- Australia

- /

- Industrials

- /

- ASX:SST

Discover 3 Undiscovered Gems in Australia to Enhance Your Portfolio

Reviewed by Simply Wall St

In the last week, the Australian market has remained flat, yet it has experienced a robust 20% growth over the past year with earnings forecasted to grow by 12% annually. In such a dynamic environment, identifying stocks that are poised for growth can enhance your portfolio by capitalizing on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Hancock & Gore | NA | -70.20% | 38.14% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

AMCIL (ASX:AMH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amcil Limited is a publicly owned investment manager with a market cap of A$376.70 million.

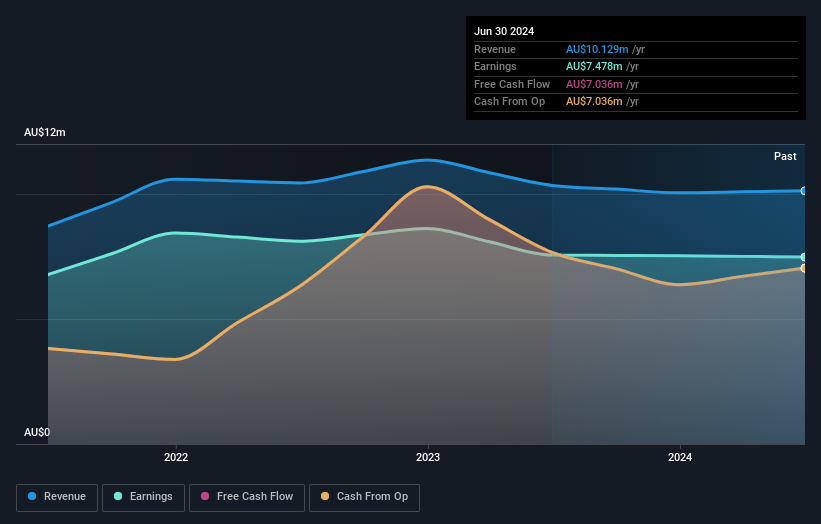

Operations: Amcil Limited generates revenue primarily through investments, totaling A$10.13 million.

AMCIL, a nimble player in the Australian market, reported earnings results for the year ending June 30, 2024. Revenue was A$10.13 million, slightly down from A$10.34 million the previous year, while net income stood at A$7.48 million compared to A$7.56 million prior. Despite a minor dip in basic earnings per share to A$0.0238 from A$0.0243 last year, AMCIL remains debt-free with high-quality past earnings and positive free cash flow of approximately A$7 million as of September 2023. The company also announced a share buyback program targeting up to 9.9% of its issued capital for strategic management purposes.

- Click here and access our complete health analysis report to understand the dynamics of AMCIL.

Explore historical data to track AMCIL's performance over time in our Past section.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties with a market capitalization of A$402.09 million.

Operations: Kingsgate Consolidated generates revenue primarily from its Chatree segment, amounting to A$133.09 million.

