- United Arab Emirates

- /

- Basic Materials

- /

- DFM:NCC

Dana Gas PJSC And 2 Other Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

As most Gulf markets track Asian shares higher, buoyed by stronger-than-expected U.S. economic data, investors are increasingly eyeing opportunities within the Middle East's dynamic landscape. In this environment of renewed optimism, identifying stocks with strong fundamentals and growth potential becomes crucial for those seeking to capitalize on the region's evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC, with a market cap of AED5.90 billion, operates in the exploration, production, transportation, processing, distribution, marketing, and sale of natural gas and petroleum-related products across the United Arab Emirates, Iraq, and Egypt.

Operations: With a revenue of $329 million from its oil and gas integrated segment, Dana Gas PJSC's financial performance is influenced by its operations in the UAE, Iraq, and Egypt. The company focuses on maximizing efficiency in its core activities to optimize profitability.

Dana Gas, a key player in the Middle East's energy sector, showcases a robust financial position with its net debt to equity ratio at 1.6%, reflecting prudent management. The KM250 expansion project in Kurdistan, completed eight months early, boosts gas processing capacity by 50% to 750 MMscf/d, enhancing regional power supply and industrial growth. Despite a slight dip in production to 51,000 boepd for H1 2025 compared to last year’s figures, Dana Gas maintains high-quality earnings with net income reaching US$73 million for the first half of this year. This underscores its resilience amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Dana Gas PJSC's health report.

Evaluate Dana Gas PJSC's historical performance by accessing our past performance report.

National Cement Company (Public Shareholding) (DFM:NCC)

Simply Wall St Value Rating: ★★★★★☆

Overview: National Cement Company (Public Shareholding) is involved in the manufacture and sale of cement and related products both within the United Arab Emirates and internationally, with a market capitalization of AED1.47 billion.

Operations: The company's primary revenue stream is derived from its cement segment, which generated AED193.90 million.

