- United Kingdom

- /

- Professional Services

- /

- LSE:CPI

These 4 Measures Indicate That Capita (LON:CPI) Is Using Debt In A Risky Way

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Capita plc (LON:CPI) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View 3 warning signs we detected for Capita

What Is Capita's Net Debt?

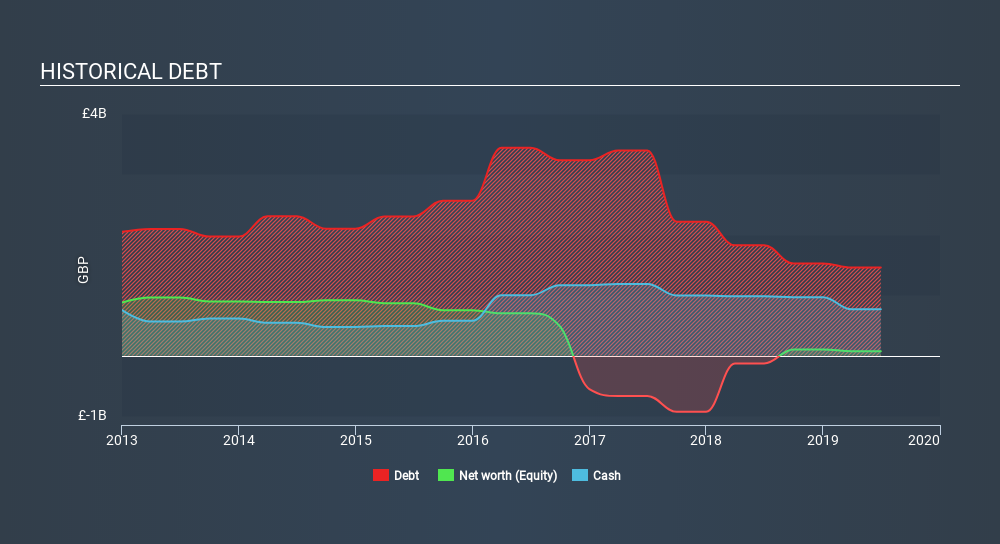

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Capita had UK£1.46b of debt, an increase on UK£1.8k, over one year. However, it does have UK£765.8m in cash offsetting this, leading to net debt of about UK£691.8m.

A Look At Capita's Liabilities

According to the last reported balance sheet, Capita had liabilities of UK£2.62b due within 12 months, and liabilities of UK£1.84b due beyond 12 months. On the other hand, it had cash of UK£765.8m and UK£896.4m worth of receivables due within a year. So it has liabilities totalling UK£2.80b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of UK£2.74b, we think shareholders really should watch Capita's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Capita's debt to EBITDA ratio (2.8) suggests that it uses some debt, its interest cover is very weak, at 2.3, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Even worse, Capita saw its EBIT tank 62% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Capita can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Capita burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Capita's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least its net debt to EBITDA is not so bad. Taking into account all the aforementioned factors, it looks like Capita has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Capita (of which 3 are major) which any shareholder or potential investor should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:CPI

Capita

Operates an outsourcer that supports clients across the public and private sectors in the United Kingdom and rest of Europe.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives