Stock Analysis

Analysts Just Published A Bright New Outlook For Banco do Brasil S.A.'s (BVMF:BBAS3)

Shareholders in Banco do Brasil S.A. (BVMF:BBAS3) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

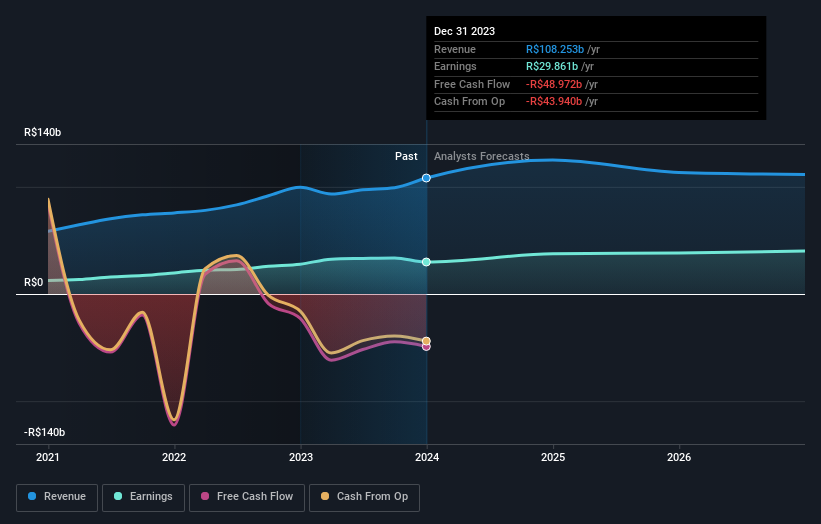

After the upgrade, the ten analysts covering Banco do Brasil are now predicting revenues of R$125b in 2024. If met, this would reflect a notable 15% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to bounce 47% to R$7.70. Before this latest update, the analysts had been forecasting revenues of R$101b and earnings per share (EPS) of R$6.56 in 2024. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for Banco do Brasil

As a result, it might be a surprise to see that the analysts have cut their price target 6.3% to R$32.95, which could suggest the forecast improvement in performance is not expected to last.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We can infer from the latest estimates that forecasts expect a continuation of Banco do Brasil'shistorical trends, as the 15% annualised revenue growth to the end of 2024 is roughly in line with the 13% annual revenue growth over the past five years. Juxtapose this against our data, which suggests that other companies (with analyst coverage) in the industry are forecast to see their revenues grow 16% per year. It's clear that while Banco do Brasil's revenue growth is expected to continue on its current trajectory, it's only expected to grow in line with the industry itself.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. There was also an upgrade to revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider market. A lower price target is not intuitively what we would expect from a company whose business prospects are improving - at least judging by these forecasts - but if the underlying fundamentals are strong, Banco do Brasil could be one for the watch list.

Better yet, our automated discounted cash flow calculation (DCF) suggests Banco do Brasil could be moderately undervalued. For more information, you can click through to our platform to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're helping make it simple.

Find out whether Banco do Brasil is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BBAS3

Banco do Brasil

Banco do Brasil S.A., together with its subsidiaries, provides banking products and services for individuals, companies, and public sectors in Brazil and internationally.

Undervalued average dividend payer.