- United Arab Emirates

- /

- Entertainment

- /

- ADX:PALMS

Should Weakness in Palms Sports PJSC's (ADX:PALMS) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

With its stock down 13% over the past three months, it is easy to disregard Palms Sports PJSC (ADX:PALMS). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Particularly, we will be paying attention to Palms Sports PJSC's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Palms Sports PJSC

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Palms Sports PJSC is:

19% = د.إ104m ÷ د.إ543m (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. So, this means that for every AED1 of its shareholder's investments, the company generates a profit of AED0.19.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Palms Sports PJSC's Earnings Growth And 19% ROE

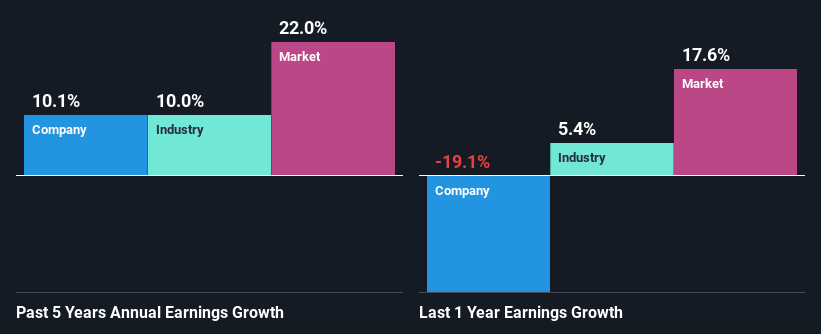

When you first look at it, Palms Sports PJSC's ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 7.3%, is definitely interesting. This certainly adds some context to Palms Sports PJSC's moderate 10% net income growth seen over the past five years. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. Therefore, the growth in earnings could also be the result of other factors. For example, it is possible that the broader industry is going through a high growth phase, or that the company has a low payout ratio.

We then performed a comparison between Palms Sports PJSC's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 10% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Palms Sports PJSC is trading on a high P/E or a low P/E, relative to its industry.

Is Palms Sports PJSC Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 92% (or a retention ratio of 8.0%) for Palms Sports PJSC suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

While Palms Sports PJSC has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend.

Summary

In total, it does look like Palms Sports PJSC has some positive aspects to its business. Especially the growth in earnings which was backed by a moderate ROE. Still, the ROE could have been even more beneficial to investors had the company been reinvesting more of its profits. As highlighted earlier, the current reinvestment rate appears to be negligible. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Palms Sports PJSC's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:PALMS

Palms Sports PJSC

Provides sports training programs for Jiu-Jitsu and other sports in the United Arab Emirates.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives