Stock Analysis

- Hong Kong

- /

- Trade Distributors

- /

- SEHK:380

Do China Pipe Group's (HKG:380) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like China Pipe Group (HKG:380), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for China Pipe Group

How Fast Is China Pipe Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that China Pipe Group has managed to grow EPS by 18% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

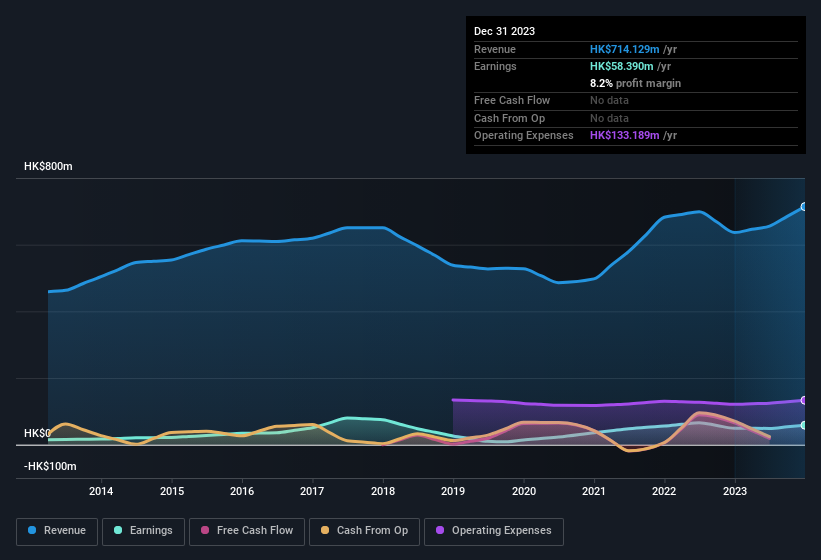

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for China Pipe Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to HK$714m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since China Pipe Group is no giant, with a market capitalisation of HK$136m, you should definitely check its cash and debt before getting too excited about its prospects.

Are China Pipe Group Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in China Pipe Group will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 69% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Valued at only HK$136m China Pipe Group is really small for a listed company. That means insiders only have HK$94m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is China Pipe Group Worth Keeping An Eye On?

You can't deny that China Pipe Group has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Still, you should learn about the 2 warning signs we've spotted with China Pipe Group.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in HK with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether China Pipe Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:380

China Pipe Group

China Pipe Group Limited, an investment holding company, trades in construction materials in Hong Kong, Macau, and Mainland China.

Flawless balance sheet and good value.