- Hong Kong

- /

- Consumer Services

- /

- SEHK:6068

With EPS Growth And More, Wisdom Education International Holdings (HKG:6068) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Wisdom Education International Holdings (HKG:6068). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Wisdom Education International Holdings

Wisdom Education International Holdings's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Wisdom Education International Holdings has grown EPS by 22% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

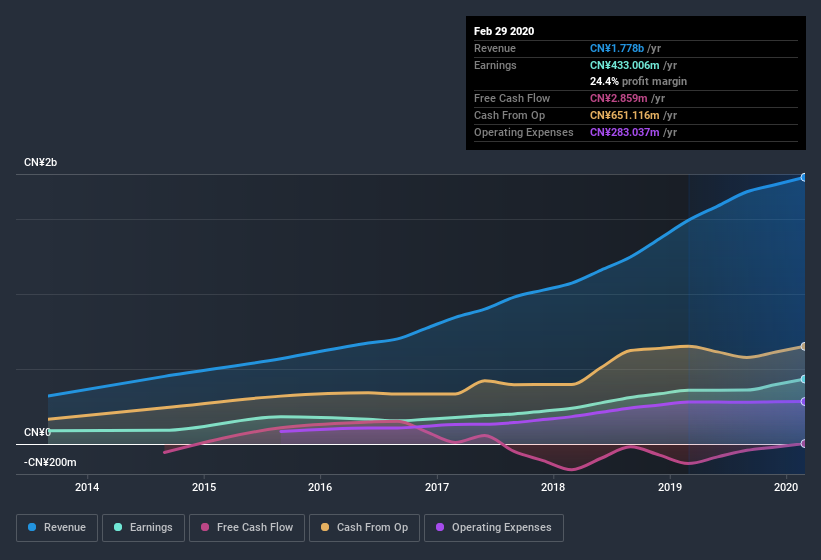

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Wisdom Education International Holdings shareholders can take confidence from the fact that EBIT margins are up from 26% to 29%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Wisdom Education International Holdings's forecast profits?

Are Wisdom Education International Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Wisdom Education International Holdings top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Chairman & CEO, Suwen Li, paid CN¥1.1m to buy shares at an average price of CN¥3.14.

On top of the insider buying, we can also see that Wisdom Education International Holdings insiders own a large chunk of the company. Indeed, with a collective holding of 73%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. And their holding is extremely valuable at the current share price, totalling CN¥6.1b. Now that's what I call some serious skin in the game!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Suwen Li, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Wisdom Education International Holdings with market caps between CN¥2.8b and CN¥11b is about CN¥3.5m.

Wisdom Education International Holdings offered total compensation worth CN¥1.9m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Wisdom Education International Holdings Worth Keeping An Eye On?

For growth investors like me, Wisdom Education International Holdings's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. We should say that we've discovered 3 warning signs for Wisdom Education International Holdings that you should be aware of before investing here.

The good news is that Wisdom Education International Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Wisdom Education International Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wisdom Education International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:6068

Wisdom Education International Holdings

An investment holding company, operates schools in the People’s Republic of China and Hong Kong.

Flawless balance sheet with solid track record.