- United Arab Emirates

- /

- Insurance

- /

- DFM:SUKOON

Top Middle Eastern Dividend Stocks To Consider

Reviewed by Simply Wall St

Amid mixed performances across Gulf bourses, driven by concerns over U.S. Federal Reserve independence and fluctuating oil prices, the Middle Eastern markets present a complex landscape for investors. In such an environment, dividend stocks can offer stability and potential income, making them an attractive option for those looking to navigate these uncertain market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.98% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.60% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.73% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.03% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.26% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.83% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.21% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.77% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.82% | ★★★★★☆ |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | 6.06% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

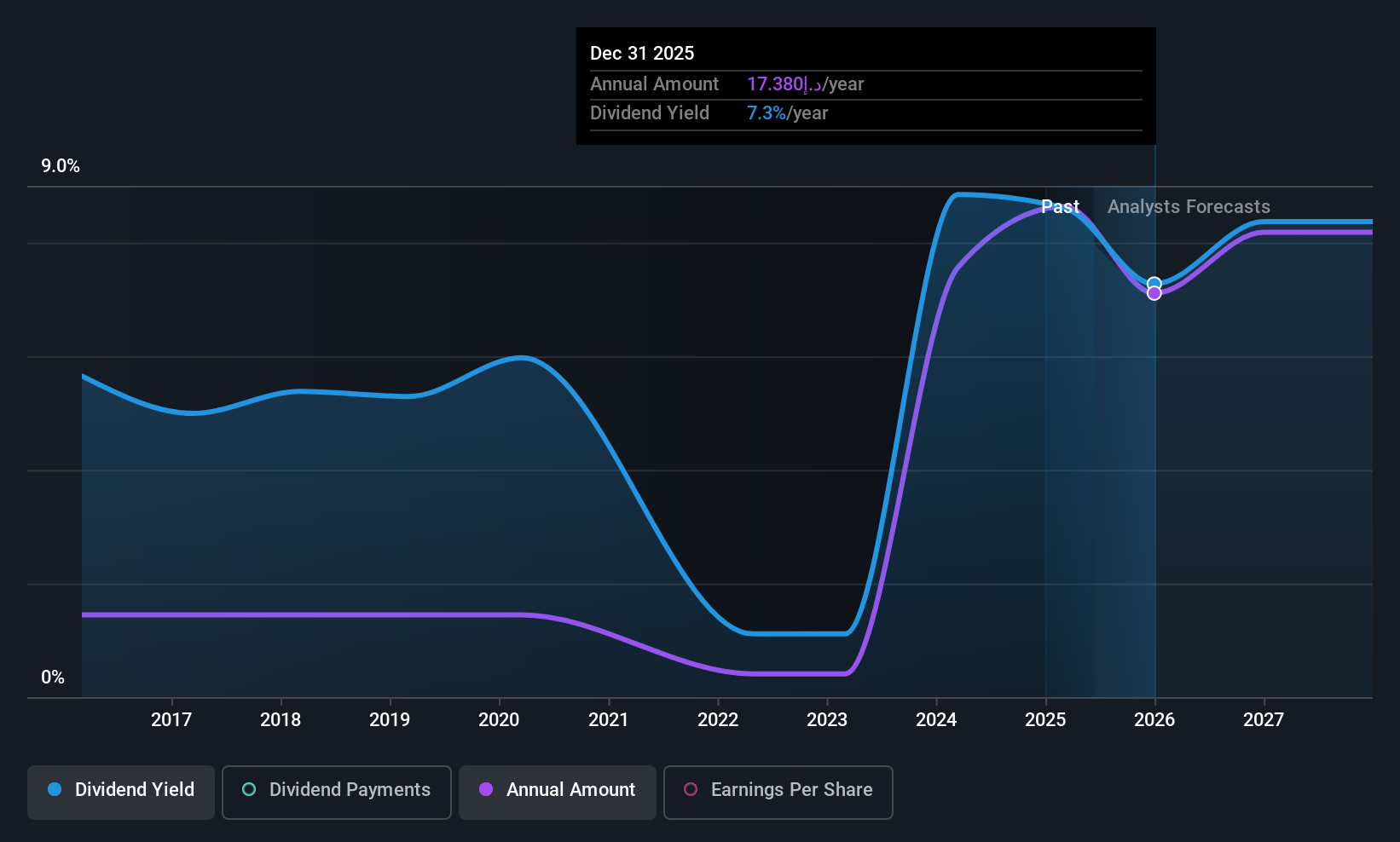

Mashreqbank PSC (DFM:MASQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mashreqbank PSC offers a range of banking and financial services to both individuals and corporate clients, with a market capitalization of AED49.95 billion.

Operations: Mashreqbank PSC's revenue is derived from several segments, including Retail at AED4.18 billion, Wholesale Banking at AED4.70 billion, Insurance & Others at AED3.40 billion, and Treasury and Capital Markets at AED1.19 billion.

Dividend Yield: 8.5%

Mashreqbank PSC's dividend yield is among the top 25% in the AE market, but its dividend payments have been volatile over the past decade. The current payout ratio of 51.3% suggests dividends are covered by earnings, with similar coverage expected in three years. Despite recent declines in net income and earnings per share for Q2 2025, Mashreqbank remains attractively valued at 28% below its estimated fair value, offering potential appeal to dividend investors seeking high yields.

- Take a closer look at Mashreqbank PSC's potential here in our dividend report.

- Our expertly prepared valuation report Mashreqbank PSC implies its share price may be lower than expected.

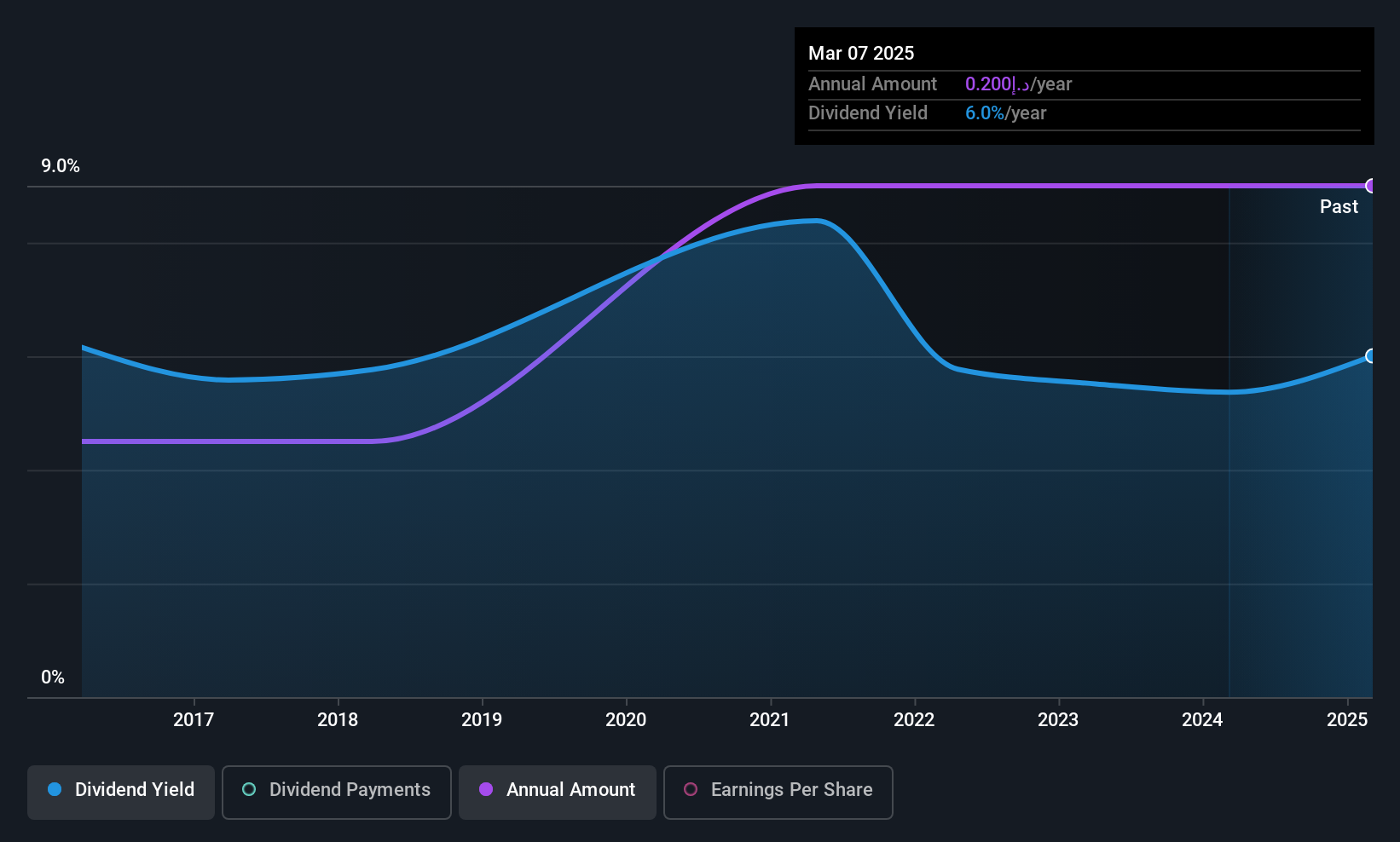

Sukoon Insurance PJSC (DFM:SUKOON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sukoon Insurance PJSC offers insurance solutions to individuals and businesses in the United Arab Emirates, with a market cap of AED1.62 billion.

Operations: Sukoon Insurance PJSC generates revenue primarily from its Life Insurance segment, contributing AED184.62 million, and its Non-Life Insurance segment, contributing AED5.03 billion.

Dividend Yield: 5.7%

Sukoon Insurance PJSC's dividend payments have been volatile over the past decade, yet they are well-covered by both earnings and cash flows, with a low payout ratio of 27.9% and a cash payout ratio of 13.6%. Despite its stable share price, the stock remains illiquid. Recent earnings growth—net income increased to AED 90.16 million in Q2 2025—suggests potential for future stability, though its current dividend yield of 5.71% is below top-tier levels in the AE market.

