- Australia

- /

- Capital Markets

- /

- ASX:SEC

3 ASX Penny Stocks With Market Caps Under A$400M

Reviewed by Simply Wall St

The Australian market is poised for a quiet end to the week, with futures indicating a slight decline of around 0.5%, following a turbulent period influenced by high job cuts in the US and ongoing concerns about AI valuations. Despite these broader market challenges, investors often seek opportunities in lesser-known areas like penny stocks, which can offer affordability and potential growth. Although the term "penny stocks" might seem outdated, it still holds significance as these smaller or newer companies can present unique investment opportunities when backed by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.475 | A$136.13M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.42 | A$114.16M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.88 | A$54.8M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.92 | A$448.77M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.69 | A$272.35M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.14 | A$1.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.77 | A$256.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.57 | A$2.42B | ✅ 3 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.38 | A$625.38M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

EZZ Life Science Holdings (ASX:EZZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EZZ Life Science Holdings Limited is involved in the formulation, production, marketing, and sale of health and wellbeing products across Australia, New Zealand, Mainland China, and South-East Asia with a market cap of A$114.16 million.

Operations: The company's revenue is primarily derived from its Company Owned segment, which generated A$63.21 million, and the Brought in Lines segment, contributing A$3.66 million.

Market Cap: A$114.16M

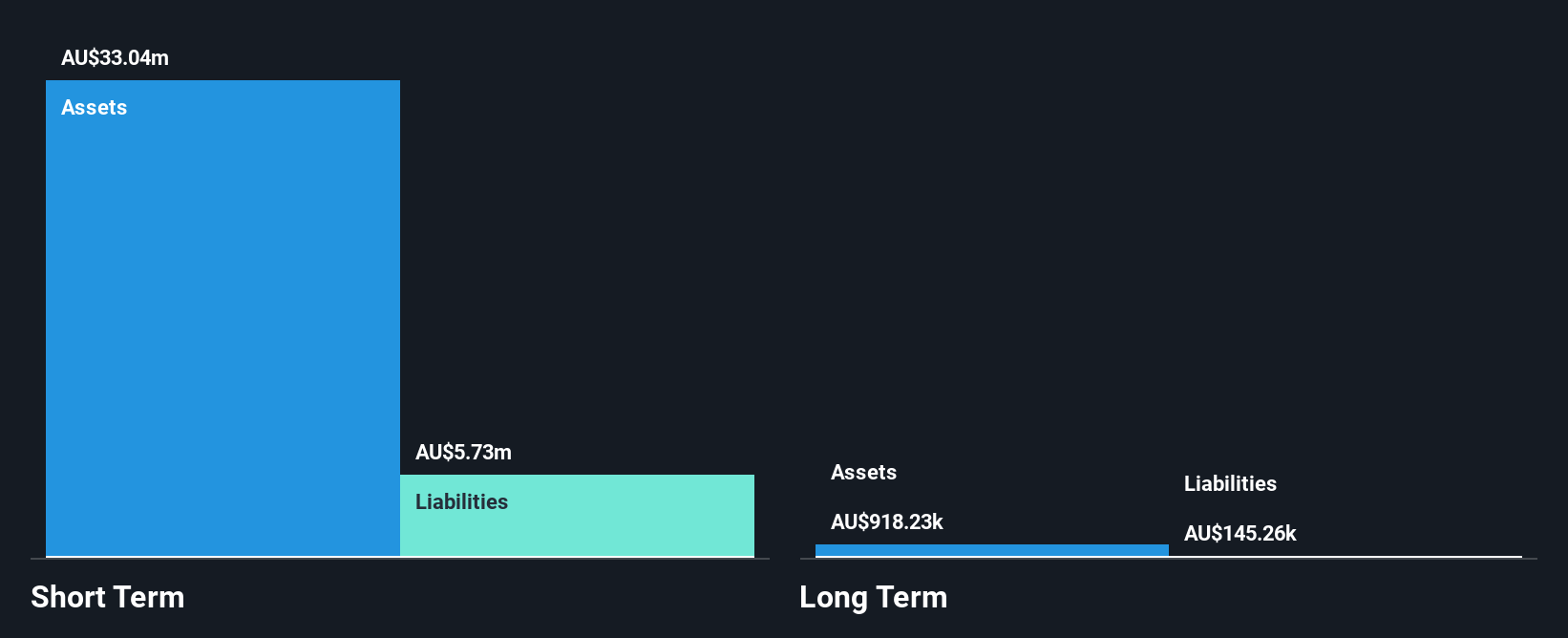

EZZ Life Science Holdings has demonstrated financial resilience with A$66.87 million in sales for the year ending June 2025, maintaining steady revenue growth despite a slight decline in net income to A$6.73 million. The company boasts strong liquidity, with short-term assets of A$33 million comfortably covering both short and long-term liabilities. EZZ's debt-free status enhances its financial stability, while its high Return on Equity at 24% indicates efficient management of shareholder funds. However, recent removal from the S&P/ASX Emerging Companies Index may signal challenges ahead amidst negative earnings growth over the past year compared to industry averages.

- Dive into the specifics of EZZ Life Science Holdings here with our thorough balance sheet health report.

- Learn about EZZ Life Science Holdings' future growth trajectory here.

Mayne Pharma Group (ASX:MYX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mayne Pharma Group Limited is a specialty pharmaceutical company that commercializes women's health and dermatology pharmaceuticals across Australia, New Zealand, the United States, Canada, Europe, Asia, and other international markets with a market cap of A$398.10 million.

