Time To Worry? Analysts Just Downgraded Their Emirates Integrated Telecommunications Company PJSC (DFM:DU) Outlook

Today is shaping up negative for Emirates Integrated Telecommunications Company PJSC (DFM:DU) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

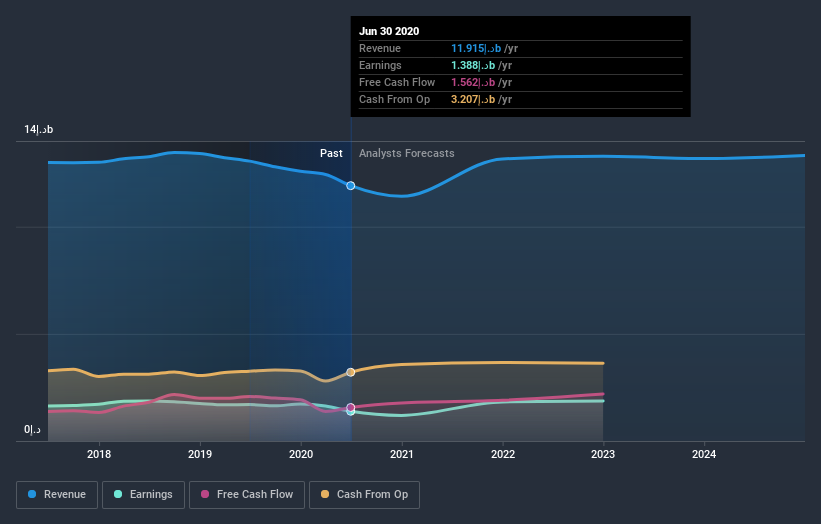

Following the downgrade, the consensus from dual analysts covering Emirates Integrated Telecommunications Company PJSC is for revenues of د.إ11b in 2020, implying a measurable 4.2% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of د.إ13b in 2020. It looks like forecasts have become a fair bit less optimistic on Emirates Integrated Telecommunications Company PJSC, given the substantial drop in revenue estimates.

See our latest analysis for Emirates Integrated Telecommunications Company PJSC

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Emirates Integrated Telecommunications Company PJSC's past performance and to peers in the same industry. We would highlight that sales are expected to reverse, with the forecast 4.2% revenue decline a notable change from historical growth of 0.6% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 2.9% annually for the foreseeable future. It's pretty clear that Emirates Integrated Telecommunications Company PJSC's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Emirates Integrated Telecommunications Company PJSC this year. They're also anticipating slower revenue growth than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Emirates Integrated Telecommunications Company PJSC after today.

Need some more information? At least one of Emirates Integrated Telecommunications Company PJSC's dual analysts has provided estimates out to 2024, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Emirates Integrated Telecommunications Company PJSC, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Emirates Integrated Telecommunications Company PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About DFM:DU

Emirates Integrated Telecommunications Company PJSC

Provides carrier, data hub, internet exchange facilities, and satellite service primarily in the United Arab Emirates.

Outstanding track record with excellent balance sheet and pays a dividend.