- Australia

- /

- Metals and Mining

- /

- ASX:SPD

3 ASX Penny Stocks With Market Caps Below A$300M

Reviewed by Simply Wall St

As the Australian market prepares for a modest 0.17% gain, investors are keeping a close eye on global events and their potential impact on local indices. For those willing to explore beyond well-known stocks, penny stocks present intriguing opportunities despite being considered an outdated term. These smaller or newer companies often combine affordability with growth potential, and we'll explore three such stocks that stand out for their financial strength and hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.685 | A$217.26M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.78 | A$143.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.905 | A$1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.505 | A$71M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.57 | A$396.25M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.64M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.64 | A$172.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$825.78M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.93 | A$685.73M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 997 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$172.72 million.

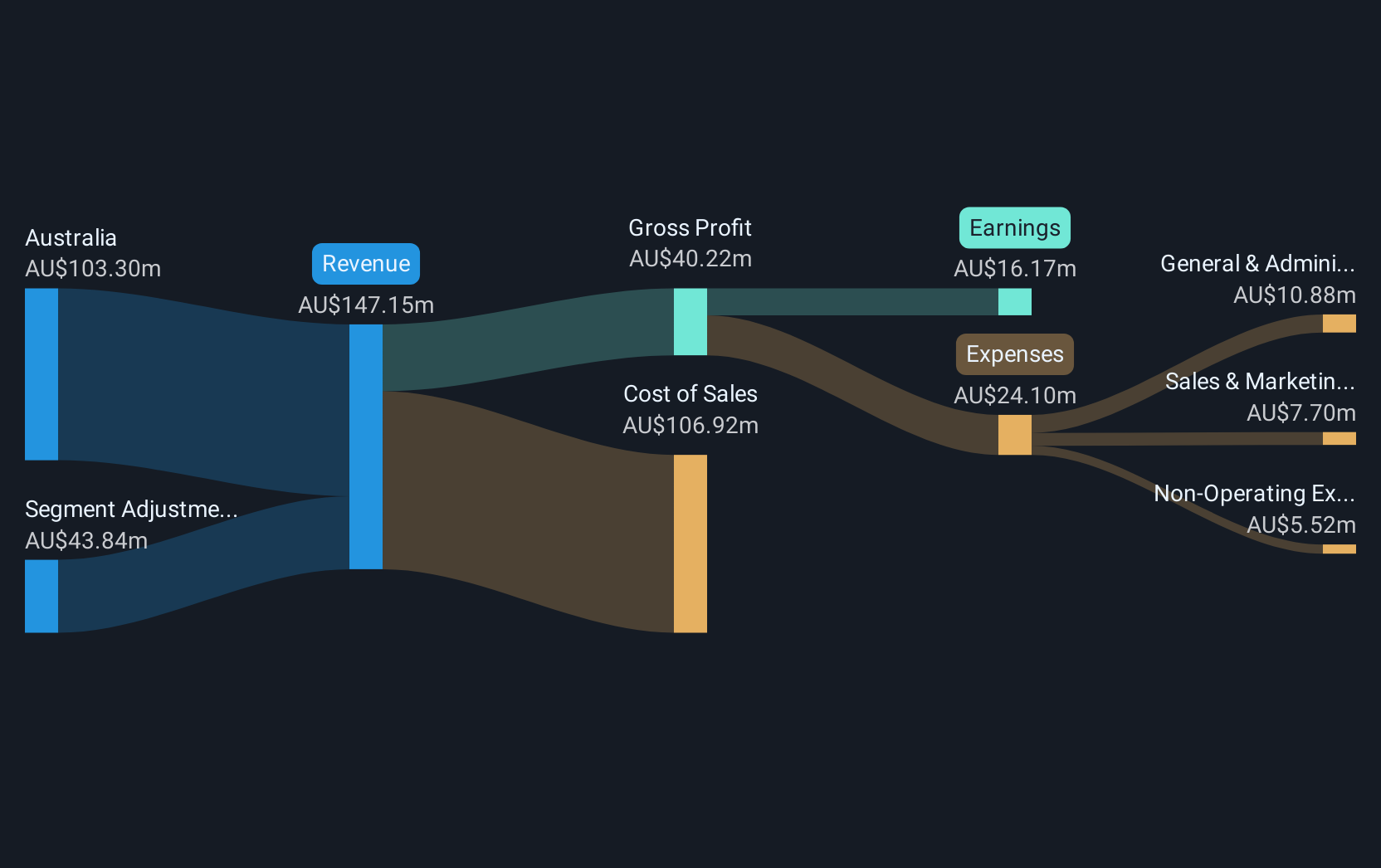

Operations: The company generates revenue primarily from its operations in Australia, amounting to A$103.30 million.

