Pearl Global Industries Limited's (NSE:PGIL) Share Price Not Quite Adding Up

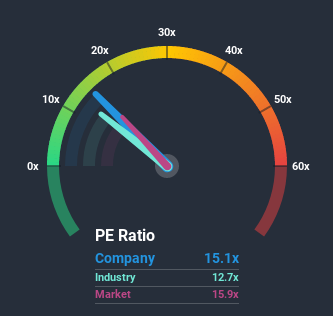

There wouldn't be many who think Pearl Global Industries Limited's (NSE:PGIL) price-to-earnings (or "P/E") ratio of 15.1x is worth a mention when the median P/E in India is similar at about 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Pearl Global Industries' receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Pearl Global Industries

Is There Some Growth For Pearl Global Industries?

There's an inherent assumption that a company should be matching the market for P/E ratios like Pearl Global Industries' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 68% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 47% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Pearl Global Industries' P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Pearl Global Industries currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 4 warning signs we've spotted with Pearl Global Industries (including 1 which is potentially serious).

If you're unsure about the strength of Pearl Global Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you decide to trade Pearl Global Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:PGIL

Pearl Global Industries

Manufactures and exports readymade garments in India and internationally.

High growth potential with solid track record.