- United Arab Emirates

- /

- Hospitality

- /

- ADX:NCTH

Discovering Undiscovered Gems in the Middle East This August 2025

Reviewed by Simply Wall St

In recent months, the Middle East market has experienced a mixed performance, with most Gulf bourses witnessing declines due to lower oil prices and varied corporate earnings, while some indices like Qatar's have shown resilience with modest gains. Amid these fluctuating conditions, identifying promising small-cap stocks requires careful evaluation of their growth potential and ability to navigate economic challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 15.77% | 4.39% | 8.74% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We'll examine a selection from our screener results.

National Corporation for Tourism and Hotels (ADX:NCTH)

Simply Wall St Value Rating: ★★★★★☆

Overview: National Corporation for Tourism and Hotels (ADX:NCTH) is involved in investing in, owning, and managing hotels and leisure complexes across the United Arab Emirates with a market capitalization of AED 1.85 billion.

Operations: NCTH generates revenue primarily from three segments: hotels (AED 223.92 million), retail services (AED 53.45 million), and catering services (AED 429.15 million). The company incurs eliminations of AED -7.96 million in its financial reporting, impacting overall revenue figures.

National Corporation for Tourism and Hotels, a smaller player in the Middle East hospitality sector, reported AED 497 million in sales for Q2 2025, with net income reaching AED 57.38 million. The company's earnings per share from continuing operations stood at AED 0.03 for the quarter. Over the past year, earnings grew by 8.7%, outpacing the industry's -12% decline, indicating robust performance amidst challenging conditions. With high-quality earnings and interest payments well covered by EBIT at a ratio of 6.3x, NCTH appears to be trading significantly below its fair value estimate by about 73%.

