- United Arab Emirates

- /

- Chemicals

- /

- ADX:BOROUGE

Some Shareholders Feeling Restless Over Borouge plc's (ADX:BOROUGE) P/E Ratio

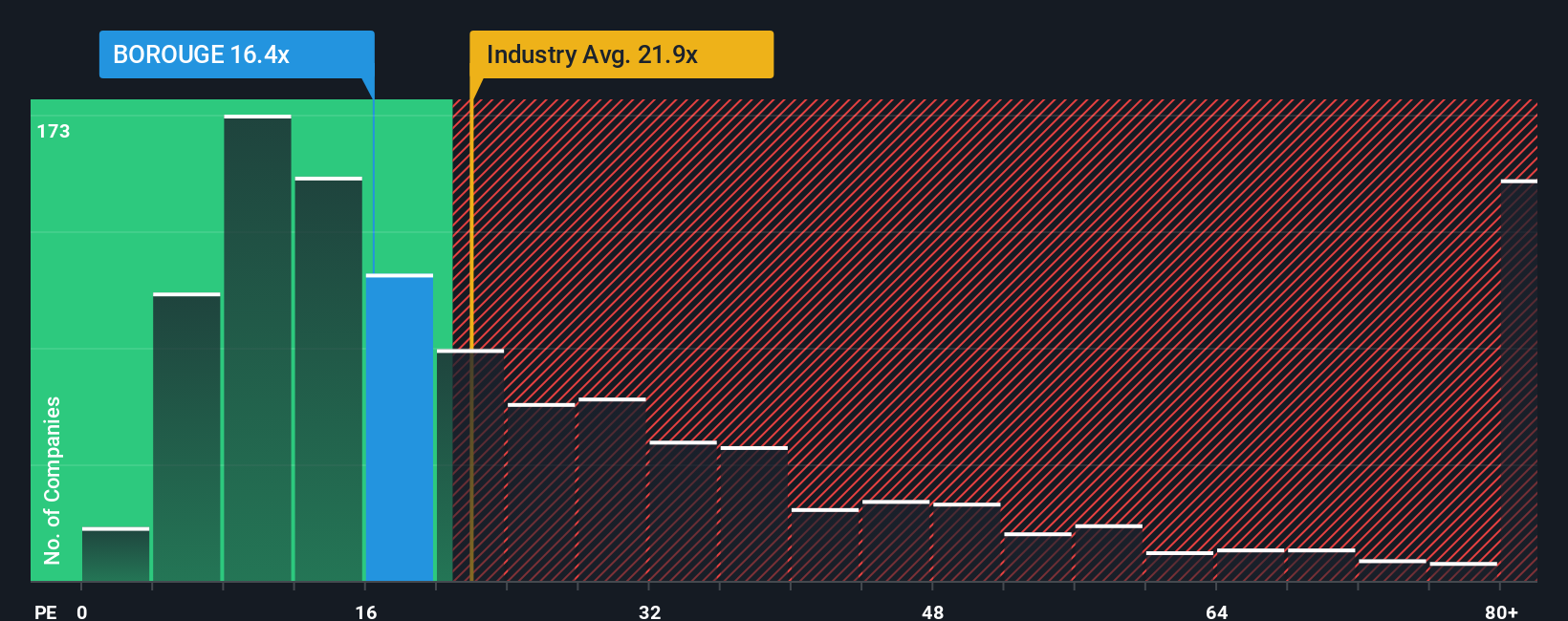

When close to half the companies in the United Arab Emirates have price-to-earnings ratios (or "P/E's") below 12x, you may consider Borouge plc (ADX:BOROUGE) as a stock to potentially avoid with its 16.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for Borouge as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Borouge

How Is Borouge's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Borouge's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 16%. However, this wasn't enough as the latest three year period has seen a very unpleasant 15% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 0.4% per year during the coming three years according to the eleven analysts following the company. With the market predicted to deliver 8.1% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Borouge is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Borouge's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Borouge that you need to be mindful of.

You might be able to find a better investment than Borouge. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Borouge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:BOROUGE

Borouge

Through its subsidiaries, provides polymer solutions in the People’s Republic of China, India, the United Arab Emirates, Austria, Egypt, Pakistan, Vietnam, Saudi Arabia, Bangladesh, Japan, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives