Stock Analysis

- Portugal

- /

- Electric Utilities

- /

- ENXTLS:EDP

The Price Is Right For EDP - Energias de Portugal, S.A. (ELI:EDP)

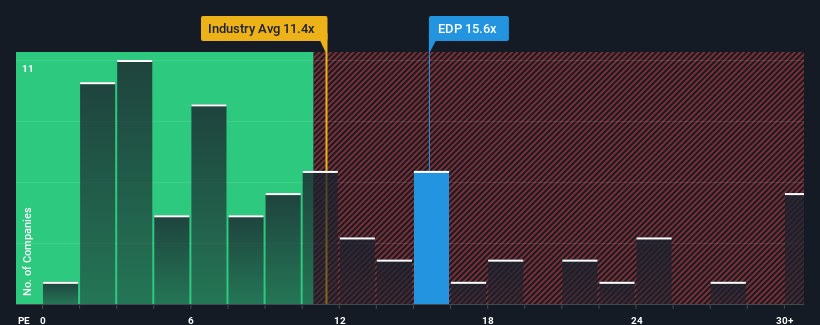

With a price-to-earnings (or "P/E") ratio of 15.6x EDP - Energias de Portugal, S.A. (ELI:EDP) may be sending bearish signals at the moment, given that almost half of all companies in Portugal have P/E ratios under 12x and even P/E's lower than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, EDP - Energias de Portugal has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for EDP - Energias de Portugal

Does Growth Match The High P/E?

In order to justify its P/E ratio, EDP - Energias de Portugal would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 34% last year. As a result, it also grew EPS by 7.6% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 9.1% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 5.4% per annum growth forecast for the broader market.

With this information, we can see why EDP - Energias de Portugal is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On EDP - Energias de Portugal's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of EDP - Energias de Portugal's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for EDP - Energias de Portugal (1 doesn't sit too well with us!) that you should be aware of.

You might be able to find a better investment than EDP - Energias de Portugal. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether EDP - Energias de Portugal is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:EDP

EDP - Energias de Portugal

EDP - Energias de Portugal, S.A. engages in the generation, transmission, distribution, and supply of electricity in Portugal, Spain, France, Poland, Romania, Italy, Belgium, the United Kingdom, Greece, Colombia, Brazil, North America, and internationally.

Solid track record average dividend payer.