- India

- /

- Construction

- /

- NSEI:POWERMECH

Take Care Before Jumping Onto Power Mech Projects Limited (NSE:POWERMECH) Even Though It's 26% Cheaper

The Power Mech Projects Limited (NSE:POWERMECH) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

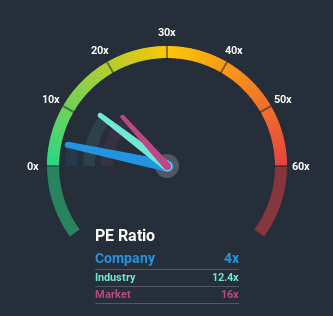

Following the heavy fall in price, Power Mech Projects' price-to-earnings (or "P/E") ratio of 4x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 16x and even P/E's above 39x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

The earnings growth achieved at Power Mech Projects over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Power Mech Projects

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Power Mech Projects' to be considered reasonable.

Retrospectively, the last year delivered a decent 7.9% gain to the company's bottom line. The latest three year period has also seen an excellent 103% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Power Mech Projects' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Having almost fallen off a cliff, Power Mech Projects' share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Power Mech Projects revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Power Mech Projects (1 is potentially serious!) that you should be aware of.

Of course, you might also be able to find a better stock than Power Mech Projects. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade Power Mech Projects, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:POWERMECH

Power Mech Projects

Provides services in power and infrastructure sectors in India and internationally.

Flawless balance sheet with high growth potential.