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Value Rating: ★★★★★★

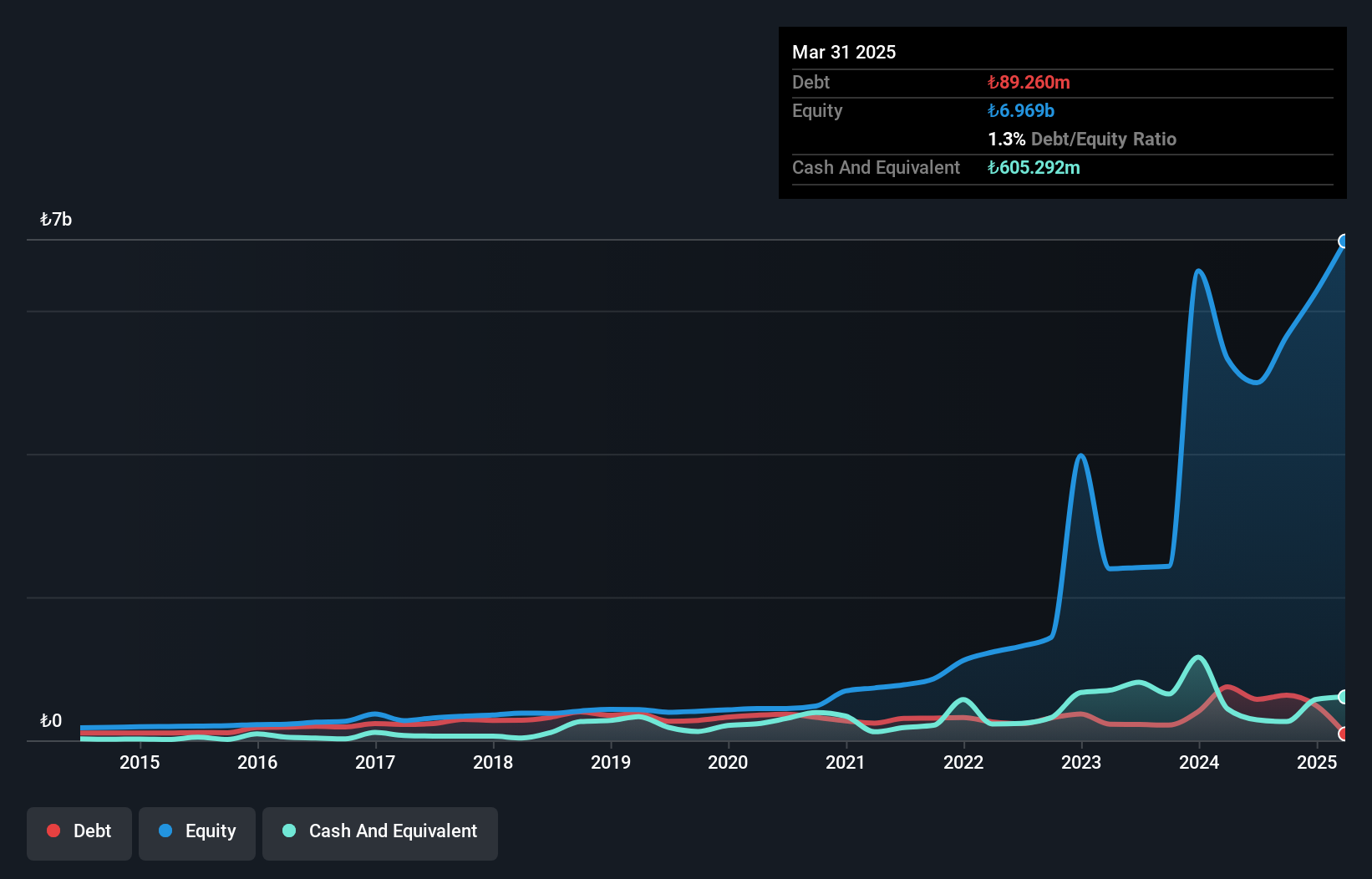

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi is engaged in the production and sale of plastic pipes, spare parts, and various profiles and plastic goods both in Turkey and internationally, with a market capitalization of TRY11.97 billion.

Operations: The company generates revenue primarily from its Building Products segment, amounting to TRY9.31 billion.

Ege Profil Ticaret ve Sanayi Anonim Sirketi, a compact player in the building industry, recently reported a significant drop in earnings with sales at TRY 2.42 billion and net income at TRY 74.69 million, compared to TRY 3.74 billion and TRY 299.17 million respectively from the previous year. Despite this downturn, its debt-to-equity ratio impressively shrank from 78.9% to just 1.3% over five years, indicating effective debt management strategies are in place. The company's interest payments are comfortably covered by EBIT at a robust 29 times coverage, showcasing strong operational efficiency despite recent challenges in growth rates relative to industry peers.

Ratio Energies - Limited Partnership (TASE:RATI)

