Stock Analysis

- United States

- /

- Pharma

- /

- NasdaqCM:SNDL

SNDL Inc. (NASDAQ:SNDL) Shares Fly 60% But Investors Aren't Buying For Growth

SNDL Inc. (NASDAQ:SNDL) shares have had a really impressive month, gaining 60% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 39%.

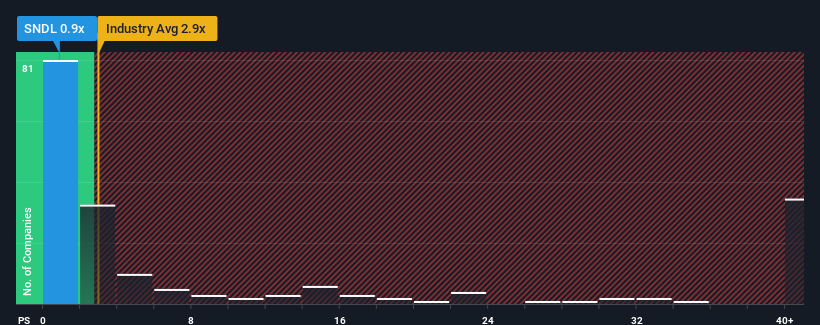

Even after such a large jump in price, SNDL may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 2.9x and even P/S higher than 18x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for SNDL

How Has SNDL Performed Recently?

SNDL certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SNDL.Is There Any Revenue Growth Forecasted For SNDL?

The only time you'd be truly comfortable seeing a P/S as depressed as SNDL's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 11% per year over the next three years. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why SNDL's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Even after such a strong price move, SNDL's P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that SNDL maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for SNDL that you need to be mindful of.

If you're unsure about the strength of SNDL's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether SNDL is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SNDL

SNDL

SNDL Inc. engages in the production, distribution, and sale of cannabis products in Canada.

Flawless balance sheet with reasonable growth potential.