Stock Analysis

As global markets navigate a landscape of shifting interest rates and varied economic indicators, smaller-cap stocks have been showing notable strength. Penny stocks, a term that may seem outdated but remains relevant, often represent smaller or newer companies with potential for significant value. By focusing on those with strong financials and clear growth paths, investors can uncover opportunities in these lesser-known equities that offer both stability and potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR340.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$495.14M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR139.44M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.08B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$63.88M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR305.39M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.245 | £433.13M | ★★★★☆☆ |

Click here to see the full list of 5,787 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gulf Pharmaceutical Industries P.S.C., known as Julphar, manufactures and sells pharmaceutical and medical products in the UAE, GCC countries, and internationally with a market cap of AED1.61 billion.

Operations: The company's revenue is primarily derived from its Planet segment, which generated AED1.11 billion, and its Manufacturing segment, contributing AED798.3 million.

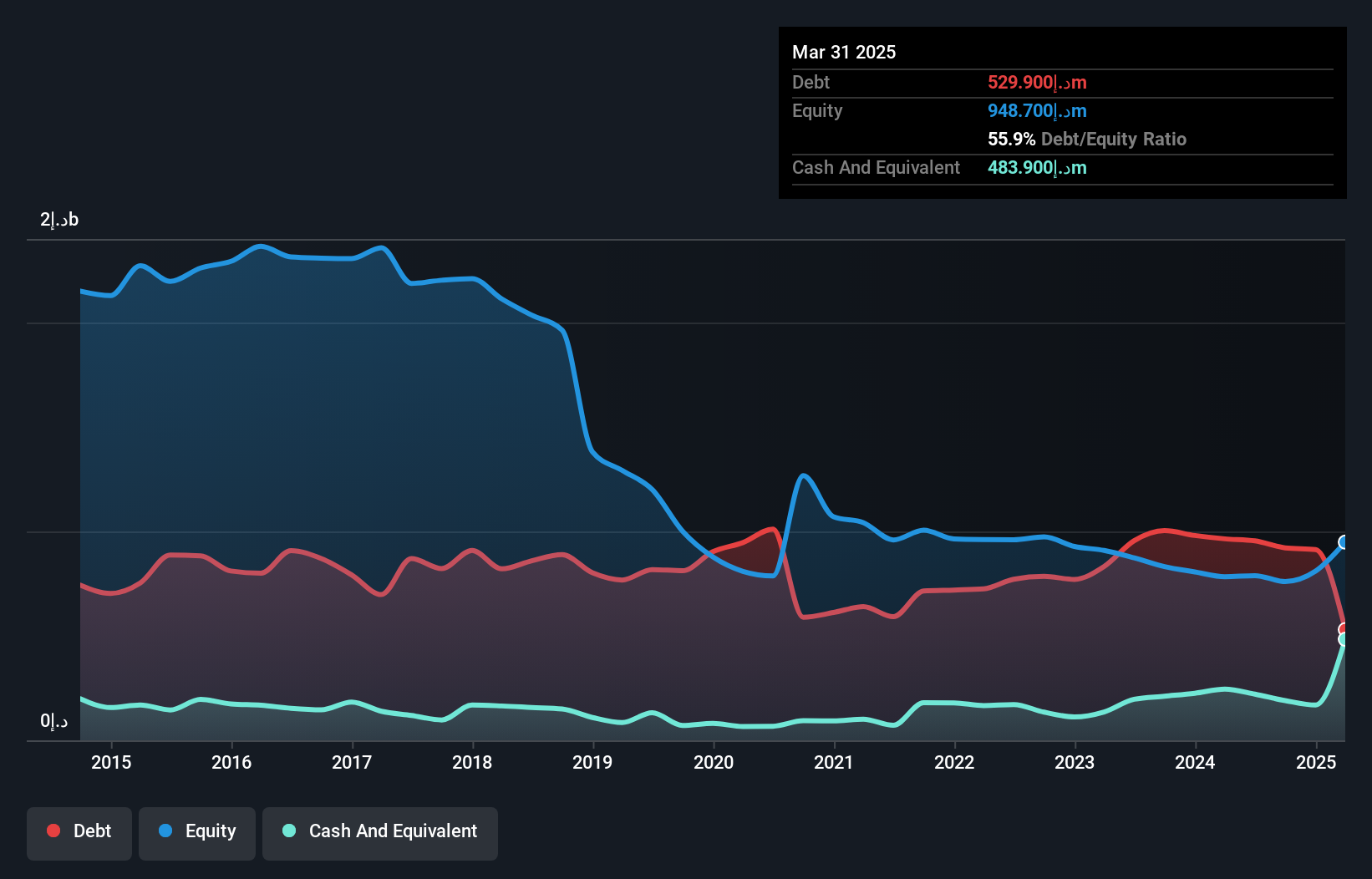

Market Cap: AED1.61B

Gulf Pharmaceutical Industries P.S.C., or Julphar, has shown resilience despite being unprofitable. The company reported a significant reduction in net losses over the past year, with recent quarterly results indicating a net loss of AED 3.3 million compared to AED 41.2 million previously. While its debt-to-equity ratio is high at 93.1%, Julphar's short-term assets comfortably cover both its short- and long-term liabilities, providing some financial stability. The management team and board are experienced, contributing to strategic oversight as the company trades significantly below estimated fair value, offering potential opportunities for investors interested in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Gulf Pharmaceutical Industries P.S.C.

- Gain insights into Gulf Pharmaceutical Industries P.S.C's historical outcomes by reviewing our past performance report.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market cap of HK$32.65 billion.

Operations: Dongguan Rural Commercial Bank Co., Ltd. does not report specific revenue segments.

