- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

Zip Co (ASX:ZIP) Valuation in Focus After Record Financial Results and Strategic Updates

Reviewed by Simply Wall St

Zip Co (ASX:ZIP) drew attention this week by delivering its strongest-ever financial results. The company revealed record earnings along with operational updates at the 2025 AGM. Improvements in operating margin and growth across its main markets were highlighted.

See our latest analysis for Zip Co.

Despite Zip Co’s impressive operational progress and standout full-year financial results, the share price has pulled back sharply in recent weeks, with a 28.5% decline over the past month and a 12.9% fall across the last week alone. However, the company’s year-to-date share price gain of 13.5% and a remarkable 355% total shareholder return over three years suggest there is still plenty of long-term momentum, even if short-term confidence has cooled.

If Zip’s recent volatility piqued your interest, now could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Zip Co’s share price retreating despite record profits and robust growth, investors may wonder if the recent pullback signals an undervalued opportunity or if the market has already factored in the company’s future prospects.

Most Popular Narrative: 33.9% Undervalued

With the most-followed narrative suggesting fair value is significantly above Zip Co’s last close of A$3.37, expectations are running hot for future catalysts and financial acceleration.

Zip Co is poised to benefit from the accelerating shift toward digital payments and increasing e-commerce penetration, as evidenced by strong transaction volumes (up 30%) and targeted partnerships with platforms like Google and Stripe. These partnerships are likely to drive higher transaction values and revenue growth.

Enhanced adoption among Millennials and Gen Z, who favor flexible, interest-free payment options, is driving increased transaction frequency and customer engagement (with transactions per active customer up 62% over two years). This supports durable volume growth and increases total revenue.

What is powering such a bold price target for Zip Co? The answer lies in ambitious forecasts for near-double-digit margins and sustained top-line expansion, a performance matched by only a few companies in the sector. Interested in which underlying revenue and profit assumptions push this stock so far above today’s levels? The story becomes even more intriguing when you see the full set of projections and compare them with what is already priced in by the market.

Result: Fair Value of $5.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing regulatory scrutiny and intensifying fintech competition could put pressure on Zip Co’s margins or slow its future growth trajectory.

Find out about the key risks to this Zip Co narrative.

Another View: Market Multiples Tell a Different Story

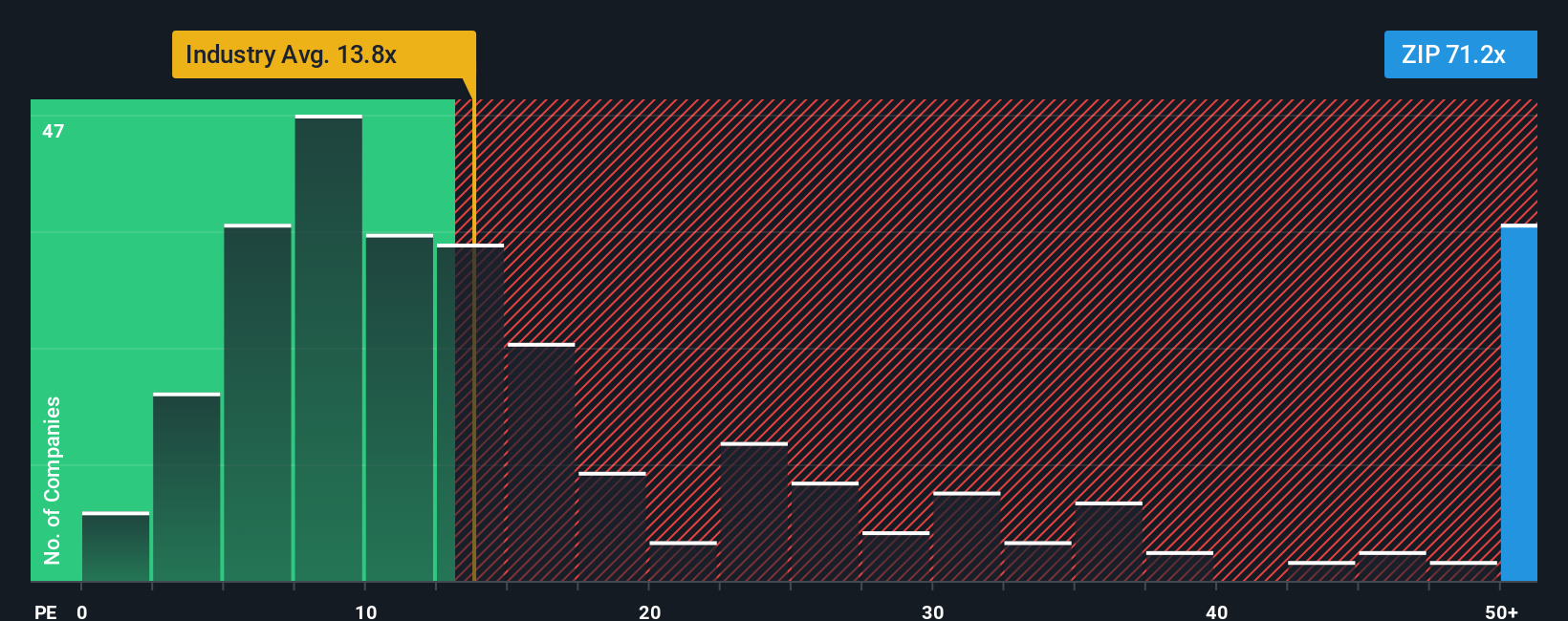

While the popular narrative points to Zip Co being undervalued, the market’s own metrics tell a more cautious story. The company’s price-to-earnings ratio sits much higher than both its global industry average (54.2x vs. 13.5x) and the peer average (11.6x), and even exceeds the fair ratio of 30.1x. This sizable gap raises important questions about near-term upside and the risk of a market correction. Could the premium for growth be overdone, or is the market right to bet on further acceleration?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zip Co Narrative

If you would rather shape the story for yourself or see the numbers from a different angle, you can dig into the data and build your own take in just a few minutes, all with Do it your way.

A great starting point for your Zip Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on fast-moving opportunities! Take your research to the next level by checking out stocks that offer strong growth, innovation, and resilient returns across emerging trends.

- Capture the momentum in AI breakthroughs by tapping into these 24 AI penny stocks, which are at the forefront of intelligent automation and machine learning.

- Lock in steady income streams with these 16 dividend stocks with yields > 3%, offering attractive yields above 3 percent and solid financial health.

- Stay ahead of the curve in digital currency innovation with these 82 cryptocurrency and blockchain stocks and identify companies driving blockchain progress and next-generation payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives