Stock Analysis

Would Indo Count Industries Limited (NSE:ICIL) Be Valuable To Income Investors?

Is Indo Count Industries Limited (NSE:ICIL) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

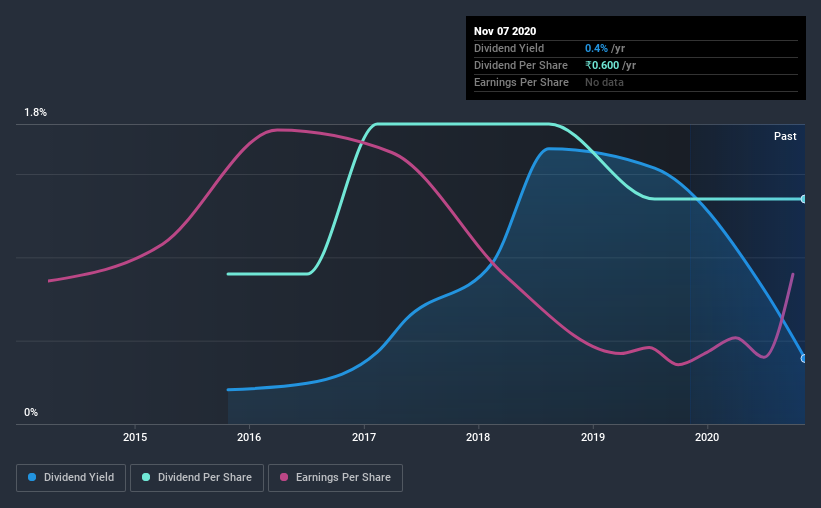

Investors might not know much about Indo Count Industries's dividend prospects, even though it has been paying dividends for the last five years and offers a 0.4% yield. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. That said, the recent jump in the share price will make Indo Count Industries's dividend yield look smaller, even though the company prospects could be improving. There are a few simple ways to reduce the risks of buying Indo Count Industries for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Indo Count Industries!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 9.2% of Indo Count Industries' profits were paid out as dividends in the last 12 months. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Indo Count Industries' cash payout ratio last year was 2.6%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout. It's positive to see that Indo Count Industries' dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

We update our data on Indo Count Industries every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the data, we can see that Indo Count Industries has been paying a dividend for the past five years. During the past five-year period, the first annual payment was ₹0.4 in 2015, compared to ₹0.6 last year. Dividends per share have grown at approximately 8.4% per year over this time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Over the past five years, it looks as though Indo Count Industries' EPS have declined at around 3.6% a year. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

To summarise, shareholders should always check that Indo Count Industries' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. It's great to see that Indo Count Industries is paying out a low percentage of its earnings and cash flow. Earnings per share are down, and Indo Count Industries' dividend has been cut at least once in the past, which is disappointing. Ultimately, Indo Count Industries comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Indo Count Industries (of which 1 doesn't sit too well with us!) you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading Indo Count Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Indo Count Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ICIL

Indo Count Industries

Manufactures and sells home textile products in India.

Proven track record with adequate balance sheet.