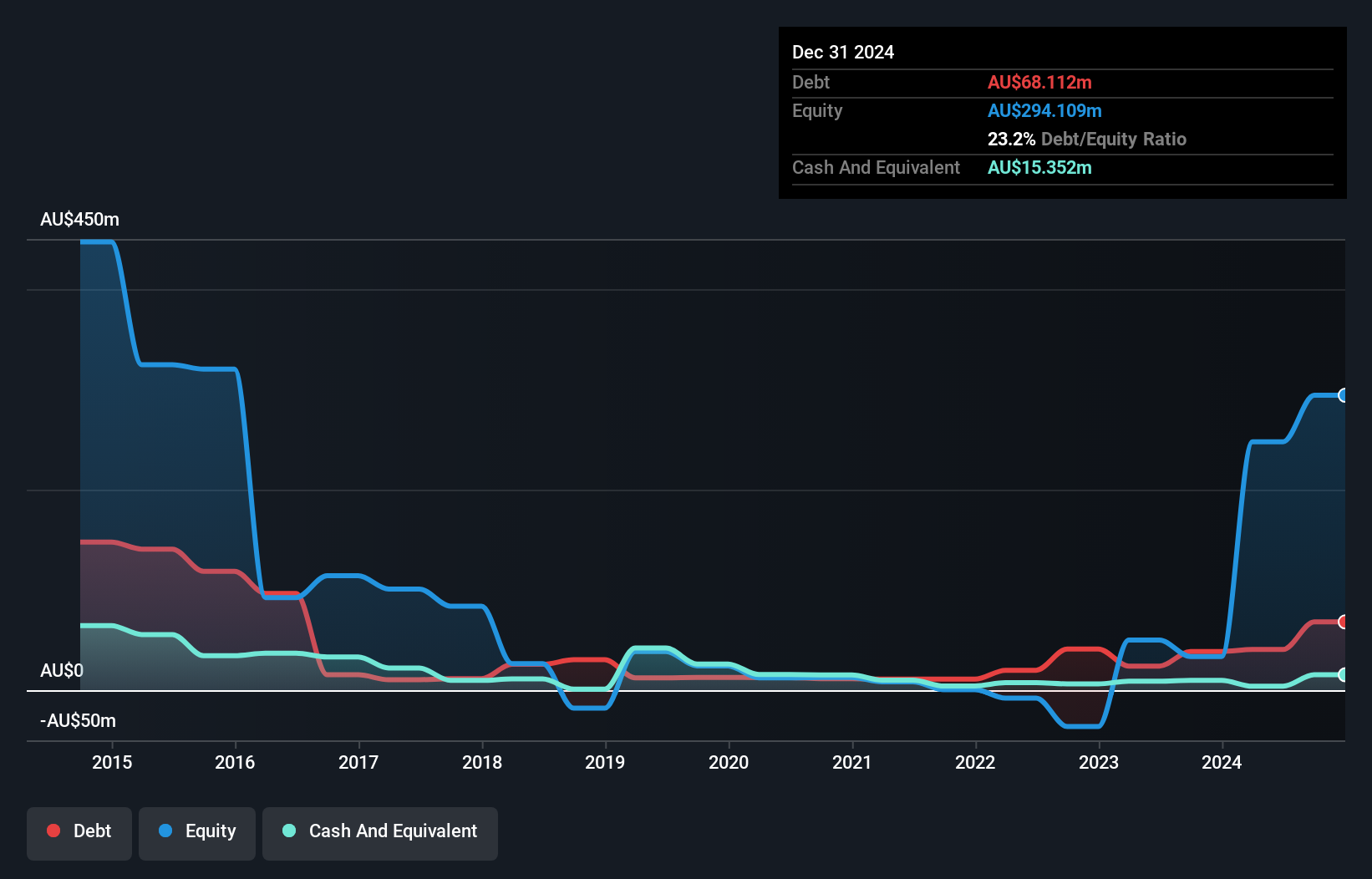

Kingsgate Consolidated, a player in the Australian mining sector, has shown impressive financial performance recently. The company's earnings skyrocketed by 4116% over the past year, significantly outpacing industry growth. Sales for the year ended June 30, 2024, reached A$133.09 million from A$27.34 million previously, with net income hitting A$199.76 million compared to just A$4.74 million a year ago. Despite this surge in earnings and trading at nearly 94% below estimated fair value, future projections suggest a potential average decline of 57% per year in earnings over the next three years amidst forecasted revenue growth of about 29%.

- Get an in-depth perspective on Kingsgate Consolidated's performance by reading our health report here.

Gain insights into Kingsgate Consolidated's past trends and performance with our Past report.

Steamships Trading (ASX:SST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Steamships Trading Company Limited operates in the shipping, transport, property, and hospitality sectors in Papua New Guinea with a market capitalization of A$434.12 million.

