Stock Analysis

When you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Trulieve Cannabis Corp. (CSE:TRUL) share price has soared 111% return in just a single year. It's up an even more impressive 137% over the last quarter. Unfortunately the longer term returns are not so good, with the stock falling 71% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Trulieve Cannabis

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Trulieve Cannabis actually shrank its EPS by 140%. We do note that there were extraordinary items impacting the result.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Trulieve Cannabis' revenue actually dropped 7.3% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

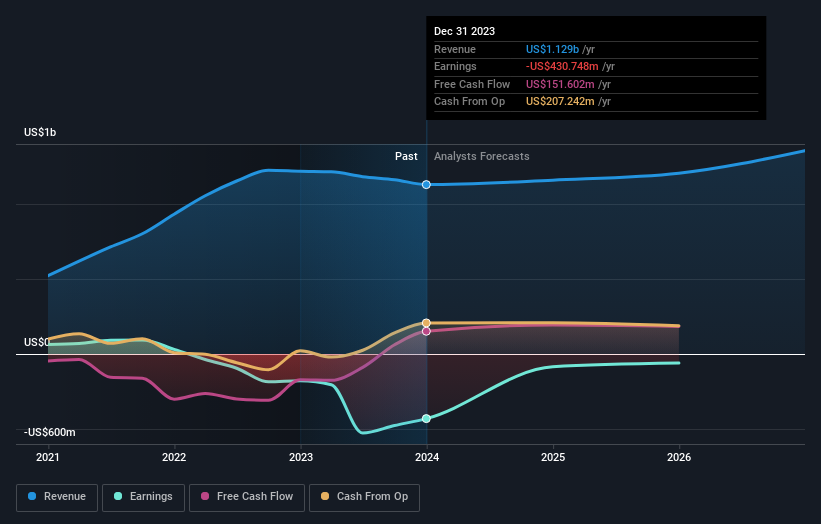

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Trulieve Cannabis is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's nice to see that Trulieve Cannabis shareholders have received a total shareholder return of 111% over the last year. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Trulieve Cannabis has 2 warning signs we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Trulieve Cannabis is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:TRUL

Trulieve Cannabis

Trulieve Cannabis Corp., together with its subsidiaries, operates as a cannabis retailer.

Adequate balance sheet and fair value.