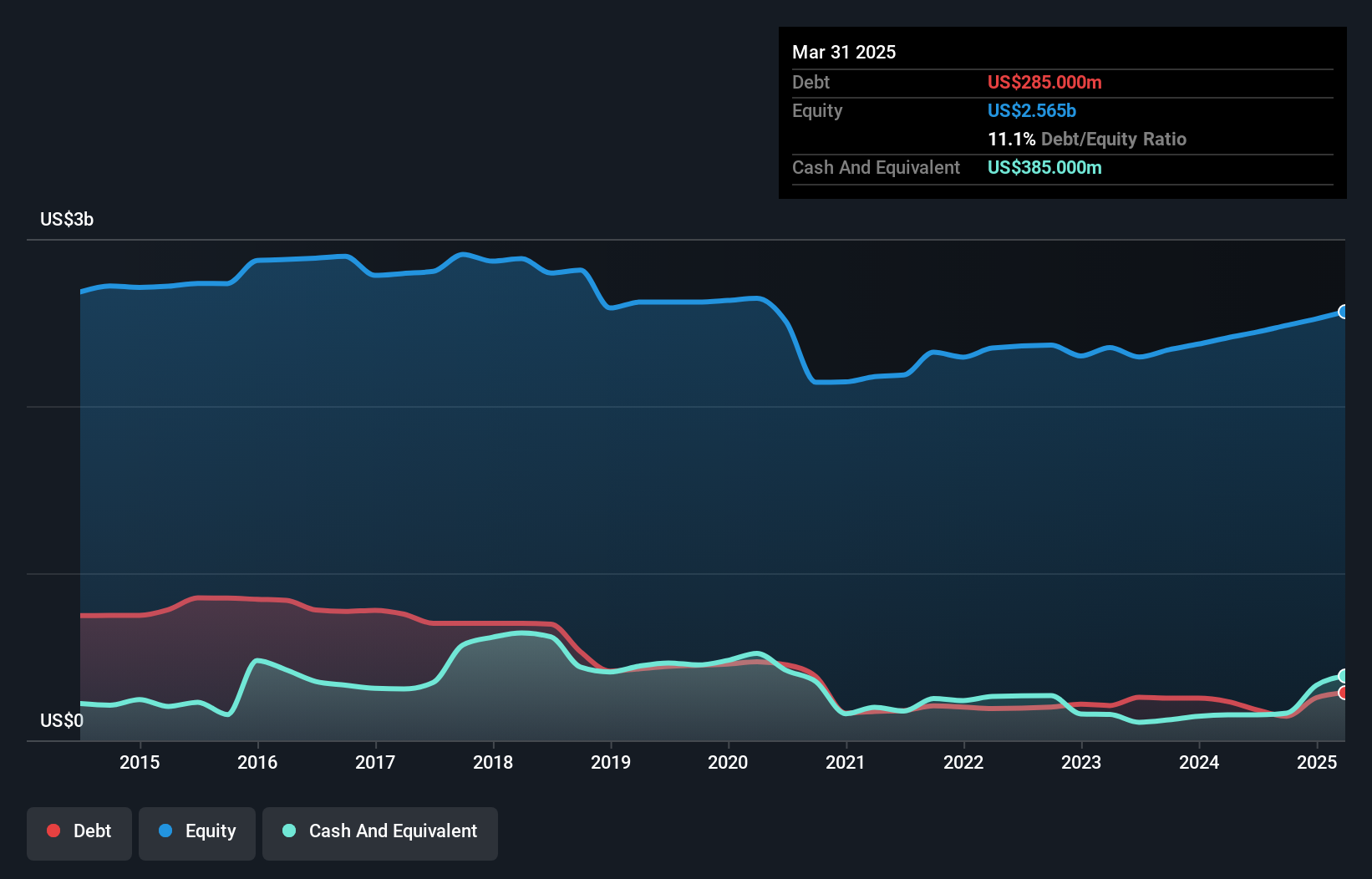

National Cement Company (NCC) has shown robust performance, with earnings climbing 45.8% annually over the past five years. The company reported Q2 2025 sales of AED 57.82 million, a significant rise from AED 35.96 million in the previous year, and net income reached AED 10.88 million compared to a loss of AED 0.81 million previously. Despite its volatile share price recently, NCC's debt-to-equity ratio improved dramatically from 20.4% to just 0.2%. Trading at about 84% below estimated fair value suggests potential for investors seeking undervalued opportunities in the region's cement sector.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪2.13 billion, operates in Israel offering a range of insurance products through its subsidiaries.

Operations: The company generates revenue primarily from life insurance and long-term savings, contributing ₪1.19 billion, and general insurance segments like automobile property insurance at ₪704.65 million. Health insurance also forms a significant part of its revenue stream with ₪638.15 million.

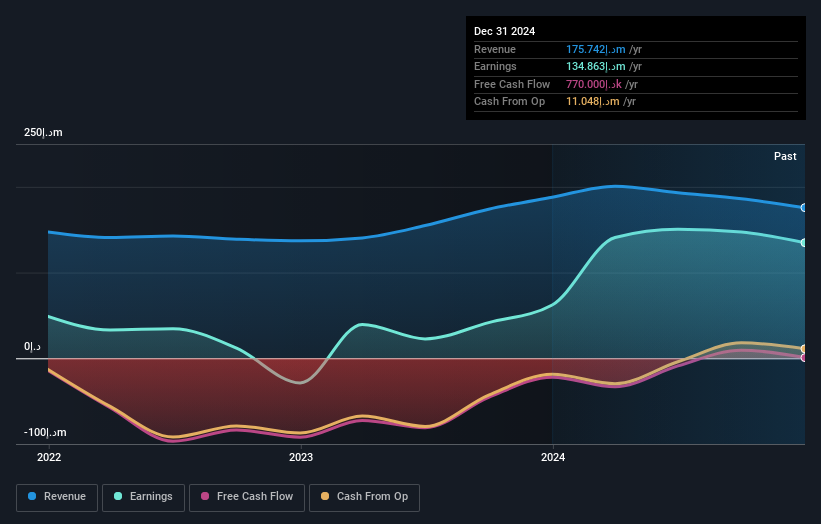

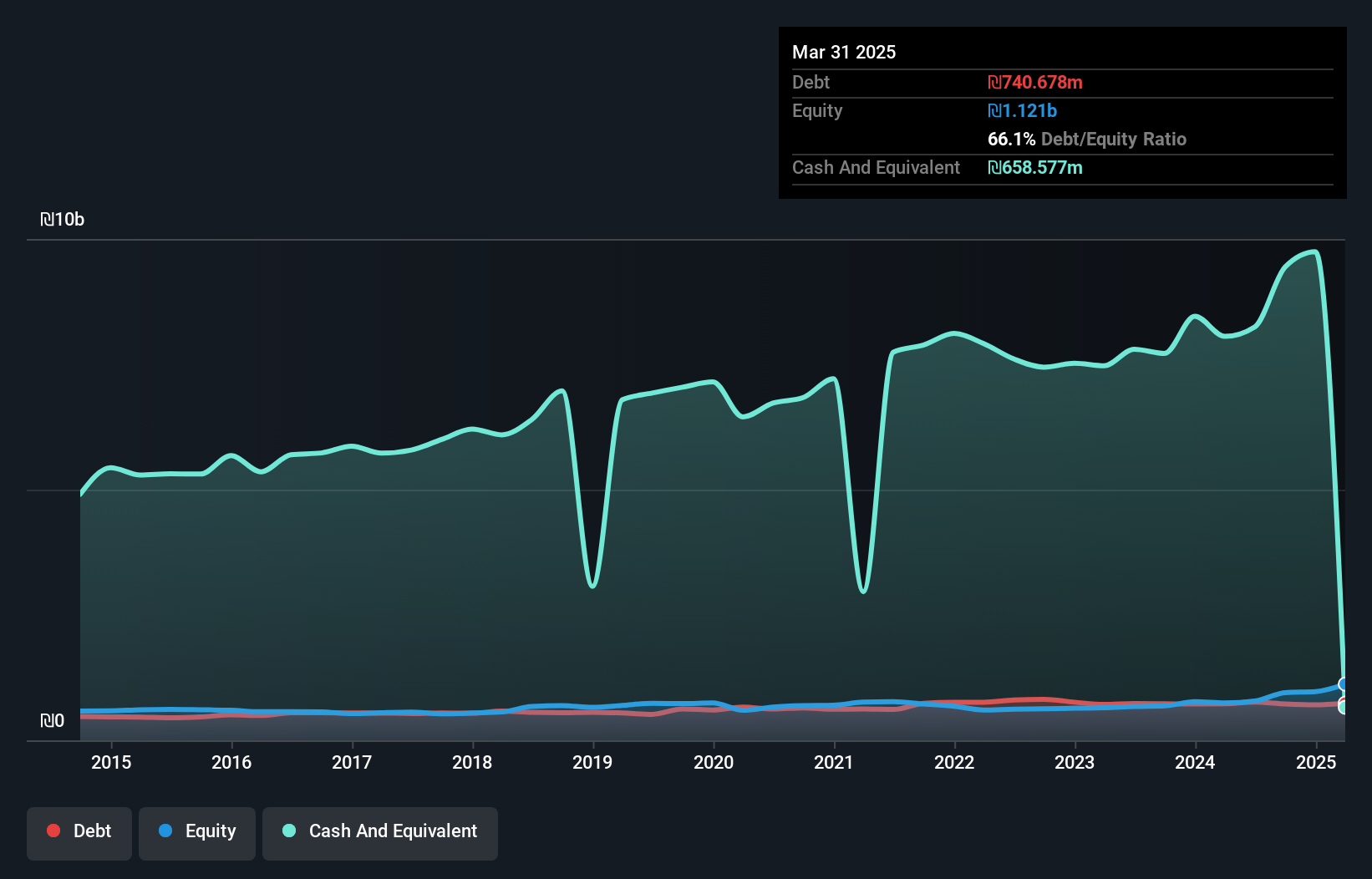

Ayalon Insurance, a nimble player in the insurance sector, has shown robust financial health with its interest payments on debt well-covered by EBIT at 6.1 times. Over the past five years, Ayalon reduced its debt-to-equity ratio from 94% to 54.4%, indicating effective management of liabilities. The company trades at 33.5% below estimated fair value, suggesting potential upside for investors. Recent earnings reports revealed a net income of ILS 144 million for Q2 2025, up from ILS 75 million last year, and it has been added to the S&P Global BMI Index, highlighting growing recognition in global markets.

Seize The Opportunity

- Gain an insight into the universe of 210 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Cement Company (Public Shareholding) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:NCC

National Cement Company (Public Shareholding)

Engages in the manufacture and sale of cement and related products in the United Arab Emirates and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives