- Australia

- /

- Construction

- /

- ASX:MND

Investors Appear Satisfied With Monadelphous Group Limited's (ASX:MND) Prospects

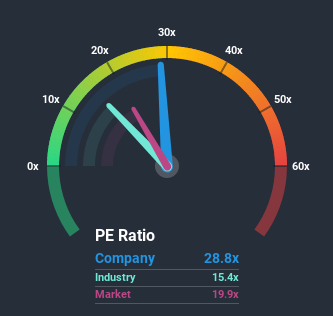

When close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may consider Monadelphous Group Limited (ASX:MND) as a stock to potentially avoid with its 28.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

Monadelphous Group has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Monadelphous Group

Does Growth Match The High P/E?

Monadelphous Group's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. The last three years don't look nice either as the company has shrunk EPS by 37% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 23% per annum as estimated by the twelve analysts watching the company. With the market only predicted to deliver 18% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Monadelphous Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Monadelphous Group's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Monadelphous Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Monadelphous Group that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you’re looking to trade Monadelphous Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:MND

Monadelphous Group

An engineering group, engages in the provision of construction, maintenance, and industrial services to resources, energy, and infrastructure sectors in Australia, China, Mongolia, Papua New Guinea, China, the Philippines, and internationally.

Excellent balance sheet and fair value.