Stock Analysis

Shareholders in Emirates Integrated Telecommunications Company PJSC (DFM:DU) are in the red if they invested a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Emirates Integrated Telecommunications Company PJSC (DFM:DU) have tasted that bitter downside in the last year, as the share price dropped 10%. That's well below the market decline of 0.05%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 5.5% in three years.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Emirates Integrated Telecommunications Company PJSC

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Emirates Integrated Telecommunications Company PJSC share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

We don't see any weakness in the Emirates Integrated Telecommunications Company PJSC's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Unless, of course, the market was expecting a revenue uptick.

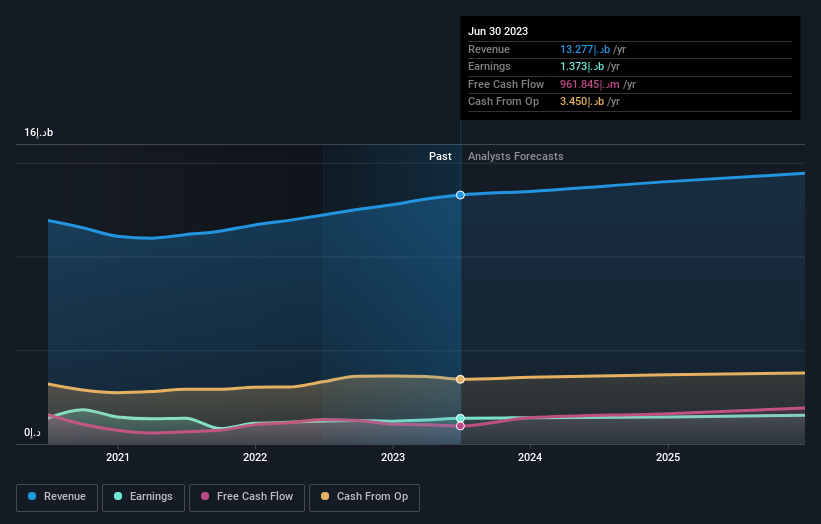

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Emirates Integrated Telecommunications Company PJSC has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Emirates Integrated Telecommunications Company PJSC will earn in the future (free profit forecasts).

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Emirates Integrated Telecommunications Company PJSC the TSR over the last 1 year was -5.6%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that Emirates Integrated Telecommunications Company PJSC shareholders are down 5.6% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.05%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Emirates Integrated Telecommunications Company PJSC is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Emirates Integrated Telecommunications Company PJSC is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:DU

Emirates Integrated Telecommunications Company PJSC

Emirates Integrated Telecommunications Company PJSC provides carrier, data hub, internet exchange facilities, and satellite service primarily in the United Arab Emirates.

Excellent balance sheet with proven track record and pays a dividend.