Market Cap: A$172.72M

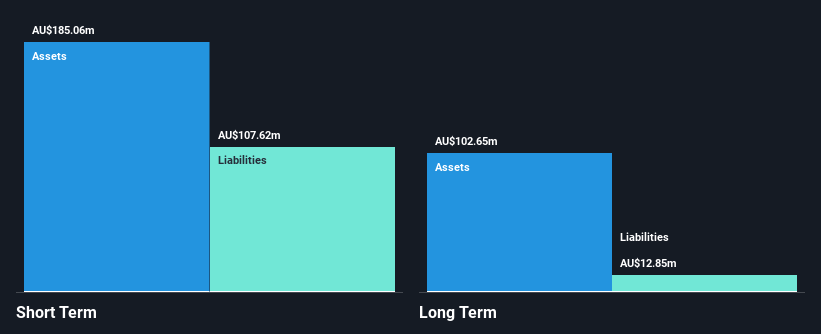

Bisalloy Steel Group demonstrates a solid financial position with earnings growth of 14% over the past year, surpassing the industry average. The company's high Return on Equity of 21.7% and strong cash flow coverage of debt underscore its financial health. Despite unstable dividends, Bisalloy's net profit margins have improved to 11%, and its short-term assets comfortably cover liabilities. Recent inclusion in the S&P/ASX All Ordinaries Index reflects market confidence, while stable weekly volatility suggests consistent performance. However, sales have slightly decreased year-on-year, indicating potential challenges in revenue generation amidst otherwise robust fundamentals.

- Jump into the full analysis health report here for a deeper understanding of Bisalloy Steel Group.

- Learn about Bisalloy Steel Group's future growth trajectory here.

Fleetwood (ASX:FWD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fleetwood Limited operates in the design, manufacture, sale, and installation of modular accommodation and buildings across Australia and New Zealand, with a market cap of A$265.65 million.

Operations: The company generates revenue through its RV Solutions segment with A$71.51 million, Building Solutions contributing A$340.12 million, and Community Solutions adding A$50.02 million.

