Stock Analysis

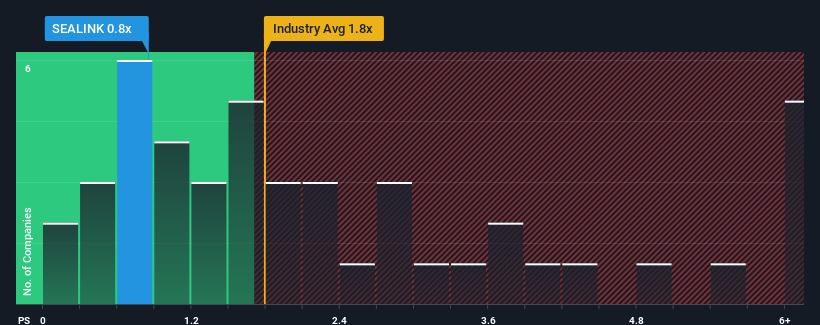

Sealink International Berhad's (KLSE:SEALINK) price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Machinery industry in Malaysia, where around half of the companies have P/S ratios above 1.8x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Sealink International Berhad

How Sealink International Berhad Has Been Performing

With revenue growth that's exceedingly strong of late, Sealink International Berhad has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sealink International Berhad's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sealink International Berhad's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 63% last year. The strong recent performance means it was also able to grow revenue by 113% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 26% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Sealink International Berhad's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Sealink International Berhad currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sealink International Berhad, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Sealink International Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KLSE:SEALINK

Sealink International Berhad

Sealink International Berhad, an investment holding company, owns, builds, and operates a fleet of offshore marine support vessels in Malaysia, Singapore, and Vietnam.

Excellent balance sheet and good value.