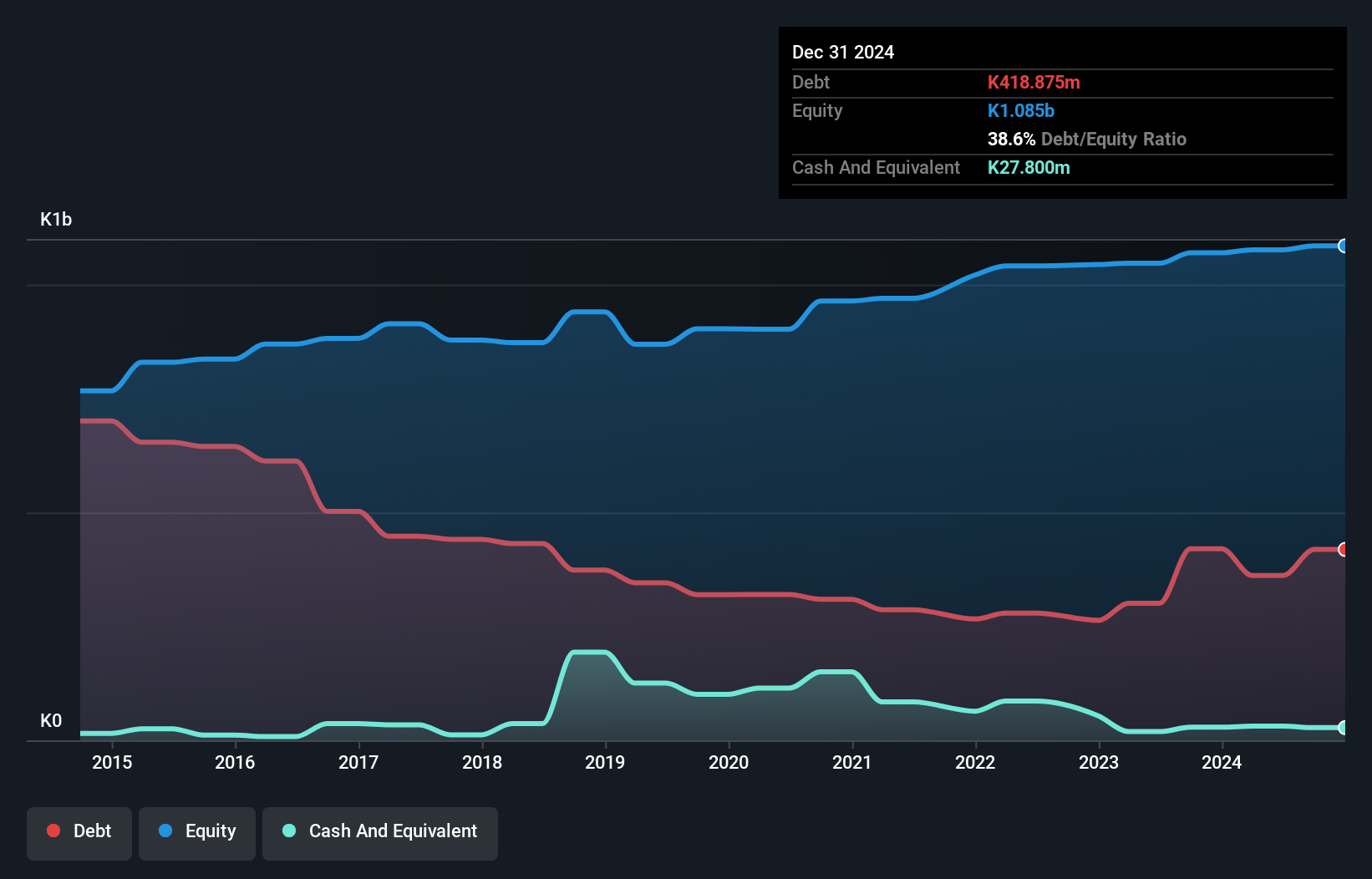

Operations: Revenue is primarily derived from logistics (PGK 404.68 million) and property and hospitality (PGK 313.16 million) sectors. The finance, investment, and eliminations segment shows a negative contribution of PGK -7.20 million.

Steamships Trading, a notable player in the Industrials sector, has shown promising financial performance. Its earnings grew by 38% over the past year, notably outpacing the industry average of 6%. The company’s interest payments are well-covered with an EBIT coverage of 19.5 times, indicating strong profitability. Despite a large one-off gain of PGK17.7 million impacting recent results, its debt-to-equity ratio improved from 39.8% to 33.6% over five years, demonstrating effective debt management. Although shares are highly illiquid and free cash flow is negative, its price-to-earnings ratio of 19.2x remains attractive compared to the broader Australian market at 19.8x.

- Dive into the specifics of Steamships Trading here with our thorough health report.

Examine Steamships Trading's past performance report to understand how it has performed in the past.

Summing It All Up

- Dive into all 55 of the ASX Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SST

Steamships Trading

Engages in the shipping, transport, property, and hospitality operation businesses in Papua New Guinea.

Excellent balance sheet with proven track record.