Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:MLX

3 ASX Penny Stocks With A$400M Market Cap

Reviewed by Simply Wall St

The Australian market has been relatively stable, with the ASX200 closing slightly down by 0.06% as investors await key economic data, particularly the upcoming Quarterly CPI figures. In this context, penny stocks—often representing smaller or newer companies—continue to capture attention for their potential value and growth opportunities at lower price points. Despite being a somewhat outdated term, these stocks can still offer significant upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.62 | A$74.43M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.78 | A$292.36M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.57 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$99.57M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$823.33M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$59.91M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.98 | A$117.4M | ★★★★★★ |

Click here to see the full list of 1,029 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Horizon Oil Limited, along with its subsidiaries, is involved in the exploration, development, and production of oil and gas properties across China, New Zealand, and Australia with a market capitalization of A$308.81 million.

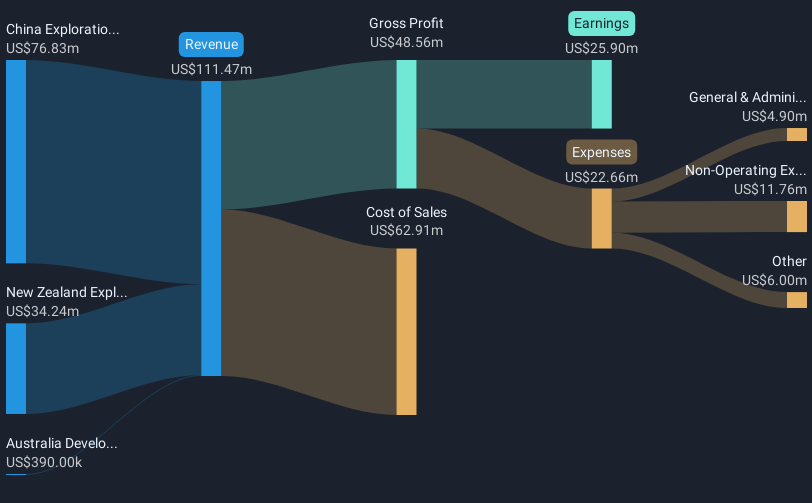

Operations: The company's revenue segments include $76.83 million from China Exploration and Development, $34.24 million from New Zealand Exploration and Development, and $0.39 million from Australia Development.

Market Cap: A$308.81M

Horizon Oil's market capitalization of A$308.81 million places it in the realm of smaller stocks, with its operations spanning China, New Zealand, and Australia. Despite a decline in earnings and net profit margins from the previous year, the company remains financially robust with more cash than debt and operating cash flow well covering its liabilities. Recent board changes introduce seasoned leadership with Dr. Peter Goode joining as an independent non-executive director. However, challenges persist as earnings growth has been negative recently despite a history of profit growth over five years at 14.9% annually.

- Get an in-depth perspective on Horizon Oil's performance by reading our balance sheet health report here.

- Examine Horizon Oil's earnings growth report to understand how analysts expect it to perform.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metals X Limited is an Australian company focused on the production of tin, with a market capitalization of A$381.07 million.

Operations: The company's revenue is primarily derived from its 50% stake in the Renison Tin Operation, contributing A$186.22 million.