Market Cap: A$265.65M

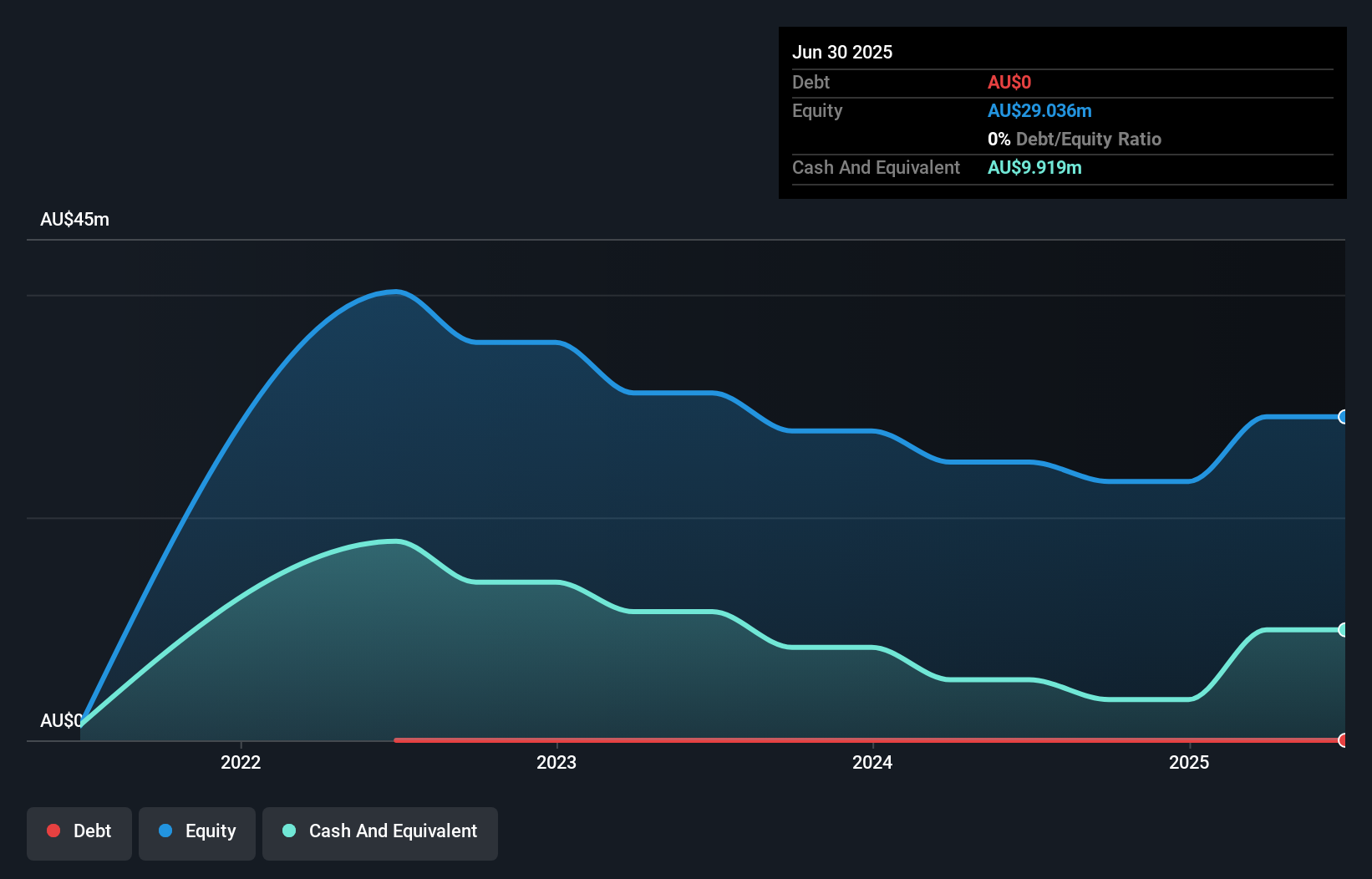

Fleetwood Limited, with a market cap of A$265.65 million, operates debt-free and has seen its earnings grow by 9.6% annually over the past five years. Despite recent negative earnings growth of -31.8%, the company reported half-year sales of A$271.94 million, up from A$228.92 million the previous year, alongside a net income increase to A$4.66 million from A$3.86 million year-on-year. Fleetwood's dividend yield of 8.07% is not well-covered by earnings, yet it recently declared an increased fully franked dividend per share for six months ended December 2024 amidst stable weekly volatility and significant share buybacks completed in late 2024.

- Navigate through the intricacies of Fleetwood with our comprehensive balance sheet health report here.

- Examine Fleetwood's earnings growth report to understand how analysts expect it to perform.

Southern Palladium (ASX:SPD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Palladium Limited, with a market cap of A$31.83 million, is involved in the exploration and development of platinum group metals through its subsidiaries.

Operations: Southern Palladium Limited does not report any revenue segments.

Market Cap: A$31.83M

Southern Palladium Limited, with a market cap of A$31.83 million, remains pre-revenue but shows potential through strategic developments in its Bengwenyama platinum group metals project. The recent Environmental Authorisation paves the way for mining rights, reflecting strong permitting work and commitment to responsible development. The company is refining its Pre-Feasibility Study with a focus on reducing initial capital requirements by implementing a two-stage development strategy. Despite ongoing losses and high share price volatility, Southern Palladium's debt-free status and sufficient cash runway provide financial stability as it progresses towards project execution.

- Dive into the specifics of Southern Palladium here with our thorough balance sheet health report.

- Assess Southern Palladium's previous results with our detailed historical performance reports.

Make It Happen

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 994 more companies for you to explore.Click here to unveil our expertly curated list of 997 ASX Penny Stocks.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SPD

Southern Palladium

Engages in the exploration and development of platinum group metals.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives