Undervalued Small Caps In Australia With Insider Buying For August 2024

Reviewed by Simply Wall St

The Australian market has shown promising performance, climbing 2.2% in the last 7 days and 6.6% over the past year, with earnings forecasted to grow by 13% annually. In this favorable environment, identifying undervalued small-cap stocks with insider buying can present compelling opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| RAM Essential Services Property Fund | NA | 5.9x | 44.66% | ★★★★★☆ |

| Healius | NA | 0.6x | 46.58% | ★★★★★☆ |

| Elders | 22.6x | 0.5x | 49.87% | ★★★★☆☆ |

| Eagers Automotive | 9.4x | 0.3x | 42.18% | ★★★★☆☆ |

| DUG Technology | 57.9x | 4.0x | 9.72% | ★★★★☆☆ |

| Codan | 29.8x | 4.4x | 33.72% | ★★★★☆☆ |

| Neuren Pharmaceuticals | 13.0x | 8.8x | -17.34% | ★★★★☆☆ |

| Coventry Group | 293.5x | 0.4x | 1.30% | ★★★★☆☆ |

| Dicker Data | 22.7x | 0.8x | 8.55% | ★★★☆☆☆ |

| FINEOS Corporation Holdings | NA | 2.5x | -743.39% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

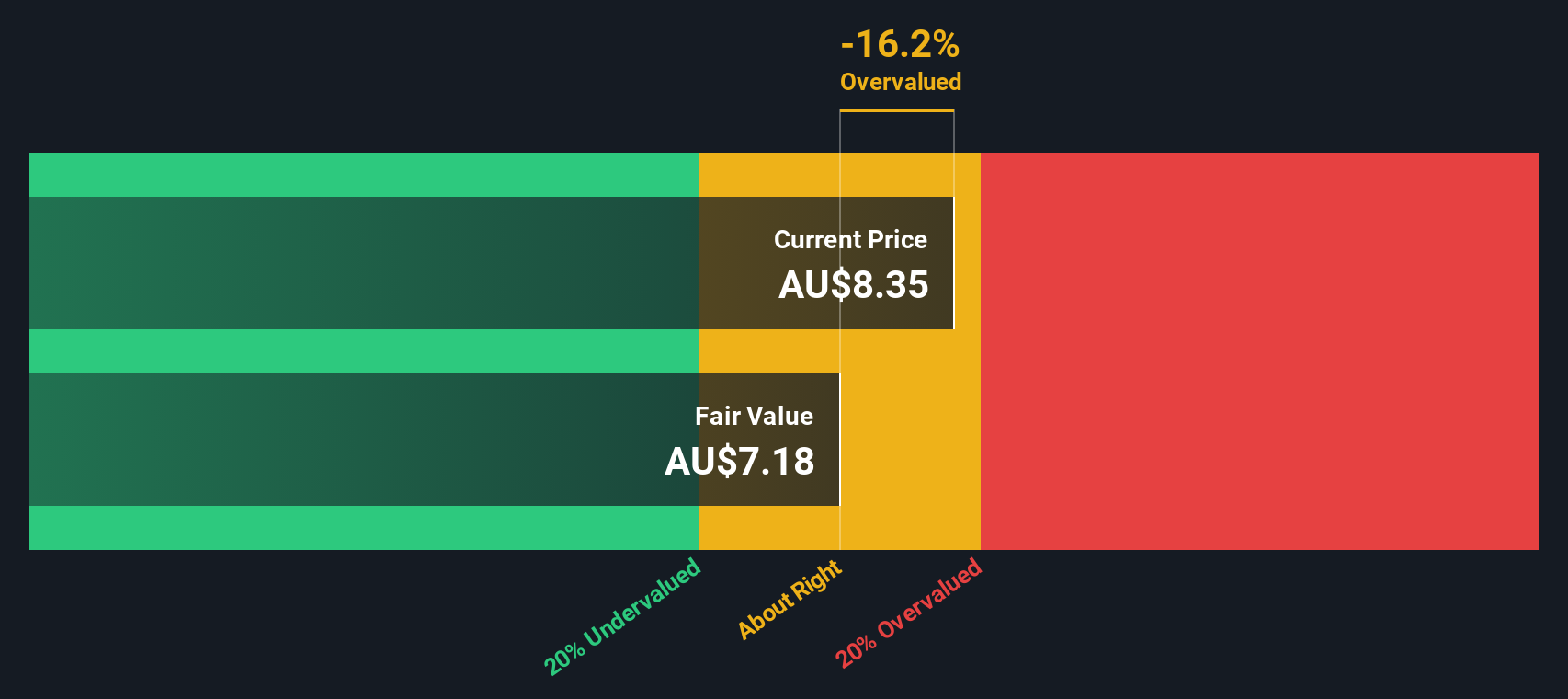

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a technology company specializing in communications and metal detection solutions, with a market cap of A$1.40 billion.

