Some Shareholders Feeling Restless Over Andritz AG's (VIE:ANDR) P/E Ratio

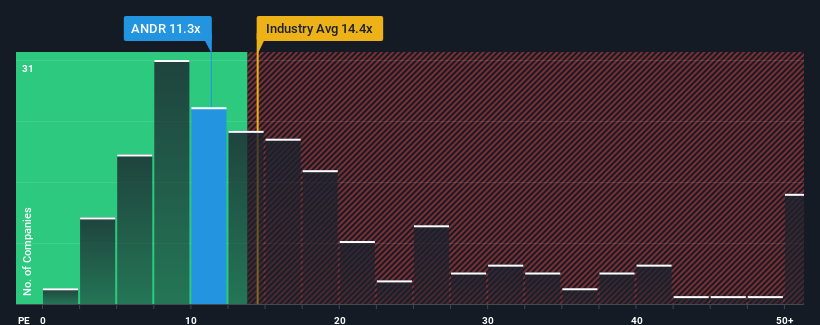

When close to half the companies in Austria have price-to-earnings ratios (or "P/E's") below 8x, you may consider Andritz AG (VIE:ANDR) as a stock to potentially avoid with its 11.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

There hasn't been much to differentiate Andritz's and the market's earnings growth lately. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Andritz

How Is Andritz's Growth Trending?

Andritz's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 29%. The latest three year period has also seen an excellent 126% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 1.1% each year as estimated by the seven analysts watching the company. That's shaping up to be similar to the 1.4% per year growth forecast for the broader market.

With this information, we find it interesting that Andritz is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Andritz's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Andritz's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Andritz (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Andritz, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:ANDR

Andritz

Provides plants, equipment, and services for pulp and paper industry, metalworking and steel industries, hydropower stations, and solid/liquid separation in the municipal and industrial sectors in Europe, North America, South America, China, Asia, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.