Vita Life Sciences Limited's (ASX:VLS) Prospects Need A Boost To Lift Shares

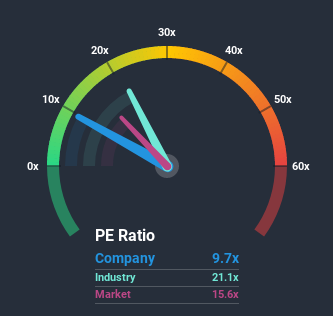

With a price-to-earnings (or "P/E") ratio of 9.7x Vita Life Sciences Limited (ASX:VLS) may be sending bullish signals at the moment, given that almost half of all companies in Australia have P/E ratios greater than 16x and even P/E's higher than 30x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Vita Life Sciences has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Vita Life Sciences

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Vita Life Sciences' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 29% gain to the company's bottom line. Still, incredibly EPS has fallen 5.4% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 0.8% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Vita Life Sciences is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Vita Life Sciences' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Vita Life Sciences maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Vita Life Sciences (1 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Vita Life Sciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Vita Life Sciences, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:VLS

Vita Life Sciences

A healthcare company, engages in formulating, packaging, distributing, and selling vitamins and supplements in Australia, Singapore, Malaysia, Thailand, Vietnam, Indonesia, and China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives