Stock Analysis

- Australia

- /

- Oil and Gas

- /

- ASX:EME

ASX Penny Stocks To Consider In October 2024

Reviewed by Simply Wall St

The Australian stock market is experiencing a cautious rise, with the ASX200 set to increase by 0.27%, despite global uncertainties impacting investor sentiment. In this context, identifying stocks with solid fundamentals becomes crucial for investors seeking potential opportunities. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that can offer both affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,029 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Credit Clear (ASX:CCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Credit Clear Limited develops and implements a receivables management platform and provides receivable collection services in Australia and New Zealand, with a market cap of A$142.98 million.

Operations: The company's revenue is derived from two segments: Collections, generating A$35.09 million, and Legal Services, contributing A$7.15 million.

Market Cap: A$142.98M

Credit Clear Limited, with a market cap of A$142.98 million, operates in the receivables management sector across Australia and New Zealand. Despite being unprofitable, the company has positive and growing free cash flow, providing a runway for more than three years. Recent earnings results show an increase in sales to A$42 million for the year ending June 2024, reducing net losses significantly from A$11.06 million to A$4.5 million year-on-year. The appointment of Jodie Bedoya as a non-executive director brings extensive industry expertise to its board, potentially strengthening its strategic direction in debt resolution services.

- Click here and access our complete financial health analysis report to understand the dynamics of Credit Clear.

- Understand Credit Clear's earnings outlook by examining our growth report.

Energy Metals (ASX:EME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Energy Metals Limited is a uranium exploration company based in Australia with a market cap of A$23.07 million.

Operations: The company's revenue is derived primarily from its uranium exploration activities, totaling A$0.02 million.

