In 2005, Franz Gasselsberger was appointed CEO of Oberbank AG (VIE:OBS). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for Oberbank

How Does Franz Gasselsberger's Compensation Compare With Similar Sized Companies?

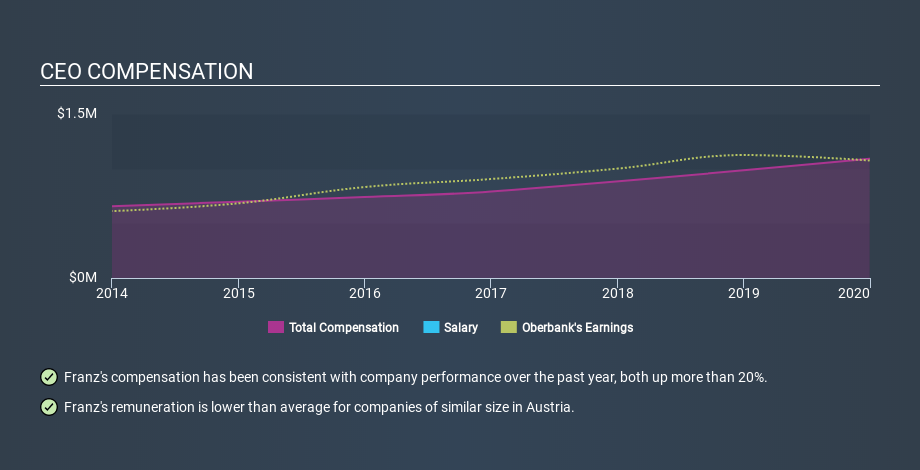

According to our data, Oberbank AG has a market capitalization of €3.0b, and paid its CEO total annual compensation worth €1.1m over the year to December 2019. We examined companies with market caps from €1.8b to €5.7b, and discovered that the median CEO total compensation of that group was €1.8m.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. On an industry level, roughly 67% of total compensation represents salary and 33% is other remuneration. Talking in terms of the company, Oberbank prefers to reward its CEO through non-salary benefits, opting not to give Franz Gasselsberger a salary.

At first glance this seems like a real positive for shareholders, since Franz Gasselsberger is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance. The graphic below shows how CEO compensation at Oberbank has changed from year to year.

Is Oberbank AG Growing?

Over the last three years Oberbank AG has shrunk its earnings per share by an average of 3.4% per year (measured with a line of best fit). Its revenue is down 24% over last year.

Unfortunately, earnings per share have trended lower over the last three years. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Oberbank AG Been A Good Investment?

Oberbank AG has generated a total shareholder return of 10% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

It appears that Oberbank AG remunerates its CEO below most similar sized companies.

The compensation paid to Franz Gasselsberger is lower than is usual at similar sized companies. But the business isn't growing earnings per share, and the returns to shareholders haven't been wonderful. There is room for improved company performance, but we don't see the CEO pay as a big issue here. On another note, we've spotted 1 warning sign for Oberbank that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About WBAG:OBS

Mediocre balance sheet with questionable track record.