Stock Analysis

- United Arab Emirates

- /

- Real Estate

- /

- DFM:UPP

Union Properties (DFM:UPP) sheds د.إ219m, company earnings and investor returns have been trending downwards for past five years

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Union Properties Public Joint Stock Company (DFM:UPP), since the last five years saw the share price fall 48%. Furthermore, it's down 18% in about a quarter. That's not much fun for holders.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Union Properties

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Union Properties became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Arguably, the revenue drop of 7.8% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

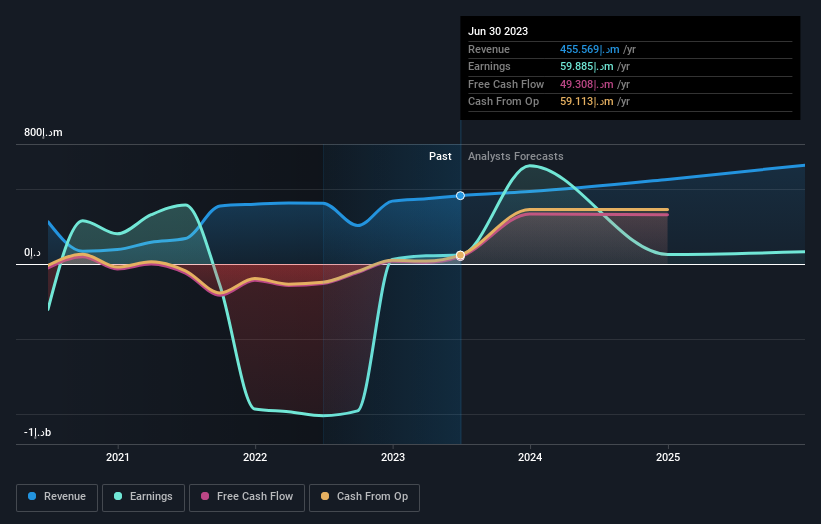

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Union Properties has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Union Properties stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Union Properties has rewarded shareholders with a total shareholder return of 35% in the last twelve months. That certainly beats the loss of about 8% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Union Properties (including 1 which doesn't sit too well with us) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Union Properties is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:UPP

Union Properties

Invests in, develops, manages, maintains, and sells real estate properties primarily in the United Arab Emirates.

Undervalued with solid track record.