Simply Wall St Value Rating: ★★★★☆☆

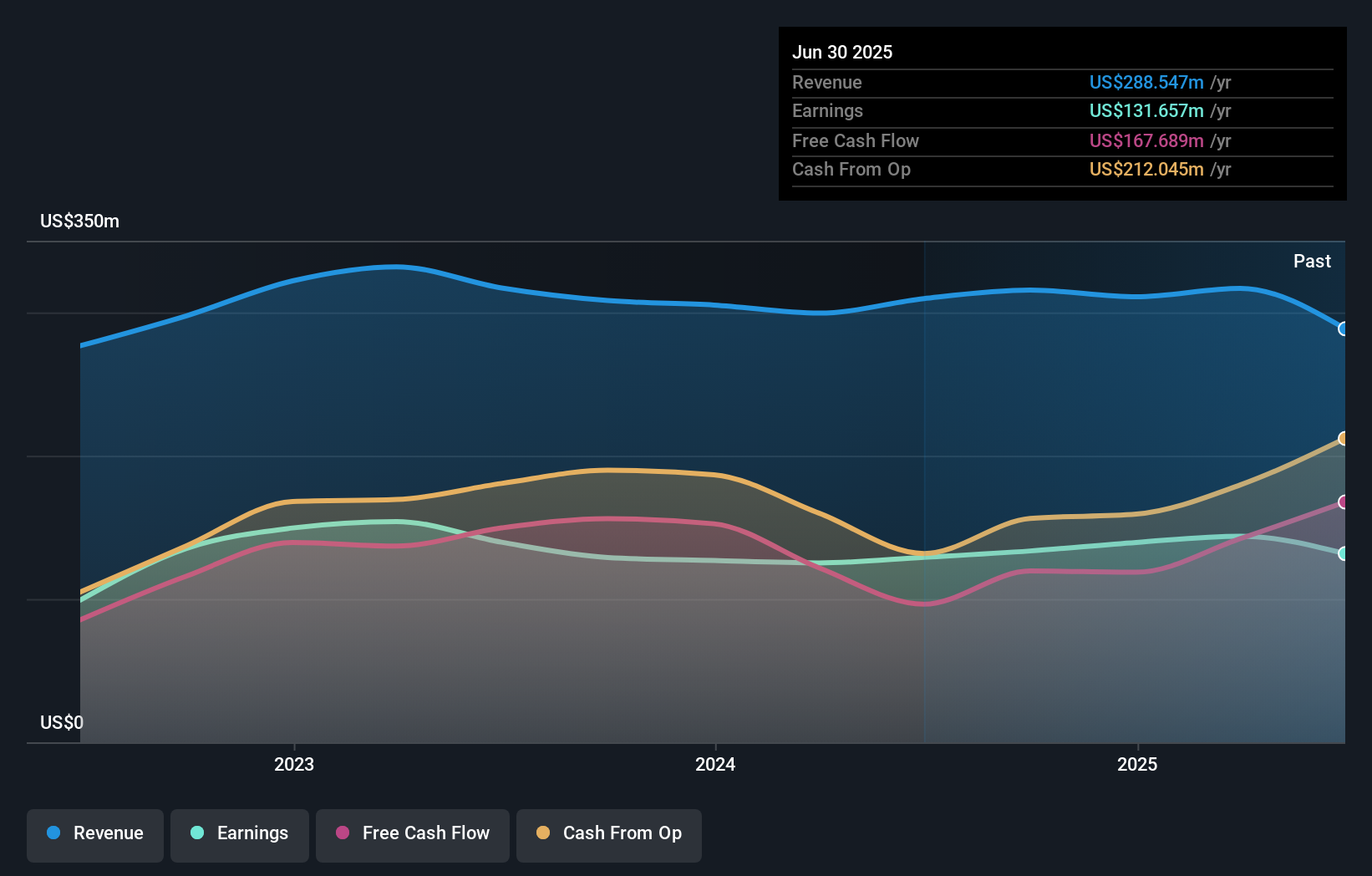

Overview: Ratio Energies - Limited Partnership, along with its subsidiaries, is involved in the exploration, development, and production of oil and natural gas both in Israel and internationally, with a market capitalization of ₪4.87 billion.

Operations: Ratio Energies generates revenue primarily from its oil and gas exploration and production segment, amounting to $316.77 million.

Ratio Energies, a promising player in the Middle East's energy sector, has demonstrated robust earnings growth of 14.9% over the past year, outpacing the broader oil and gas industry. Trading at 43.9% below its estimated fair value suggests potential undervaluation. Despite a high net debt to equity ratio of 69.6%, it's noteworthy that their debt to equity ratio has significantly improved from 509.7% to 106% over five years, indicating better financial management. The company's free cash flow remains positive at US$142 million as of March 2025, and interest payments are well-covered by EBIT at a multiple of 4.9x, reflecting strong operational performance and financial health amidst industry challenges.

- Take a closer look at Ratio Energies - Limited Partnership's potential here in our health report.

Learn about Ratio Energies - Limited Partnership's historical performance.

Taking Advantage

- Explore the 220 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Corporation for Tourism and Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:NCTH

National Corporation for Tourism and Hotels

Invests in, owns, and manages hotels and leisure complexes in the United Arab Emirates.

Minimal risk with weak fundamentals.

Market Insights

Community Narratives