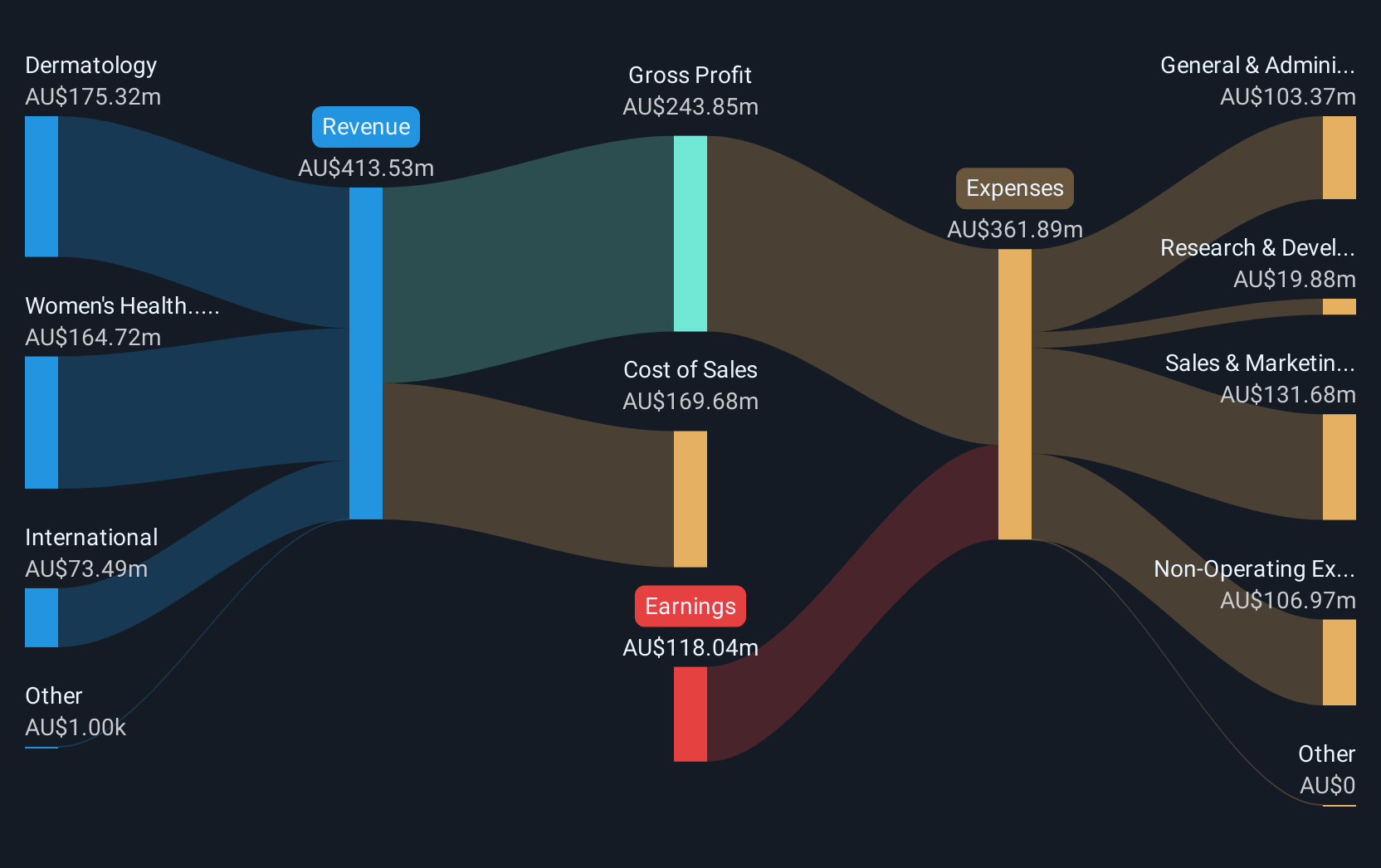

Operations: The company's revenue is derived from three main segments: A$154.09 million from dermatology, A$75.64 million from international markets, and A$178.37 million from women's health pharmaceuticals.

Market Cap: A$398.1M

Mayne Pharma Group's recent earnings report for the year ending June 2025 shows revenue of A$408.1 million, up from A$388.4 million the previous year, with a reduced net loss of A$93.84 million compared to A$174.23 million prior. Despite this improvement, the company remains unprofitable with a negative return on equity of -24.32%. Short-term assets exceed short-term liabilities by over A$90 million but fall short against long-term liabilities by approximately A$30 million. The management and board are experienced, with average tenures exceeding three years, while debt levels have decreased significantly over five years.

- Jump into the full analysis health report here for a deeper understanding of Mayne Pharma Group.

- Learn about Mayne Pharma Group's historical performance here.

Spheria Emerging Companies (ASX:SEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Spheria Emerging Companies Limited is an Australian investment company with a market cap of A$169.43 million.

Operations: The company's revenue segment consists solely of Investment Activities, generating A$24.25 million.

Market Cap: A$169.43M

Spheria Emerging Companies Limited, with a market cap of A$169.43 million, has shown robust financial performance. Its earnings surged by 116% over the past year, significantly outpacing the industry average. The company maintains a strong balance sheet with no debt and short-term assets of A$146.8 million covering both short and long-term liabilities comfortably. Despite a low return on equity at 11.5%, its price-to-earnings ratio of 10.3x suggests good value compared to the broader Australian market average of 20.7x. Recent board changes include Marcus Burns' appointment as director, enhancing strategic leadership with his extensive financial markets experience.

- Take a closer look at Spheria Emerging Companies' potential here in our financial health report.

- Assess Spheria Emerging Companies' previous results with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 416 ASX Penny Stocks by clicking here.

- Searching for a Fresh Perspective? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SEC

Spheria Emerging Companies

Operates as an investment company in Australia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives