- United Arab Emirates

- /

- Real Estate

- /

- ADX:KICO

Investors more bullish on Al Khaleej Investment P.J.S.C (ADX:KICO) this week as stock spikes 13%, despite earnings trending downwards over past year

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When you find (and hold) a big winner, you can markedly improve your finances. For example, Al Khaleej Investment P.J.S.C. (ADX:KICO) has generated a beautiful 404% return in just a single year. And in the last month, the share price has gained 168%. Looking back further, the stock price is 257% higher than it was three years ago.

Since it's been a strong week for Al Khaleej Investment P.J.S.C shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Al Khaleej Investment P.J.S.C

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Al Khaleej Investment P.J.S.C actually saw its earnings per share drop 20%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

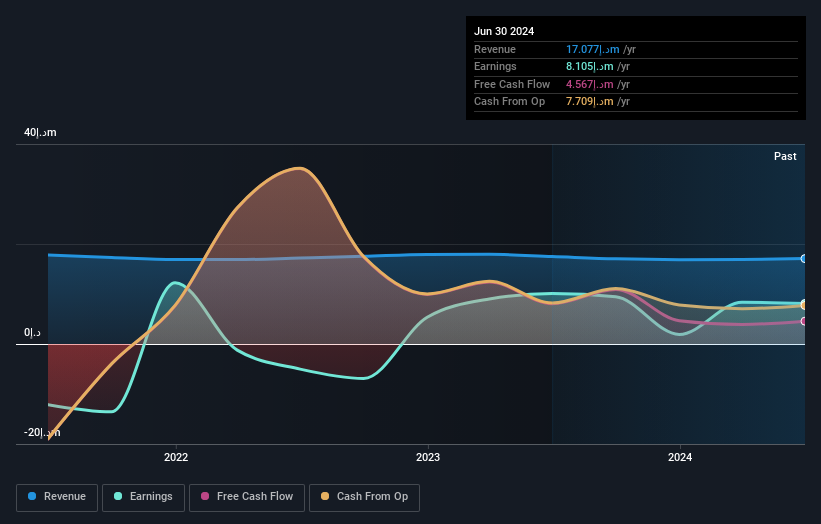

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Al Khaleej Investment P.J.S.C stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Al Khaleej Investment P.J.S.C shareholders have received a total shareholder return of 404% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Al Khaleej Investment P.J.S.C better, we need to consider many other factors. Even so, be aware that Al Khaleej Investment P.J.S.C is showing 3 warning signs in our investment analysis , and 1 of those is concerning...

Of course Al Khaleej Investment P.J.S.C may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:KICO

Al Khaleej Investment P.J.S.C

Operates as a real estate and investment company in the United Arab Emirates.

Flawless balance sheet low.