- Get an in-depth perspective on Sukoon Insurance PJSC's performance by reading our dividend report here.

- The analysis detailed in our Sukoon Insurance PJSC valuation report hints at an inflated share price compared to its estimated value.

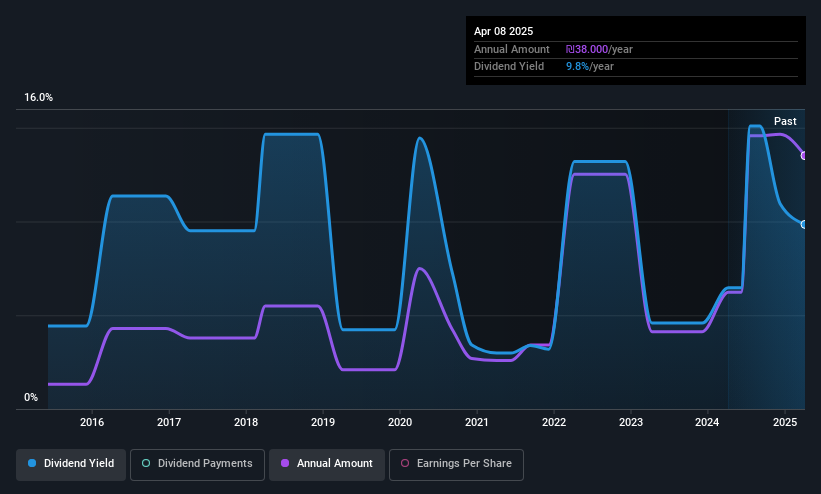

Computer Direct Group (TASE:CMDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computer Direct Group Ltd. operates in the computing and software industry in Israel with a market cap of ₪1.67 billion.

Operations: Computer Direct Group Ltd. generates revenue from various segments within the computing and software sectors in Israel.

Dividend Yield: 7.8%

Computer Direct Group's dividend yield of 7.83% ranks in the top 25% of dividend payers in the IL market, yet its dividends are not well-covered by earnings due to a high payout ratio of 137%. Despite this, dividends are adequately covered by cash flows with a cash payout ratio of 32.3%. Recent earnings growth—net income rose to ILS 25.07 million in Q2—supports potential stability, although past dividend payments have been volatile and unreliable.

- Dive into the specifics of Computer Direct Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Computer Direct Group is priced lower than what may be justified by its financials.

Seize The Opportunity

- Unlock more gems! Our Top Middle Eastern Dividend Stocks screener has unearthed 65 more companies for you to explore.Click here to unveil our expertly curated list of 68 Top Middle Eastern Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:SUKOON

Sukoon Insurance PJSC

Provides insurance solutions to individuals and businesses in the United Arab Emirates.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives