- Australia

- /

- Capital Markets

- /

- ASX:ASW

Here's Why Shareholders May Consider Paying Advanced Share Registry Limited's (ASX:ASW) CEO A Little More

Shareholders will probably not be disappointed by the robust results at Advanced Share Registry Limited (ASX:ASW) recently and they will be keeping this in mind as they go into the AGM on 18 November 2022. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for Advanced Share Registry

Comparing Advanced Share Registry Limited's CEO Compensation With The Industry

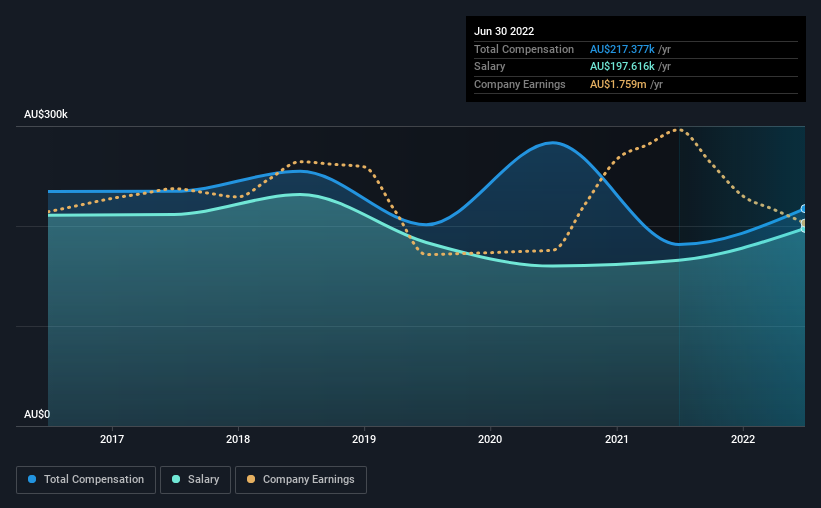

According to our data, Advanced Share Registry Limited has a market capitalization of AU$38m, and paid its CEO total annual compensation worth AU$217k over the year to June 2022. Notably, that's an increase of 20% over the year before. We note that the salary portion, which stands at AU$197.6k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below AU$304m, reported a median total CEO compensation of AU$474k. That is to say, Kim Phin Chong is paid under the industry median. Furthermore, Kim Phin Chong directly owns AU$21m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$198k | AU$166k | 91% |

| Other | AU$20k | AU$16k | 9% |

| Total Compensation | AU$217k | AU$181k | 100% |

On an industry level, roughly 59% of total compensation represents salary and 41% is other remuneration. According to our research, Advanced Share Registry has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Advanced Share Registry Limited's Growth Numbers

Over the past three years, Advanced Share Registry Limited has seen its earnings per share (EPS) grow by 5.6% per year. Its revenue is down 15% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest EPS growth gives us some relief. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Advanced Share Registry Limited Been A Good Investment?

Boasting a total shareholder return of 57% over three years, Advanced Share Registry Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 3 which make us uncomfortable) in Advanced Share Registry we think you should know about.

Important note: Advanced Share Registry is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ASW

Advanced Share Registry

Advanced Share Registry Limited provides registry services, including registry maintenance, capital raisings, corporate actions, company meetings, employee share plans, shareholder communications and in-house printing offering.

Flawless balance sheet medium.

Market Insights

Community Narratives