Market Cap: HK$32.65B

Dongguan Rural Commercial Bank's recent performance reflects some challenges, with net interest income and net income declining compared to the previous year. Despite this, the bank maintains a strong financial foundation, evidenced by an appropriate allowance for bad loans at 309% and a solid loans-to-deposits ratio of 69%. Its asset management is moderate with an assets-to-equity ratio of 12.3x, while maintaining primarily low-risk funding sources. The experienced board and management team provide stability amidst its current undervaluation in comparison to estimated fair value. However, negative earnings growth over the past year may concern potential investors.

- Click here to discover the nuances of Dongguan Rural Commercial Bank with our detailed analytical financial health report.

- Examine Dongguan Rural Commercial Bank's past performance report to understand how it has performed in prior years.

Wutong Holding Group (SZSE:300292)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wutong Holding Group Co., Ltd. manufactures intelligent telecommunication devices and provides internet information services in China, with a market cap of CN¥6.70 billion.

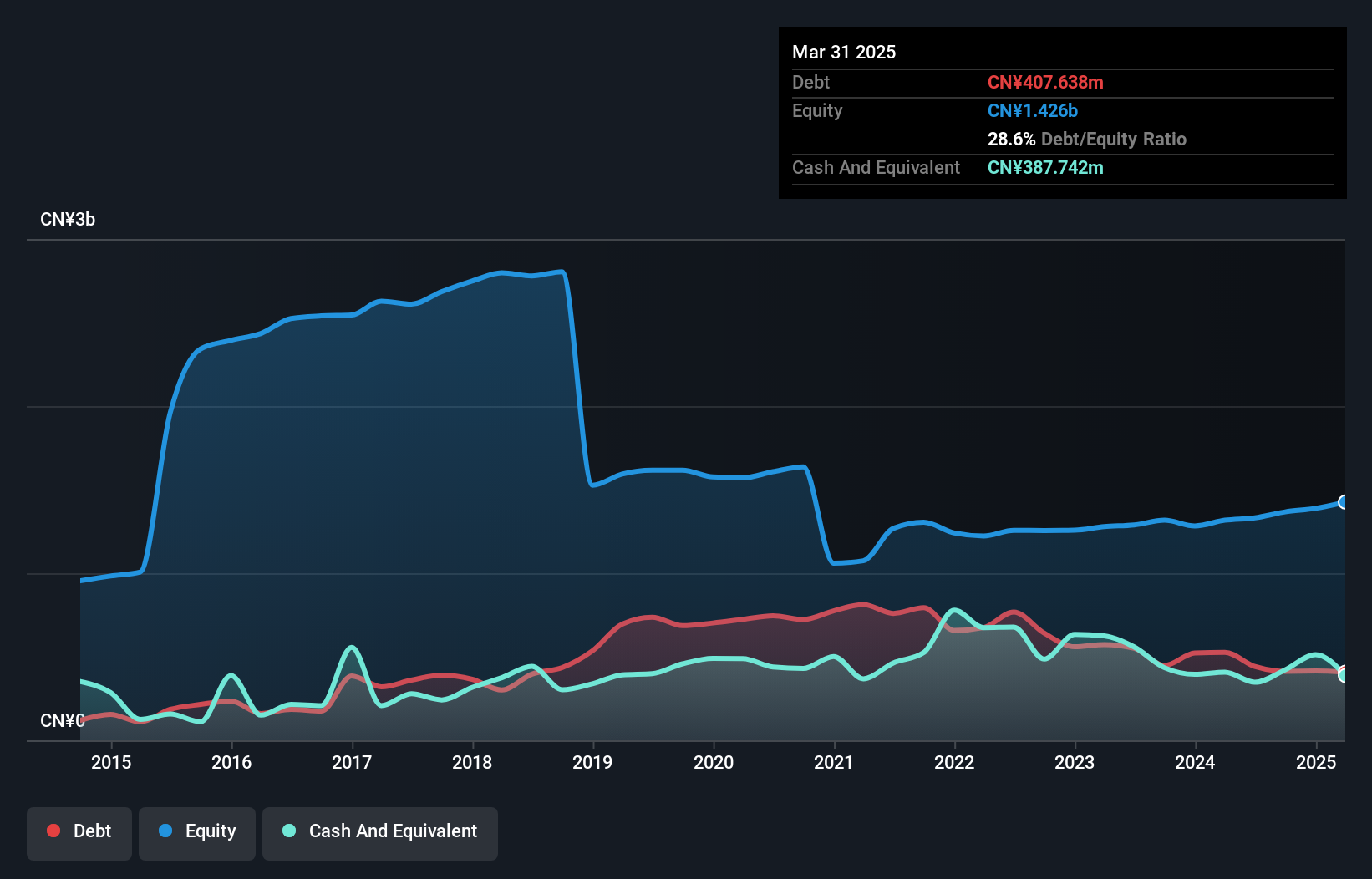

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥6.7B

Wutong Holding Group has demonstrated significant earnings growth, with a 43% increase over the past year, outperforming the broader communications industry. Despite a large one-off loss impacting recent financial results, its short-term assets comfortably cover both short and long-term liabilities. The company's net debt to equity ratio is satisfactory at 7.1%, though operating cash flow remains negative. Recently added to the S&P Global BMI Index, Wutong's revenue and net income have increased compared to last year, reflecting improved profitability margins despite ongoing share price volatility and low return on equity of 3.2%.

- Click here and access our complete financial health analysis report to understand the dynamics of Wutong Holding Group.

- Gain insights into Wutong Holding Group's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Discover the full array of 5,787 Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9889

Dongguan Rural Commercial Bank

Provides various banking products and services in China.