Stock Analysis

- Australia

- /

- Construction

- /

- ASX:DRA

DRA Global (ASX:DRA investor one-year losses grow to 44% as the stock sheds AU$34m this past week

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the DRA Global Limited (ASX:DRA) share price is down 44% in the last year. That contrasts poorly with the market decline of 2.6%. DRA Global hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

With the stock having lost 27% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for DRA Global

SWOT Analysis for DRA Global

- Debt is well covered by .

- Interest payments on debt are not well covered.

- Shareholders have been diluted in the past year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Lack of analyst coverage makes it difficult to determine DRA's earnings prospects.

- Debt is not well covered by operating cash flow.

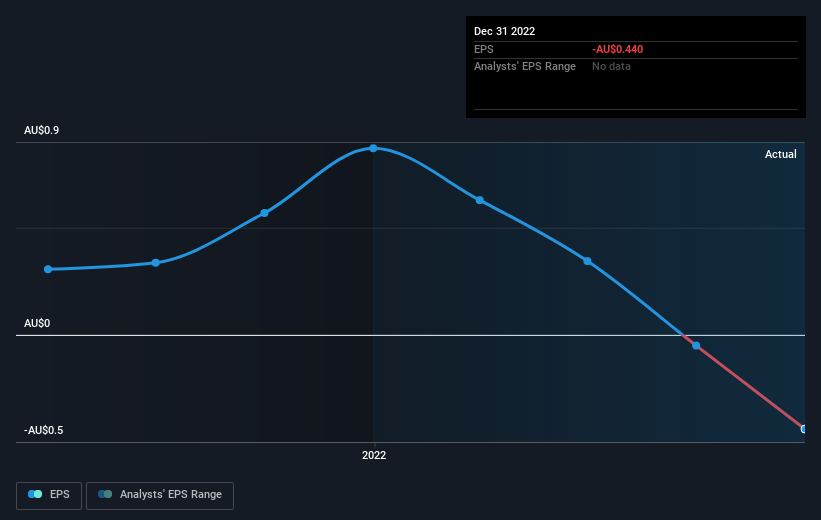

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

DRA Global fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. However, there may be an opportunity for investors if the company can recover.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While DRA Global shareholders are down 44% for the year, the market itself is up 2.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 9.7%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - DRA Global has 3 warning signs (and 1 which is significant) we think you should know about.

Of course DRA Global may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether DRA Global is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DRA

DRA Global

DRA Global Limited operates as a multi-disciplinary engineering, project delivery, and operations management company focused on the mining, mineral, and metal sectors worldwide.

Excellent balance sheet with acceptable track record.