Market Cap: A$381.07M

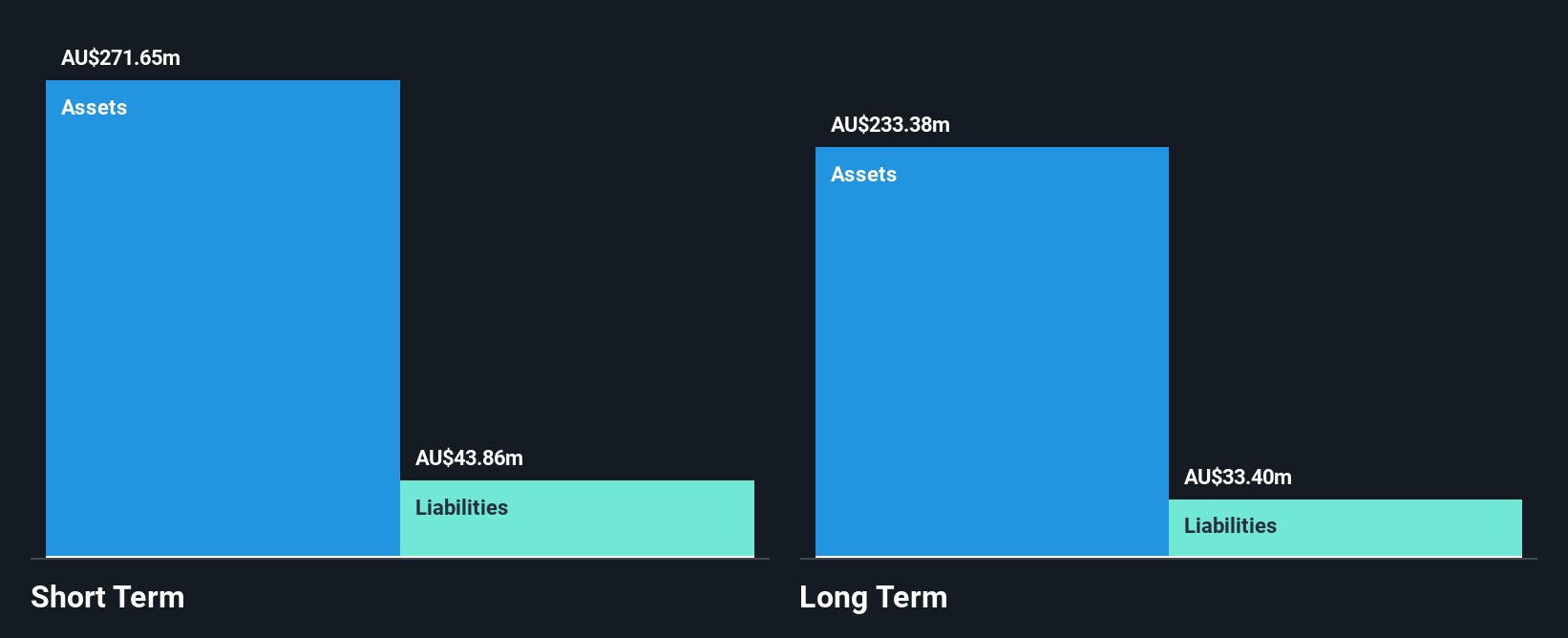

Metals X Limited, with a market capitalization of A$381.07 million, derives significant revenue from its 50% stake in the Renison Tin Operation, contributing A$186.22 million. Despite negative earnings growth recently and a low return on equity at 5%, the company maintains financial stability with more cash than debt and operating cash flow effectively covering its liabilities. The board and management team are experienced, averaging tenures of 4.5 and 3.8 years respectively. Recent earnings show improvement in sales to A$94.98 million for the half-year ending June 30, 2024, although profit margins have decreased compared to last year.

- Unlock comprehensive insights into our analysis of Metals X stock in this financial health report.

- Assess Metals X's previous results with our detailed historical performance reports.

Piedmont Lithium (ASX:PLL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Piedmont Lithium Inc. is a development stage company focused on the exploration and development of resource projects in the United States, with a market cap of A$320.58 million.

Operations: Currently, there are no reported revenue segments for this development stage company focused on resource projects in the United States.

Market Cap: A$320.58M

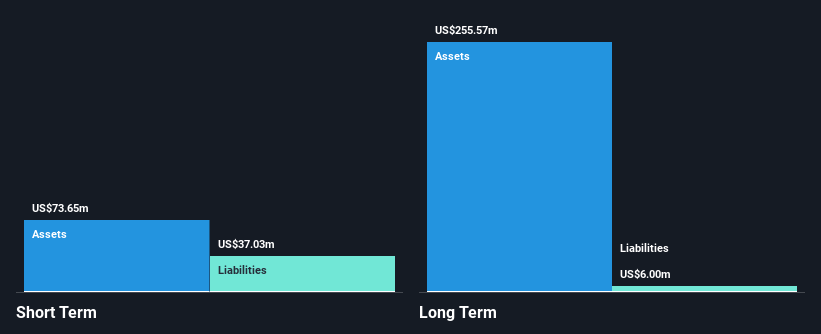

Piedmont Lithium Inc., with a market cap of A$320.58 million, is a development-stage company in the resource sector, currently pre-revenue with no significant income streams. The company has recently filed a large shelf registration totaling US$500 million, indicating potential future capital raising activities. While it reported sales of US$26.63 million for the first half of 2024, it remains unprofitable with increasing losses over recent years. Despite having more cash than debt and short-term assets exceeding liabilities, its high share price volatility and limited cash runway present challenges for investors considering penny stocks in this sector.

- Take a closer look at Piedmont Lithium's potential here in our financial health report.

- Evaluate Piedmont Lithium's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Gain an insight into the universe of 1,029 ASX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MLX

Metals X

Engages in the production of tin in Australia.