Operations: Codan generates revenue primarily from its Communications and Metal Detection segments, with the former contributing A$291.50 million and the latter A$212.20 million. The company's gross profit margin has shown variability, with recent figures around 54.42%.

PE: 29.8x

Codan, a small Australian tech company, shows potential as an undervalued stock. Recent insider confidence is evident with board members purchasing shares in June 2024. Despite relying on higher risk external borrowing for funding, Codan's earnings are projected to grow by 16.2% annually. This growth outlook highlights the company's resilience and potential for future value appreciation amidst its financial structure challenges.

- Get an in-depth perspective on Codan's performance by reading our valuation report here.

Examine Codan's past performance report to understand how it has performed in the past.

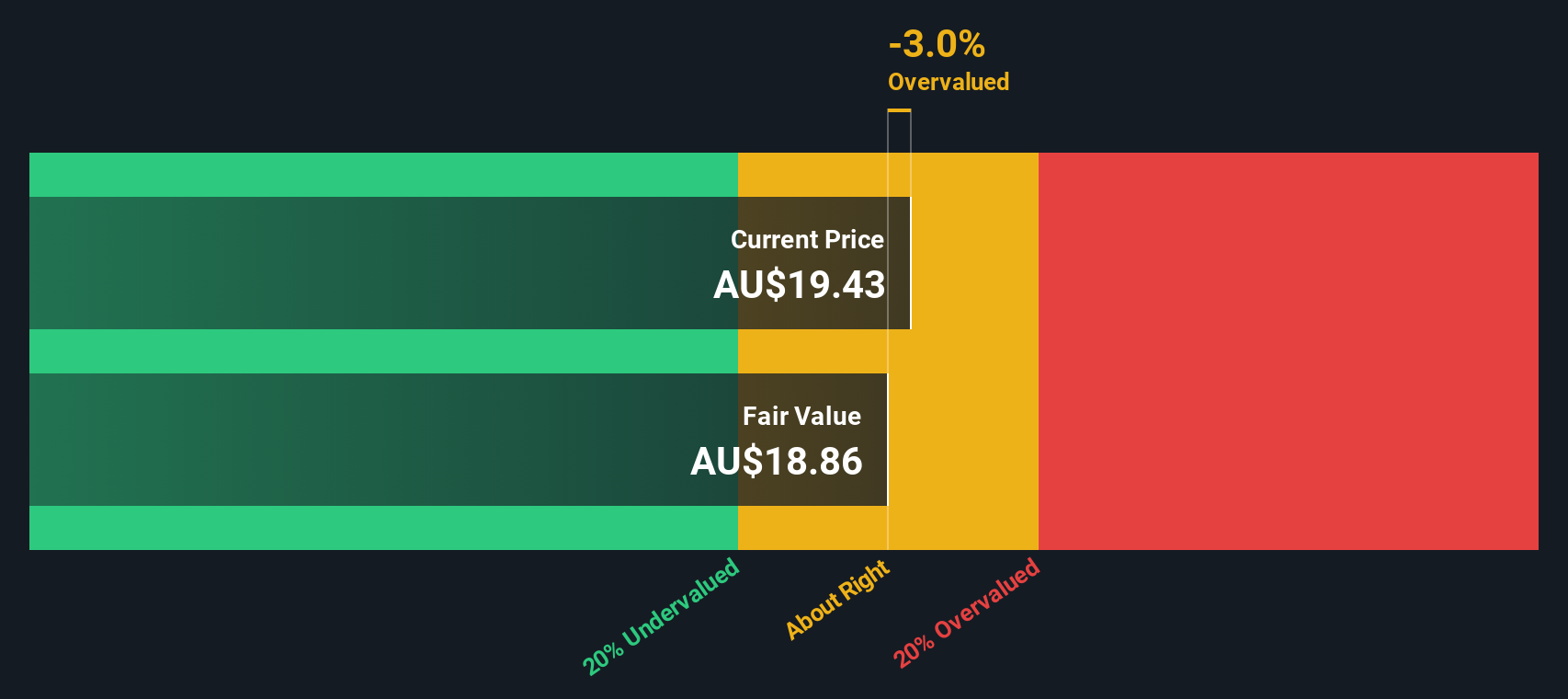

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a wholesale distributor specializing in computer peripherals with a market cap of A$1.84 billion.

Operations: The company generates revenue primarily from wholesale computer peripherals, with a gross profit margin of 14.23% as of the latest period ending December 31, 2023. Operating expenses include significant allocations to general and administrative costs and non-operating expenses.

PE: 22.7x

Dicker Data, a tech distributor in Australia, has seen significant insider confidence with executives purchasing shares consistently over the past year. Their earnings are projected to grow at 7.83% annually, indicating potential for future profitability. Despite having a high level of debt funded through external borrowing, the company maintains a strong market position without relying on customer deposits. Recent financial performance and continuous insider buying suggest that Dicker Data could be undervalued in its sector.

- Delve into the full analysis valuation report here for a deeper understanding of Dicker Data.

Assess Dicker Data's past performance with our detailed historical performance reports.