Market Cap: A$23.07M

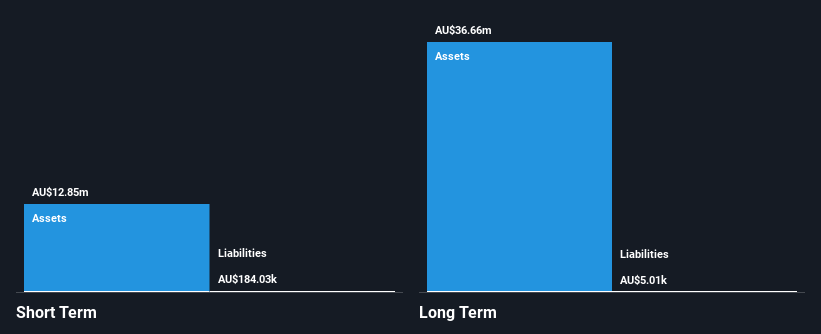

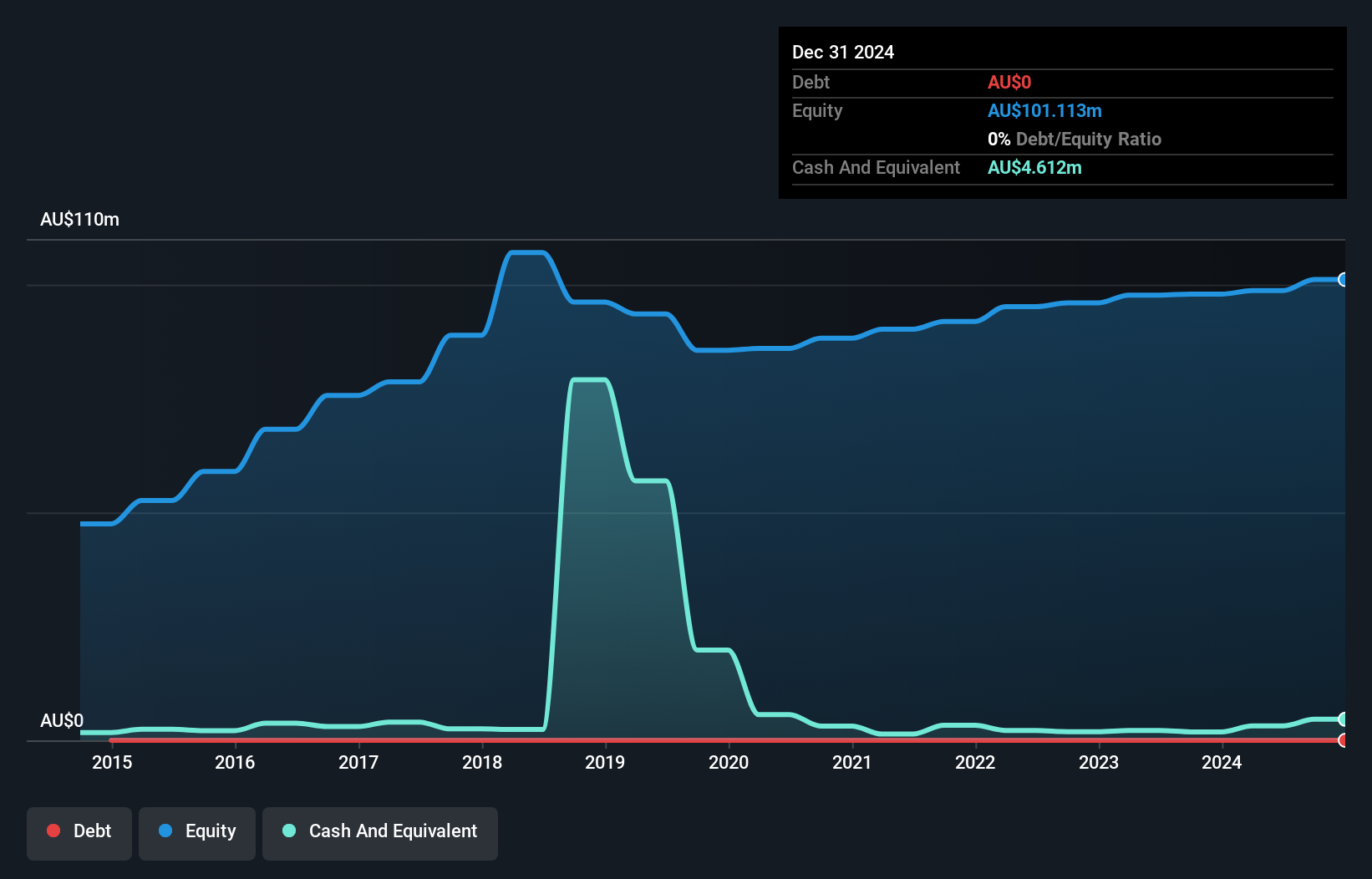

Energy Metals Limited, with a market cap of A$23.07 million, is a pre-revenue uranium exploration company. Despite its unprofitability, the firm has managed to reduce losses over the past five years and maintains a strong financial position with short-term assets of A$12.9 million exceeding both long-term liabilities and short-term obligations. The absence of debt over the last five years further strengthens its balance sheet, while a cash runway extending beyond three years offers operational stability. However, investors should note the stock's high volatility and limited revenue generation capabilities at present.

- Click to explore a detailed breakdown of our findings in Energy Metals' financial health report.

- Review our historical performance report to gain insights into Energy Metals' track record.

Rand Mining (ASX:RND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rand Mining Limited is an Australian company focused on the exploration, development, and production of mineral properties, with a market cap of A$119.44 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically in Gold & Other Precious Metals, totaling A$34.76 million.

Market Cap: A$119.44M

Rand Mining Limited, with a market cap of A$119.44 million, reported annual sales of A$34.76 million, reflecting a modest increase from the previous year. Despite its revenue generation in gold and other precious metals, the company faces challenges with declining earnings over the past five years and reduced net profit margins compared to last year. However, Rand Mining's financial position is strong due to its lack of debt and substantial short-term assets (A$81.2M) covering both short- and long-term liabilities. The seasoned management team further supports the company's operational stability despite low return on equity (6.8%).

- Click here to discover the nuances of Rand Mining with our detailed analytical financial health report.

- Gain insights into Rand Mining's historical outcomes by reviewing our past performance report.

Make It Happen

- Access the full spectrum of 1,029 ASX Penny Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EME

Energy Metals

Operates as a uranium exploration company in Australia.