

Conclusion

In total, we are pretty happy with Washington H. Soul Pattinson's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. With that said, on studying the latest analyst forecasts, we found that while the company has seen growth in its past earnings, analysts expect its future earnings to shrink. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're here to simplify it.

Discover if WHSP Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SOL

WHSP Holdings

An investment company, engages in investing various industries and asset classes in Australia.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026