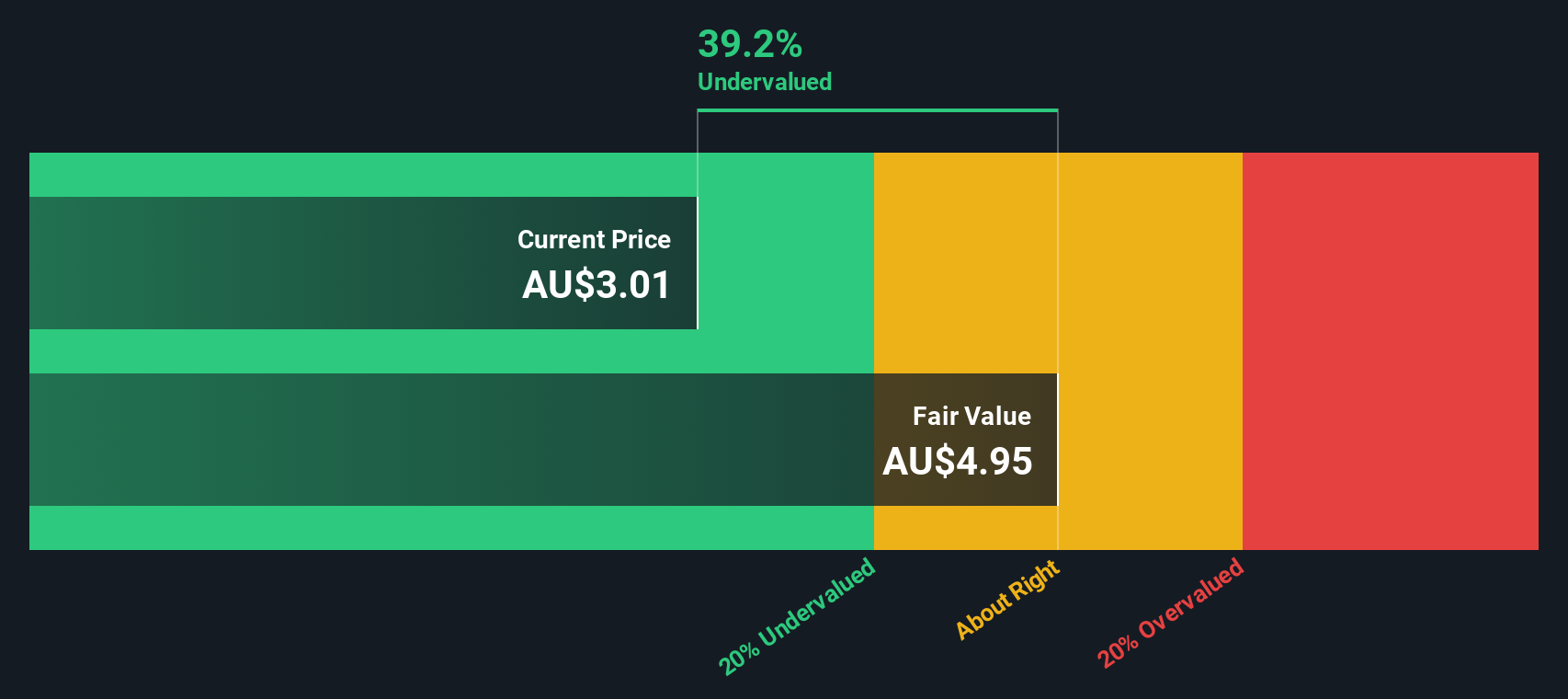

NRW Holdings (ASX:NWH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NRW Holdings is an Australian company engaged in providing diversified services across the mining, civil infrastructure, and urban development sectors with a market cap of approximately A$1.16 billion.

Operations: The company generates revenue primarily from three segments: MET (A$739.07 million), Civil (A$593.62 million), and Mining (A$1.49 billion). The gross profit margin has shown a notable trend, reaching 47.41% as of the latest period ending December 31, 2024. Operating expenses and cost of goods sold are significant components impacting net income, with the latter amounting to A$1.45 billion in the same period.

PE: 16.4x

NRW Holdings, a construction and mining services company, recently reaffirmed its revenue guidance for fiscal year 2024 at A$2.9 billion. The company completed a follow-on equity offering on July 11, raising A$5.26 million by issuing over two million shares at A$2.56 each. Notably, insider confidence is evident with recent share purchases by key personnel within the past quarter. Earnings are expected to grow annually by 13%, although funding relies entirely on external borrowing, posing higher risk factors for investors seeking undervalued opportunities in Australia's market.

- Take a closer look at NRW Holdings' potential here in our valuation report.

Understand NRW Holdings' track record by examining our Past report.

Taking Advantage

- Navigate through the entire inventory of 15 Undervalued ASX Small Caps With Insider Buying here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DDR

Dicker Data

Engages in the wholesale distribution of computer hardware, software, cloud, access control, surveillance, and technologies in Australia and New Zealand.

Proven track record with adequate balance sheet.