- Australia

- /

- Metals and Mining

- /

- ASX:MCR

Is Mincor Resources' (ASX:MCR) Share Price Gain Of 252% Well Earned?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. For instance the Mincor Resources NL (ASX:MCR) share price is 252% higher than it was three years ago. Most would be happy with that. On top of that, the share price is up 24% in about a quarter. But this could be related to the strong market, which is up 12% in the last three months.

View our latest analysis for Mincor Resources

Given that Mincor Resources didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Mincor Resources' revenue trended up 109% each year over three years. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 52% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

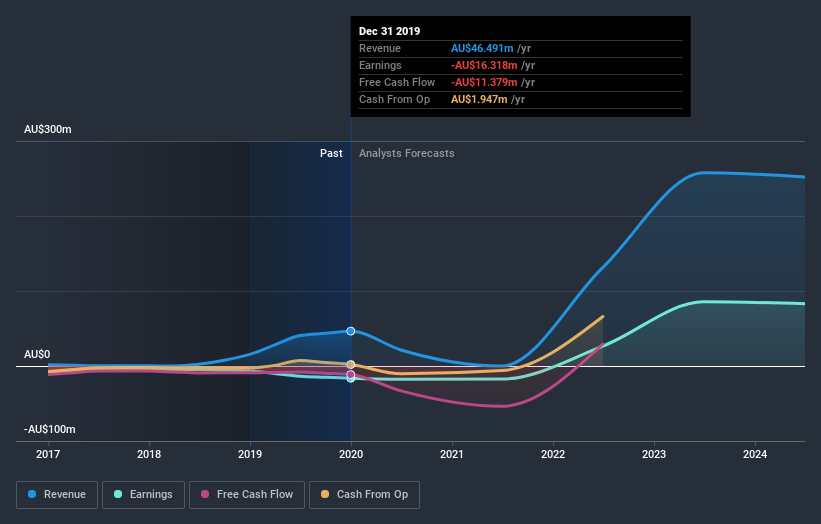

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Mincor Resources has rewarded shareholders with a total shareholder return of 51% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4.6% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Mincor Resources better, we need to consider many other factors. For instance, we've identified 1 warning sign for Mincor Resources that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Mincor Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:MCR

Mincor Resources

Mincor Resources NL, together with its subsidiaries, engages in the exploration, evaluation, development, and mining of mineral resources in Australia.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives