Stock Analysis

Pulling back 11% this week, VIGO Photonics' WSE:VGO) five-year decline in earnings may be coming into investors focus

VIGO Photonics S.A. (WSE:VGO) shareholders might be concerned after seeing the share price drop 11% in the last week. But that doesn't change the fact that the returns over the last five years have been respectable. It's good to see the share price is up 43% in that time, better than its market return of 39%. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 17% drop, in the last year.

Since the long term performance has been good but there's been a recent pullback of 11%, let's check if the fundamentals match the share price.

See our latest analysis for VIGO Photonics

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

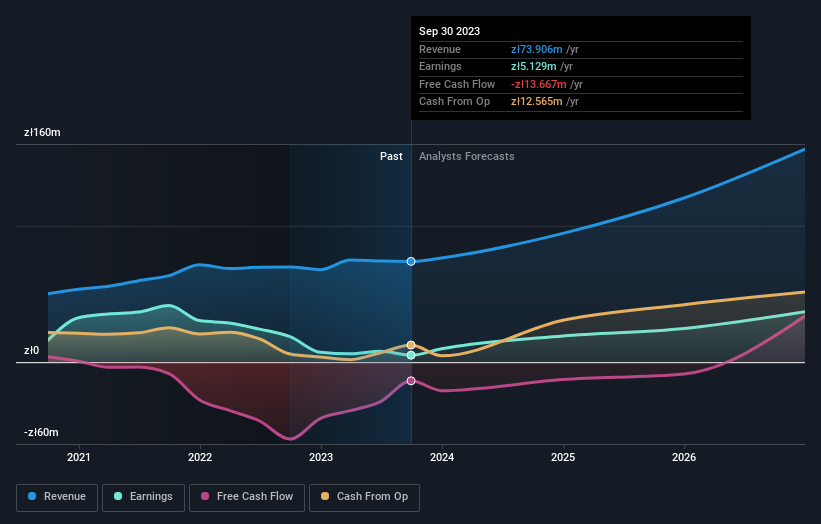

VIGO Photonics' earnings per share are down 17% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In contrast revenue growth of 16% per year is probably viewed as evidence that VIGO Photonics is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling VIGO Photonics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 28% in the last year, VIGO Photonics shareholders lost 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with VIGO Photonics , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether VIGO Photonics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:VGO

VIGO Photonics

VIGO Photonics S.A. manufactures and sells semiconductor materials, and devices for photonic and microelectronic applications worldwide.

High growth potential with mediocre balance sheet.