- Australia

- /

- Hospitality

- /

- ASX:DMP

A Look at Domino’s (ASX:DMP) Valuation Following CEO Exit and FY25 Results

Reviewed by Simply Wall St

If you’re holding shares of Domino's Pizza Enterprises (ASX:DMP) or eyeing them for a potential entry, the latest headlines are tough to ignore. The sudden resignation of CEO Mark van Dyck coincided with the company’s FY 2025 results, which reported a slight downturn in network sales. With the company now actively searching for a new chief executive, investors are left to consider how new leadership and soft sales figures might shape Domino's future. Top fund managers are suggesting the stock could be at a turning point.

This shake-up follows a year of steady pressure on Domino's stock. The share price has slid almost 50% over the last twelve months, and momentum has faded, capped off by a sharp negative reaction to the leadership news and disappointing results. Still, the company did manage to grow revenue, and profit rebounded compared to a year ago, offering just enough to fuel debate about whether recent pessimism has gone too far.

With so much uncertainty now priced into shares, the question is whether this is a rare chance to pick up Domino's at a discount or if the market’s caution reflects deeper risks not yet resolved.

Most Popular Narrative: 26% Undervalued

The most widely followed narrative suggests that Domino's Pizza Enterprises is trading significantly below its estimated fair value, with analysts expecting a meaningful upside if forecasts are achieved.

Streamlined cost structures, achieved by reducing SG&A, IT, and marketing overheads, will enable reinvestment in high-impact marketing and operational support. This supports both revenue growth and operating margin expansion over the medium to long term. Greater local market empowerment and operational accountability (for example, relocating more resources into the field and moving decision-making closer to the customer) are expected to drive improved execution at the store level. This should increase customer satisfaction, retention, and long-term same-store sales growth.

Curious how sharper cost controls and a new approach to local decision-making could reshape Domino's performance? The narrative behind this valuation teases transformative financial projections, powered by an ambitious operating strategy. Want to see which assumptions fuel the sharp discount to current prices? Dive in to uncover the surprising financial forecasts that underpin the optimism.

Result: Fair Value of $19.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sharply rising competition and the challenge of shifting away from heavy discounting could quickly undermine the optimistic outlook for Domino's shares.

Find out about the key risks to this Domino's Pizza Enterprises narrative.Another View: DCF Model Suggests Further Upside

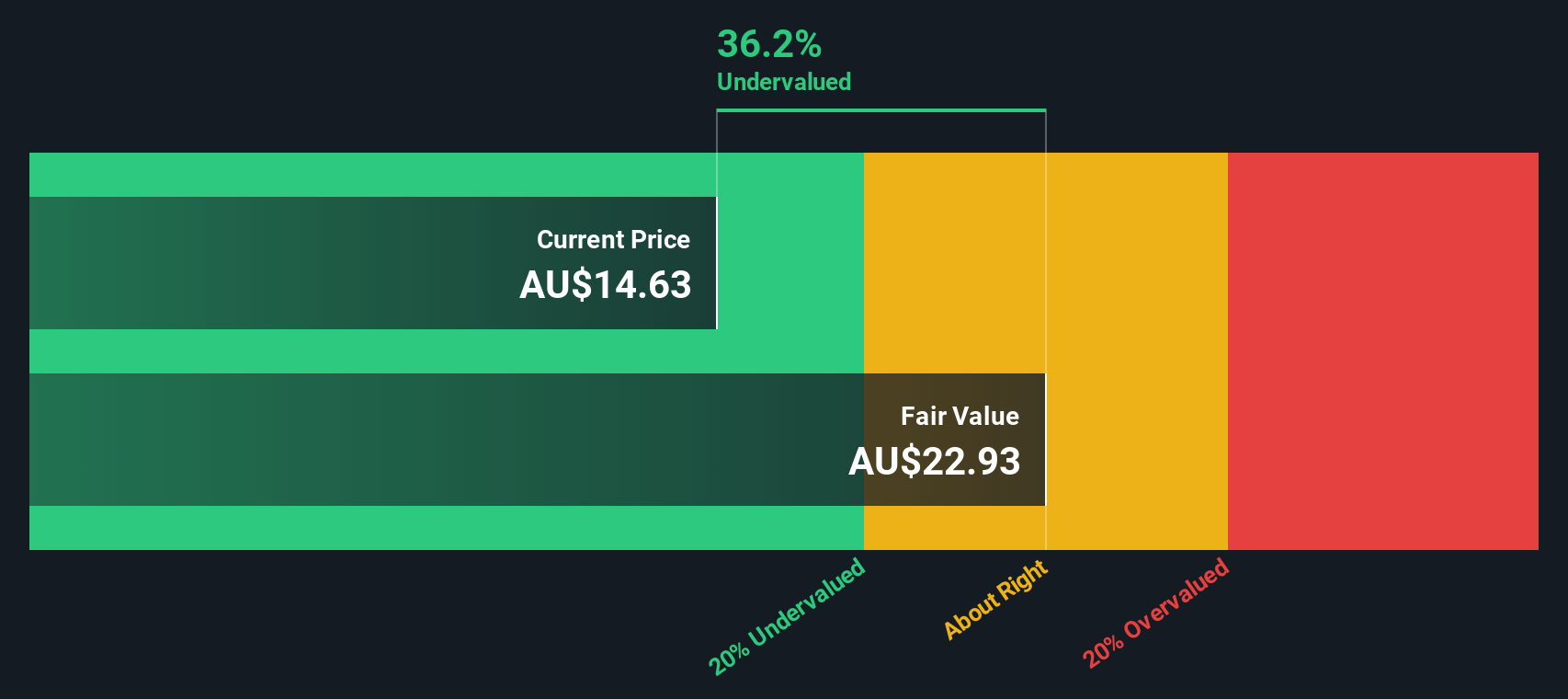

Taking a different approach, our DCF model also sees Domino's shares trading below their estimated fair value. This method supports the idea that the market might be too pessimistic right now. However, could it be missing a deeper issue?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Domino's Pizza Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Domino's Pizza Enterprises Narrative

If the current narratives do not match your perspective, consider diving into the numbers and crafting your own story. Your analysis can come together in just minutes. Do it your way

A great starting point for your Domino's Pizza Enterprises research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Your Next Stock Win?

Unlock your full investing potential by checking out handpicked opportunities that others might overlook. These screeners put powerful, targeted ideas at your fingertips. Don’t let smarter moves pass you by!

- Power up your portfolio with steady income generators by accessing dividend stocks yielding over 3% at dividend stocks with yields > 3%.

- Zero in on hidden value bargains and pinpoint companies trading below their true worth thanks to undervalued stocks based on cash flows.

- Catalyze your growth strategy by tracking advances in medical innovation, including artificial intelligence breakthroughs in healthcare, with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DMP

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives